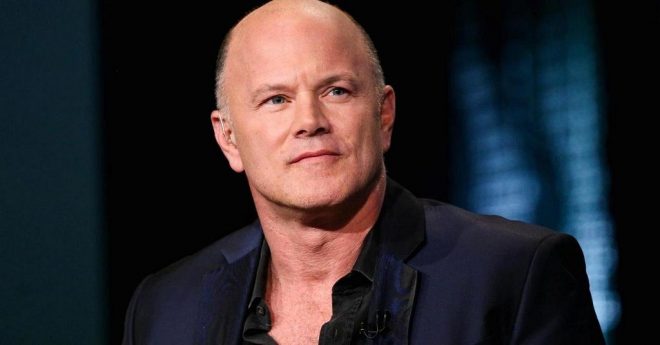

During an Interview for Bloomberg held yesterday, Mike Novogratz, a renowned capital investor, and former Goldman Sachs partner, was bullish about the future of cryptocurrencies; although this time he was also more cautious and less impulsive about his predictions.

Novogratz has always been a believer in the idea that institutional involvement is crucial to achieving the mass adoption of cryptocurrencies and the “explosion” in the markets many enthusiasts dream of.

Although there have been regulatory difficulties in the crypto markets during 2017-2018 (years in which many expected a massive involved by the institutions given the growth of the markets), Novogratz considers that during this year the price of Bitcoin will close above the actual levels, but well below the ATH of 2017.

Novogratz: Excited but Cautious

One of the reasons for this is the lack of an institutional figure to provide solidity and confidence to new investors; however, Novogratz believes this situation may change next year:

“I don’t see us breaking $10,000 by the end of the year but I think [in] Q1/Q2 if the institutions start coming in, we’ll put in new highs,”

Novogratz expressed his excitement over Fidelity’s announcement to offer custody services to investors. During the interview, he talked about the importance of this news as a possible catalyst for a future bullish run on the Bitcoin Market:

“[The Fidelity product] probably be up and running in January or Q1, and then you’ve got to run some water through the pipes, so my guess is you start seeing institutional flows into purely cryptoassets late first quarter – early second quarter …

The creation of Fidelity Digital Assets is the first step in a long-term vision to create a full-service enterprise-grade platform for digital assets”.

He stated that at this moment, Galaxy Digital, his investment firm is long on Bitcoin. From the perspective of technical analysis the immediate limits he handles are 6.2K as important support and 6.8 as a resistance to overcome:

“I think you got to take out 6800 first, and if that happens you’ll see people getting excited, and this is kind of the front run for institutions to come in …

We’re long. It has held really well above 6200.”