Investing platform Public, with over 1 million users, is rolling out cryptocurrency trading. “Crypto is gaining momentum as a compelling asset class for millions of investors,” the company said. Public Launches Cryptocurrency Trading Investing platform Public describes itself as “the investing social network where members can own fractional shares of stocks and ETFs [exchange-traded funds], follow popular creators, and share ideas within a community of investors.” The company announced Thursday: Today, we’re adding crypto on Public. Members will be able to buy, sell, and hold crypto assets in the same…

Day: October 7, 2021

Elon Musk के इस बयान से बहुत नुक़सान हुआ | Tesla | Cryptocurrency | Bitcoin | Kharcha-Pani Ep 77

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io थकान और कमज़ोरी से दे आज़ादी #LivogenTonic #Livogen For more information visit- Siddhant Mohan and Anshuman Tiwari brings you Kharcha-Pani, the Lallantop’s daily economic bulletin. And things we discuss today are : 1. As Elon Musk and Tesla cited environmental reasons to opt out of crypto market, many are seeing the black future of the same in coming times, Why Musk opted to do so and what India has to face? 2. Petrol and Diesel went up by 20 rupees per litre…

Venezuela’s New Digital Bolivar Isn’t Digital, and It Won’t Solve the Country’s Economic Crisis — CoinDesk

For smaller merchants, who work in dollars, the only thing that matters is the U.S. currency. “For us, the bolivar is practically irrelevant. We pay suppliers in dollars, all prices are dollarized. The only payments in bolivars are basic services, such as water, electricity and telephony,” Ernesto said. Source

New Chainalysis Report Reveals Who’s Leading the World in Crypto Adoption — CoinDesk

The report looks to provide more insight into crypto usage in particular regions, noting some interesting trends. For instance, the report shows that Africa is the smallest crypto market in the world, accounting for only 3% of the total market size across regions, but peer-to-peer trading, remittances and savings needs are powering Africa’s grassroots cryptocurrency adoption. Source

Phemex Is a Rebellion Against Traditional Finance, and It’s Winning – Sponsored Bitcoin News

sponsored Wall Street is often touted as the place where dreams come to life, but the world’s economic epicenter can also be an absolute nightmare. From brokers screaming at each other across trading floors to the modern electronic trading systems of today, money talks in Wall Street. However, while the NYSE houses over $28.5 trillion in assets, there’s still a lot left unsaid. On Wall Street, it is believed that history doesn’t repeat itself, but rhymes. The world’s financial systems have failed consistently over time, but when Phemex’s founder Jack…

🔴 REVIEW BNB FAUCET DAN AIRDROP | MINING BNB DI TRUST WALLET | LEGIT OR SCAM ?

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io REVIEW BNB FAUCET DAN AIRDROP | MINING BNB DI TRUST WALLET | LEGIT OR SCAM ? Simak videonya sampai akhir ya. LINK DAFTAR : [ SCAM ] Mining btc gratis 👇 Mining btc gratis 👇 Mining doge terbaru 2021 👇 #Bnbfaucet #Bnbairdrop #Ekogustioofficial #Miningbnb ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Highlights From CoinDesk’s Bitcoin for Advisors 2021

Ross pushed back on the ETF bit, mentioning that fees would be quite expensive, and Kitces conceded that the cost might be prohibitive. And while Kitces remains skeptical about an asset that goes up solely because others are putting money into it, he positions himself and advises others to remain curious and keep an eye out as everything continues to unfold. For one thing, Kitces said he is certain that advisors, whether they hate or love bitcoin, can no longer afford to ignore the asset. Original

Highlights from CoinDesk’s Bitcoin for Advisors 2021 — CoinDesk

Ross pushed back on the ETF bit, mentioning that fees would be quite expensive, and Kitces conceded that the cost might be prohibitive. And while Kitces remains skeptical about an asset that goes up solely because others are putting money into it, he positions himself and advises others to remain curious and keep an eye out as everything continues to unfold. For one thing, Kitces said he is certain that advisors, whether they hate or love bitcoin, can no longer afford to ignore the asset. Source

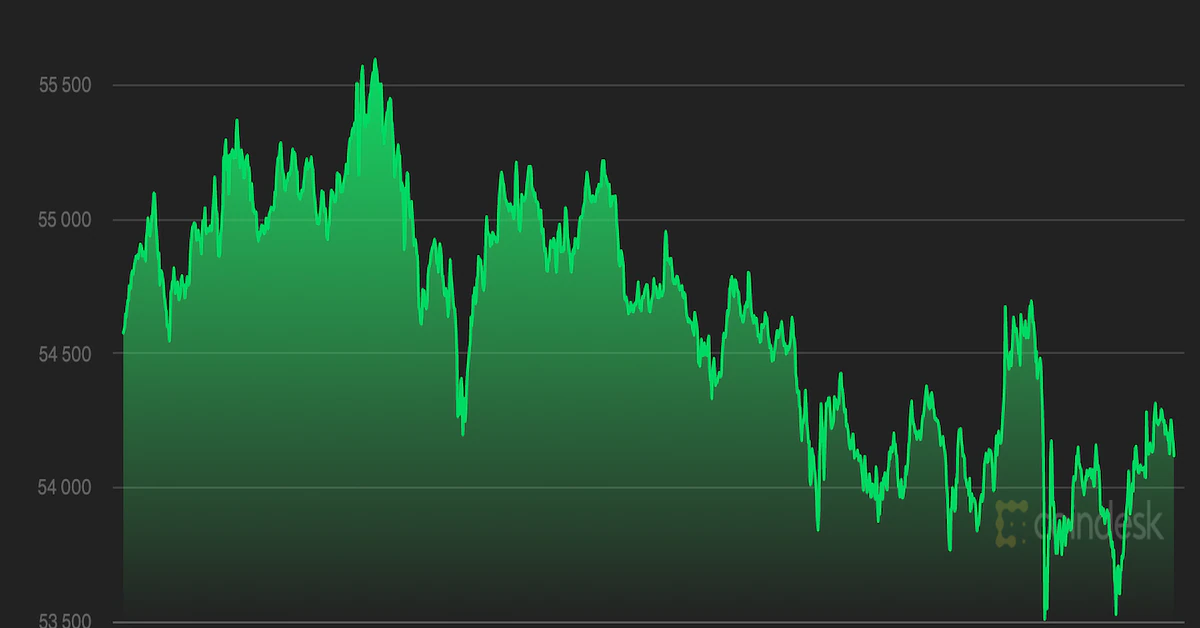

Analysts Bullish on Bitcoin as Trading Volume Rises — CoinDesk

So far, analysts are not too concerned about the sudden rise in trading activity. “Overall, the leverage ratios do not look overextended nor overheated, as we feel investors have been relatively cautious in their trading playbook,” StackFunds, a cryptocurrency investment firm, wrote in a Wednesday newsletter. Original

Tether fires back against report it is using reserves for investments and making crypto-backed loans

Tether, the largest stablecoin issuer by market capitalization, has refuted the details of a Bloomberg story on its reserves holdings. In a Thursday report, Bloomberg journalist Zeke Faux made numerous claims against Tether, including that its chief financial officer Giancarlo Devasini has used the company’s reserves to make investments, that seem to contradict Tether’s public position that the holdings were fully backed at all times. In addition, Faux alleges that Tether has invested in Chinese firms and issued crypto-backed loans “worth billions of dollars.” According to the report, he was…