There are three early applications for the JPM Coin, according to Farooq.

The first is for international payments for large corporate clients, which now typically happens using wire transfers between financial institutions on decades-old networks like Swift. Instead of sometimes taking more than a day to settle because institutions have cut-off times for transactions and countries operate on different systems, the payments will settle in real time, and at any time of day, he said.

The second is for securities transactions. In April, J.P. Morgan tested a debt issuance on the blockchain, creating a virtual simulation of a $150 million certificate of deposit for a Canadian bank. Rather than relying on wires to buy the issuance — resulting in a time gap between settling the transaction and being paid for it — institutional investors can use the J.P. Morgan token, resulting in instant settlements.

The final use for JPM Coin would be for huge corporations who use J.P Morgan’s treasury services business to replace the dollars they hold in subsidiaries across the world, Farooq said. Unseen by retail customers, the business handles a significant chunk of the world’s regulated money flows for companies from Honeywell International to Facebook, moving dollars for activities like employee and supplier payments. It generated $9 billion in revenue last year for the bank.

“Money sloshes back and forth all over the world in a large enterprise,” he said. “Is there a way to ensure that a subsidiary can represent cash on the balance sheet without having to actually wire it to the unit? That way, they can consolidate their money and probably get better rates for it.”

Looking further out, the JPM coin could be used for payments on internet-connected devices if that use for blockchain catches on, Farooq said.

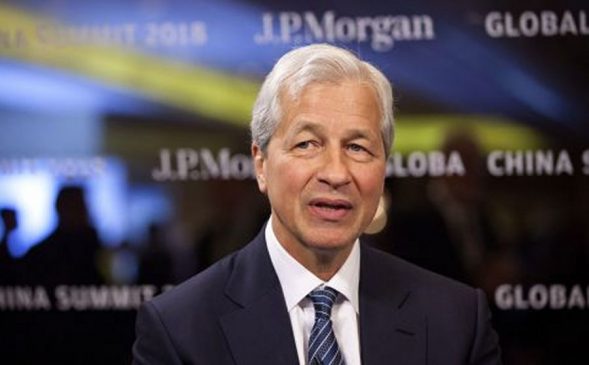

J.P Morgan is betting that its first-mover status and large market share in corporate payments – it banks 80 percent of the companies in the Fortune 500 – will give its technology a good chance of getting adopted, even if other banks create their own coins.

“Pretty much every big corporation is our client, and most of the major banks in the world are, too,” Farooq said. “Even if this was limited to JPM clients at the institutional level, it shouldn’t hold us back.”