Legislators are responding fast to the madness surrounding Gamestop and AMC shares and the hedge funds selling them short. On Jan. 28, Chairwoman of the House Financial Services Committee Maxine Waters announced a coming hearing on short-selling. Sherrod Brown, the incoming chairman of the Senate Banking Committee, similarly called for a re-examination of stock market rules. Short selling has been the subject of widespread controversy as the past two days have seen wild volatility for certain securities, especially Gamestop (GME). Retail traders, communicating via Reddit and buying on Robinhood, have been…

Day: January 28, 2021

MicroStrategy May Get Creative to Make Future Bitcoin Buys: CEO

MicroStrategy CEO Michael Saylor pledged to keep pouring the business intelligence company’s excess cash into bitcoin Thursday, telling investors his team will also “explore various approaches” for additional buys. “Going forward, we continue to plan to hold our bitcoin and invest additional excess cash flows in bitcoin. Additionally, we will explore various approaches to acquire additional bitcoin as part of our overall corporate strategy,” Saylor said in the company’s quarterly filing. The company is currently sitting on a trove of 70,784 bitcoins. While most of that was purchased with excess…

$10k Ethereum and $146k Bitcoin? (It's Not Too Late)

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io 📉 WHERE I TRADE CRYPTO ►Switch to Phemex, fastest & most secure crypto exchange. Get up to $80 FREE: 📚Free Educational Videos ► Technical Analysis Tutorial Course for Beginners: ► Margin Trading Tutorial: 🔐 Secure Your Crypto ► Shop NGRAVE, the most secure hardware wallet. Get up to 30% OFF: 💳Earn & Spend on Crypto.com ►Download the app, $50 FREE with code “koroushak”: 🌍Join Our Community ► Newsletter: ► Podcast: ► Twitter: ► Telegram: #bitcoin #crypto #livestream Disclaimer: None of the information…

Crypto industry jumps into lobbying in response to FinCEN

The crypto lobby is growing as more firms join the effort to fight rules that attack financial privacy. The Blockchain Association today announced the addition of five new members, with membership now totaling 30 firms. The new members are Uniswap, Blockfi, Fireblocks, CMT Digital and Blockchain Capital. In its tweet announcing the news, the Blockchain Association attributed the rise in membership to its work in presenting an industry response to rules from the Treasury’s Financial Crimes Enforcement Network, or FinCEN, at the tail end of the Trump administration. The association…

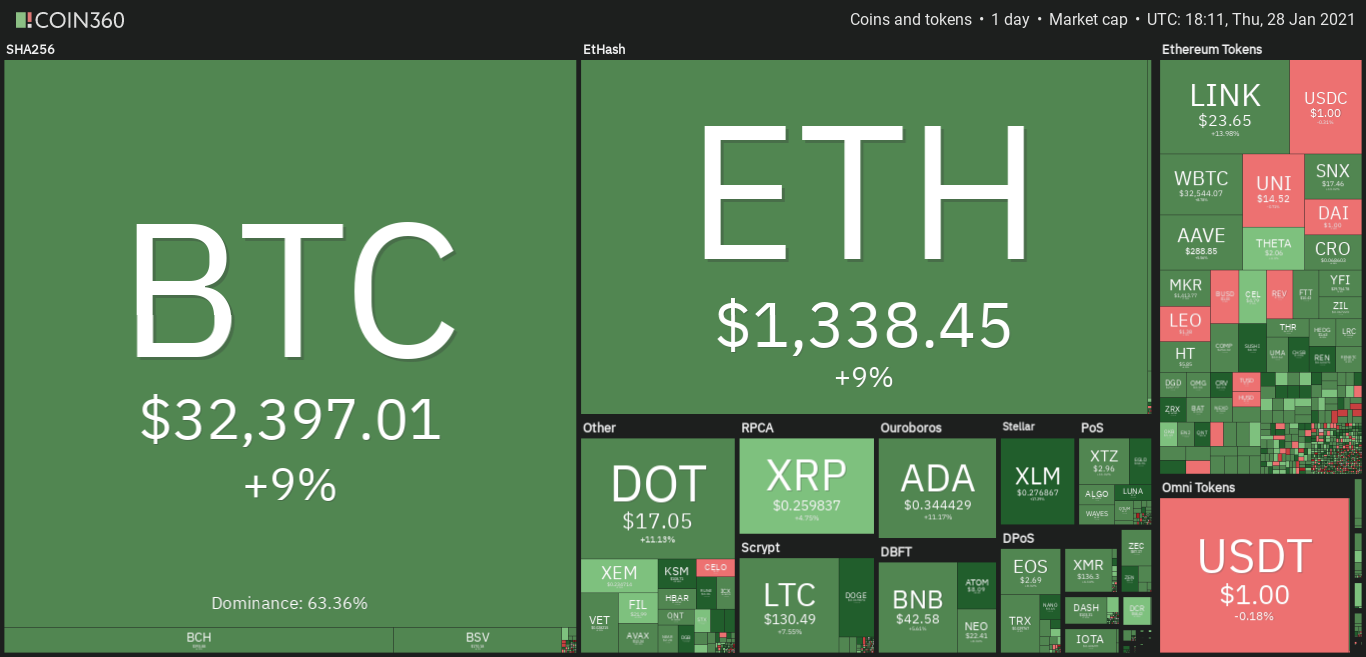

DeFi sector growth pushes Reserve Rights, 0x and Kyber Network higher

Bitcoin (BTC) has bounced back above the $32,000 level today, but Guggenheim chief investment officer Scott Minerd believes that the current institutional demand is not sufficient to keep the price above $30,000 for long. Despite this view, Minerd continues to believe that the current downturn does not alter the long-term bullish story of Bitcoin. Crypto market data daily view. Source: Coin360 While several institutional investors are turning positive on Bitcoin as a store of value, BlackRock CEO Larry Fink does not seem impressed. Fink pointed out the volatility and called Bitcoin…

US wealth manager adds 10,667 shares of GBTC as Bitcoin adoption grows

Kingfisher Capital, a North Carolina wealth manager, has scooped up 10,667 shares of the Grayscale Bitcoin Trust, according to a recent filing with the United States Securities and Exchange Commission, or SEC. The filing, which appeared on the SEC website on Thursday, highlights Kingfisher Capital’s growing diversification. The wealth manager has exposure to hundreds of companies and funds across various sectors, from banking to energy. Kingfisher reportedly had no exposure to Grayscale’s product as of November 2020, which means its purchase was recent, perhaps while Bitcoin (BTC) was at or…

Blockchain Platform to Set up a Tokenization Solution for Argentinean Farmers as Peso Keeps Plummeting – Blockchain Bitcoin News

With Argentineans facing rising inflation to near 40%, solutions appear to contain the impact on national farmers. A business blockchain platform is partnering with a peer-to-peer (P2P) marketplace to launch a program to tokenize Argentina’s agriculture. More Than 40% of the World’s Soybean Oil and Soy-Meal Production Comes From Argentina According to an announcement shared with news.Bitcoin.com, Coreledger will work with Abakus to set up a “digital barter economy” in Argentina. The project consists of enabling farmers to tokenize their agricultural assets to seek a hedge against rising inflation. It…

*Coinbase, CBDC's & XRP*

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io *Coinbase, CBDC’s & XRP* 🌎Digital Assets Daily on Twitter..🌎 twitter.com/assetsdaily 🌎 🔥 Open an IRA w/ iTrustCapital to grow your Crypto TAX-FREE 🔥 Get 1-Month FREE with Discount Code ($29.95 Savings) Link: Code: DAILY1MFREE *DISCLAIMER: All opinions expressed by content contributors that appear on D.A.D. are solely expressing their opinions and do not reflect the opinions of D.A.D., its affiliates, or its sponsors. Content contributors may have previously disseminated information on a social media platform, website, or another medium such as a…

Bitcoin Fractal From Last Bull Run Warns Of Sudden Sweep of Lows

Bitcoin is in consolidation mode after one of its largest quarterly gains on record. All signs suggest that there’s still more upside left in this bull run, but according to a fractal found during the last major market cycle, a sudden sweep of lows is possible before bulls regain control. Here’s what to expect for price action if this ultimately bullish fractal is a valid roadmap of what’s to come. Be Ready To Buy The Dip If Fractal Forming Is Accurate Bitcoin price is still trading $10,000 below its highest…

Coinbase unveils plans for direct stock listing

Coinbase, one of the world’s largest digital currency exchanges, has been rumored for some time to be considering a direct listing. In an official blog post, the cryptocurrency exchange disclosed plans to pursue a direct listing of its Class A common stock, pursuant to a registration statement with the United States Securities and Exchange Commission. The Form S-1 registration statement will become effective after the securities regulator completes its review. The direct listing format would not offer new shares but instead sell existing shares directly to the public. Some advantages…