It appears that decentralized finance (DeFi) bulls have finally returned. Aave (AAVE), one of the leading crypto-assets in the DeFi space, has surged 25% in the past 24 hours alone. This $AAVE reversal is legendary 🙌 — Spencer Noon (@spencernoon) November 8, 2020 This performance makes the coin the best-performing cryptocurrency in the top 100 by market capitalization. For further context, Bitcoin has gained five percent in the past 24 hours, as has Ethereum. The two leading cryptocurrencies have surged rapidly since the weekend lows. Aave is set to continue…

Day: November 8, 2020

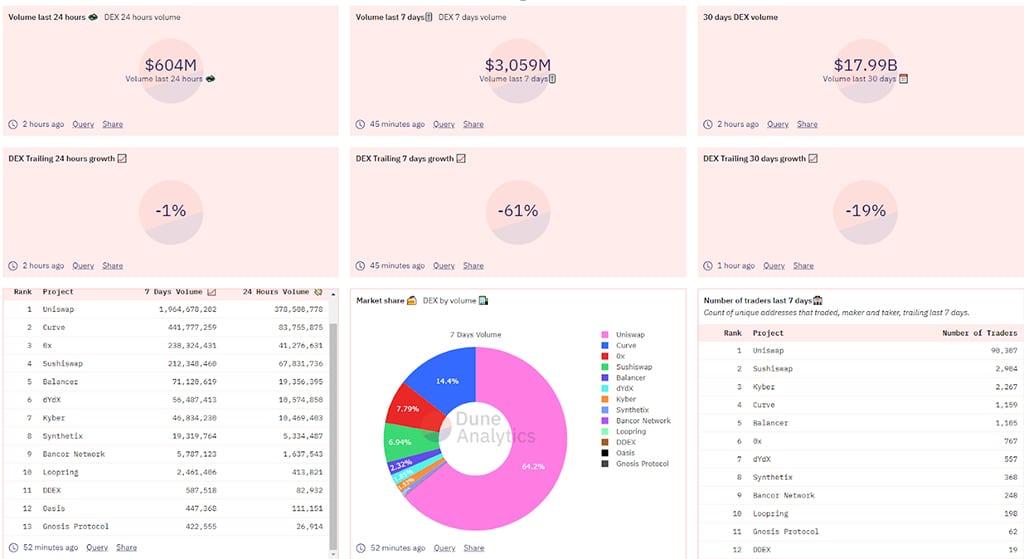

Game Changer for DEX Industry

For the time being, the DEX industry is still in its infancy. Facilitating swaps of tokens on the same blockchain is possible, but the time has come to explore the next frontier in the form of cross-chain trading. Decentralized exchanges continue to make their mark on the cryptocurrency. To take things to the next level, big changes will need to be made. Tapping into cross-chain liquidity needs to be the priority for all providers. Current DEX Landscape Glancing over the current statistics for all major DEXes in the world, it…

Whales Flip Long on Bitcoin While Retail Remains Sidelined; A Bullish Sign?

Bitcoin has been flashing signs of strength today as it rebounds from an intense selloff seen yesterday. Its reaction to this dip proves that this is a firm bull market, as each bout of selling pressure is met with serious buy-side pressure that slows its descent and helps lead it to see further upside. Where the market trends in the mid-term will depend largely on whether or not bulls can continue stopping the crypto from seeing any sustained downtrends. If bulls hold $15,000 and establish some strong support at this…

Canada’s Tax Authority Asks Court to Force Crypto Exchange to Hand Over Data on All Users

Canada’s tax authority is reportedly asking a federal court to force cryptocurrency exchange Coinsquare to hand over information and certain documents on all of its users since the beginning of 2013. The Canadian crypto exchange has over 200,000 users. Canada Revenue Agency Wants Data on All Coinsquare Users The Canadian tax authority has asked a federal judge to force Coinsquare “to hand over information and certain documents about all its clients” since the beginning of 2013, the National Post reported on Friday, elaborating: The Canada Revenue Agency wants to know…

Grin network hit with 51% attack while GRIN token remains resilient

Grin, a privacy-focused cryptocurrency built on the Mimblewimble protocol, has just suffered a 51% attack on its blockchain. According to a Nov. 7 tweet from crypto mining group 2Miners, an unknown group accumulated 57.4% of the total hash power of the Grin (GRIN) network on Saturday evening. 2Miners only had control of 19.1% of GRIN’s hash power, while sparkpool miners came in third at 18.9%. Grin Network Is Under the 51% Attack! Payouts are stopped. Please mine at your own risk only because the new blocks could be rejected.@grincouncil @grin_hub…

3 factors to consider before trading crypto perpetual futures contracts

As tempting as it can be to buy altcoins using perpetual futures, there are a few hidden traps that one should monitor closely. Over the past few years, numerous exchanges began to offer altcoin futures quoted in Tether (USDT) and stablecoin pairs, which eventually became the standard. This change is more convenient for most traders but still presents some serious issues for those willing to keep long positions open for more than a couple of weeks. Before opening any trade at an exchange offering perpetual futures, traders should be aware…

As PayPal integration looms, Paxos CEO sees mass adoption for tokenized assets

In a panel last week for the London Bullion Market Association, Paxos founder and CEO Charles Cascarilla discussed the growth of Paxos’ gold-backed ERC-20 token, PAXG, and the future of asset tokenization more generally — a future that could well involve his company’s recently-announced integration with financial giant PayPal. Speaking alongside Fidelity Labs director of product management Raghav Chawla and the LBMA’s Sakhila Mirza, Cascarilla told viewers that an asset-backed gold token was a natural fit for Paxos’ vision: “It was really a very logical thing for us to launch…

Will PayPal’s crypto integration bring crypto to the masses? Experts answer

One of the most discussed topics within the crypto community recently has been PayPal’s announcement that its customers will be able to buy and sell cryptocurrencies. The service is expected to be fully rolled out early next year. The company’s goal “to increase consumer understanding and adoption of cryptocurrency,” as stated in its press release, seems to be a needed step in cryptocurrency popularization. Mainstream awareness of crypto still remains very low. As data from a Statista survey indicates, Bitcoin (BTC) use in countries with developed economies is below 10%,…

Crypto ATMs continue to boom globally in 2020

In 2013 the world saw the debut of the first-ever Bitcoin ATM when a company called Robocoin placed a machine in a Vancouver coffee shop. Allowing customers to trade Bitcoin for cash, and vice versa, the machine saw $10,000 in BTC transacted on its first day. Now that we are a month away from the end of 2020, the estimated number of crypto ATMs around the world that allow customers to buy and sell Bitcoin (BTC) and other altcoins for cash is about 11,665 ATMs, according to CoinATMRadar. This reflects…

Warren Buffett’s Berkshire Hathaway Spends $9 Billion on Buybacks in Q3

Berkshire Hathaway bought more stocks and ramped up share buybacks in the third quarter. In Q3 earnings report released by Berkshire Hathaway Inc (NYSE: BRK.A) on Saturday, Warren Buffett‘s conglomerate repurchased $9 billion of its own stock. Compared to the record figure that amazed many of $5.1 billion in the second quarter, Berkshire has nearly doubled the amount of buying its stocks during the third quarter. Now the total buybacks during 2020 amount to $15.7 billion. UBS had estimated a total quarterly buyback of $3.2, however, it was surpassed since…