Trends in bitcoin options markets are making it difficult for financial analysts to pinpoint BTC’s next move. Data from CME’s recently published trader report shows that institutional investors are capturing a larger number of bitcoin long contracts, while hedge funds are showing an all-time high for bitcoin short contracts. On Tuesday, the price of bitcoin (BTC) has been attempting to capture the $12k price zone and a number of people are focused on the crypto assets’ next moves. While a number of crypto traders are extremely bullish some people believe…

Day: October 20, 2020

‘Garbage’ Market Data Is Holding Bitcoin Back: MicroStrategy CEO

MicroStrategy CEO Michael Saylor strongly criticized widely distributed bitcoin markets data as “garbage” and said it severely misrepresents of his own experience with the market’s real liquidity after investing in bitcoin. In a live interview Tuesday with Hedgeye CEO Keith McCullough, Saylor said bitcoin volume is being reported at a wildly inflated $24.76 billion, referencing the current volume on Apple’s Stocks application. That number is similar to 24-hour bitcoin volume of $20.3 billion reported by CoinGecko. This data “ships to a billion devices in the world,” Saylor noted, referring to Apple.…

Crushing Bitcoin Dominance Could Decimate Altcoins Through Q1 2021

The DeFi boom and an explosion of ROI across altcoins helped bring bullish sentiment back to crypto, and it helped push Bitcoin above $10,000 and hold the key level for the longest stretch ever. But while altcoins had regained some lost ground against the most dominant cryptocurrency, BTC dominance has potentially reversed, and if closes the weekly above a key level, altcoins could be decimated throughout the end of the year and into early 2021. BTC Dominance Closing Above Mid-Bollinger Band Could Crush Altcoins Into Satoshi Dust Bitcoin price is…

Line Messenger Develops Its Central Bank Digital Currency Platform

Line has revealed its intention to launch its CBDC platform. According to the report, the messaging company was moved by the increased consideration of making use of the customized digital currency in the continent. Following the recent exploration of the possibility to adapt and integrate the Central Bank Digital Currency (CBDC) among the various central banks in Asia, Line messenger, a Japanese-based company and a subsidiary of Naver have revealed its intention to come out with a CBDC platform to support the process. According to the report, the messaging company…

The US Risks Getting Left Behind on CBDCs

This week, as world leaders gather virtually for DC Fintech Week in Washington, D.C., a key focus will be on central banks issuing their own digital currencies (CBDC). A pivotal player here is the United States, which faces an increasingly urgent decision: whether to take serious steps towards issuing a CBDC, as the Bank of China and others have begun. The sooner it decides, the better. Many countries are addressing this issue seriously and quickly, as surveyed by tracking projects at the Atlantic Council and elsewhere. Pilot programs are ongoing…

Blockchain Bites: Bitcoin and the BSA, Signature Deposit Growth, Darknet Crypto Donors

Signature Bank’s deposits grew by over $4 billion. Non-profits have rejected bitcoin donations made from hackers. And a FinCEN investigation raises questions about bitcoin mixers and the Bank Secrecy Act. Here’s all the news people are talking about in crypto today. Top shelf Corporate DeFi?R3’s open-source variation of its enterprise blockchain, Corda Network, will see the addition of a native cryptocurrency. The new coin, called XDC, will open the gates to build central bank digital currencies (CBDCs) and decentralized finance applications (DeFi) on the network. Programmed by the Cordite Society, a group…

Bitcoin’s Dominance to Peak in December, Sparking Altcoin Buying Frenzy

Bitcoin has seen a massive upswing over the past couple of days that brought a firm end to its consolidation phase and is now allowing it to confront its key resistance around $12,000. This level has been holding strong as resistance, and throughout the year, any break above this level was met with heavy selling pressure that catalyzed intense selloffs. Bitcoin has also been guiding the market over the past week, but this trend appears to be shifting – as altcoins sold-off today while BTC saw a strong and sustainable…

Bitcoin Shoots Towards $12,000 as Capital Flows Back Into BTC

Bitcoin bulls are back after weeks of consolidation. The leading cryptocurrency thrust higher towards $12,000 on Tuesday morning. The coin now trades just shy of that crucial price resistance at $11,970. The cryptocurrency is expected to move higher in the days ahead as macro trends favor Bitcoin bulls. Bitcoin’s rally comes as altcoins have suffered a retracement, with most dropping a few percent across the board as a weird market dynamic emerges where altcoins seriously underperform BTC. Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom Bitcoin…

Benoît Cœuré – CBDCs Mean Evolution, Not Revolution

Who wants a central bank digital currency (CBDC)? Plenty of people, apparently; industry groups are advocating digital cash, millions of people have reportedly signed up to a lottery to receive digital renminbi in Shenzhen as part of the Chinese central bank’s pilot project, and the Libra Association wants to “integrate” CBDCs. Technology firms, banks, NGOs and consultancies are now jostling to ride the next wave of innovation. Benoît Cœuré is head of the Innovation Hub at the Bank for International Settlements and a member of the bank’s Executive Committee. Previously,…

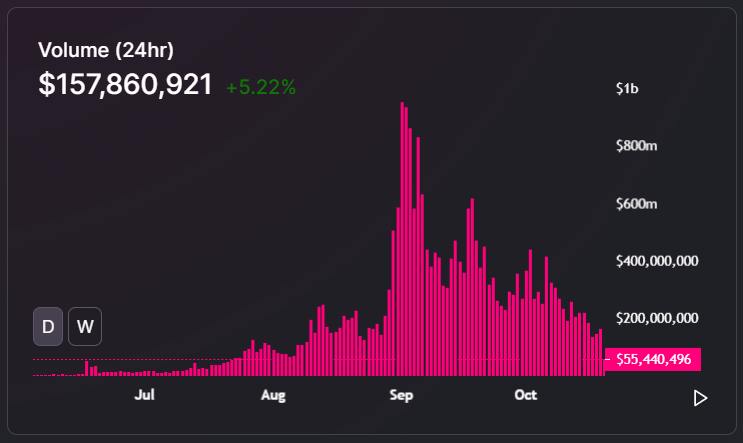

Prolonged DeFi Slump Impending? Uniswap Volume Drops 83% Since Peak

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 hours. Since then, the daily volume of the decentralized exchange has consistently dropped. On October 19, Uniswap processed $161.6 million worth of volume, marking an 83% drop since its peak. The volume of Uniswap since…