By CCN: The litecoin price has appreciated more than 18-percent this week, and fundamentals suggest that it could go even higher.

The LTC-to-dollar rate today established an intraday high of $114.89 on Coinbase exchange. That took its 24-hour adjusted gains to 8.60-percent, the highest among the top cryptocurrencies on a bullish Friday. The move further helped Litecoin erase losses incurred during the last week’s downside action entirely. At the same time, the world’s largest cryptocurrency, bitcoin, was still to recover 7-percent higher to compensate a similar weekly loss fully.

Litecoin Halving, Mimblewimble

The stark difference between the bullish bias of Litecoin and that of Bitcoin hinted that investors/traders are more interested in holding the former. That is because of Litecoin’s upcoming halving, an event which would see the asset’s supply rate reduced to half from 25 LTC to 12.5 LTC.

Investors look at the phenomenon as bullish, while taking cues from the textbook supply-demand economic theory. They believe a reduced litecoin supply against a potential appreciation in demand would make the asset more valuable. As a result, their interim hedging sentiment treats Litecoin as a more profitable asset than other top coins, especially in the near-term. That explains why the asset is moving higher than its peers on an intraday basis.

The sentiment is further visible across the Litecoin blockchain. Binance Research reported that the coin had witnessed a hashrate increase of over 150-percent in the last six months, with its mining profitability up by 125-percent. In the same period, the Litecoin price appreciated by more than 380-percent against the US dollar from a low of $22.32.

On the flipside, Litecoin still needs to prove that there would be a higher demand. The project founder Charlie Lee announced in February that they would offer increased privacy with a so-called Mimblewimble update. The announcement has worked in favor of litecoin bulls so far. But unless the real update kicks in, every upside action is appearing to be driven by speculation and speculation only.

Opportunities

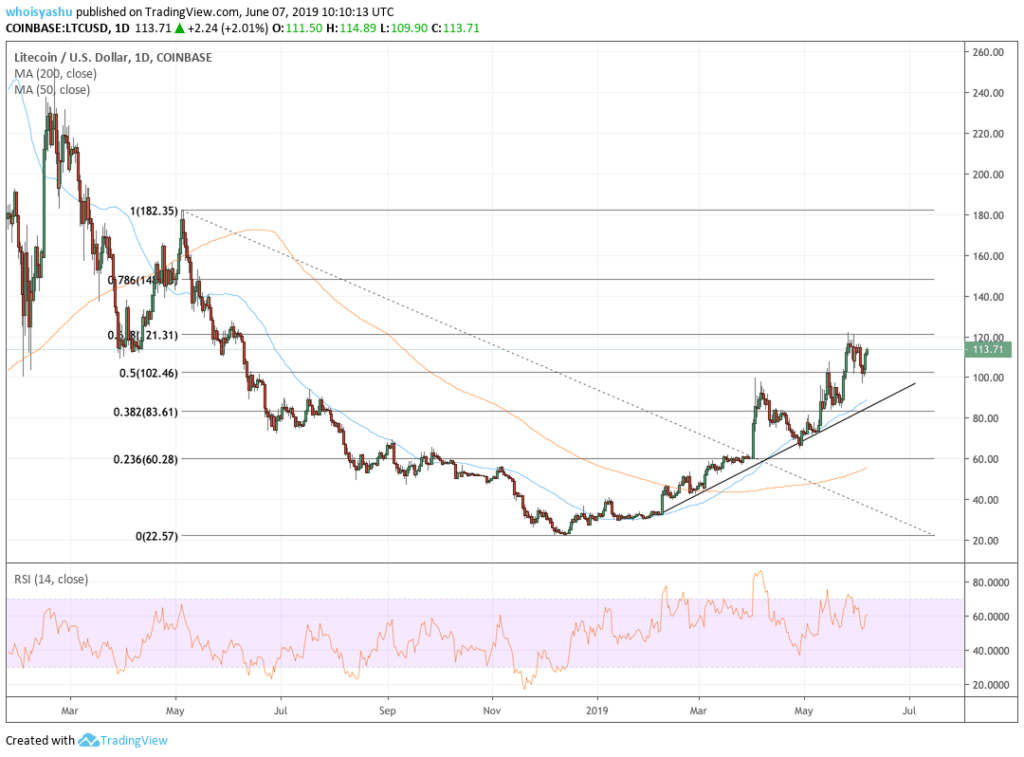

A Fibonacci retracement graph sketched from a swing high of $182 to a low of $22.57 provides an ideal illustration of how the Litecoin price could play out in next sessions. The asset is testing $121.31 as its interim resistance and $102.46 as its support. As of now, traders are looking to break above $121 to open a Long opportunity towards $148 – maybe even $182. Nevertheless, a stop loss just below the interim resistance could allow traders to minimize their losses should the bias switches back to the bearish side.

Conversely, a pullback from resistance could open a decent short opportunity towards $102.46, with $83.61 in view as a downside target. Maintaining a stop loss order just a few dollars above $102 would be a good risk management strategy, meanwhile.