Bitcoin (BTC) has beaten gold in terms of returns by such a large amount this decade that investors have firmly dismissed recent price declines.

Data from monitoring resource Blockchain shows that since 2010, Bitcoin has delivered profits of almost 9 million percent.

Bitcoin profitable 89% of its lifetime

Put differently, $1 invested in BTC ten years ago was worth around $90,000 as of Dec. 18. By comparison, $1 of gold is now worth $1.34.

Bitcoin average market price 2009-2019. Source: Blockchain

Visibly buoyed by Bitcoin’s performance, Barry Silbert, CEO of cryptocurrency investment conglomerate Digital Currency Group, deployed the popular Twitter hashtag #dropgold, with his post subsequently receiving over 1,600 retweets.

The statistics underscore Bitcoin as a winning investment for the vast majority of existence. As information portal 99 Bitcoins confirmed on Thursday, since 2009, Bitcoin has only been unprofitable to buy on 434 days — at price peaks.

This equates to 89.16% profitability, allowing BTC to put pay to gold’s record despite the precious metal’s own recent advances in U.S. dollar terms.

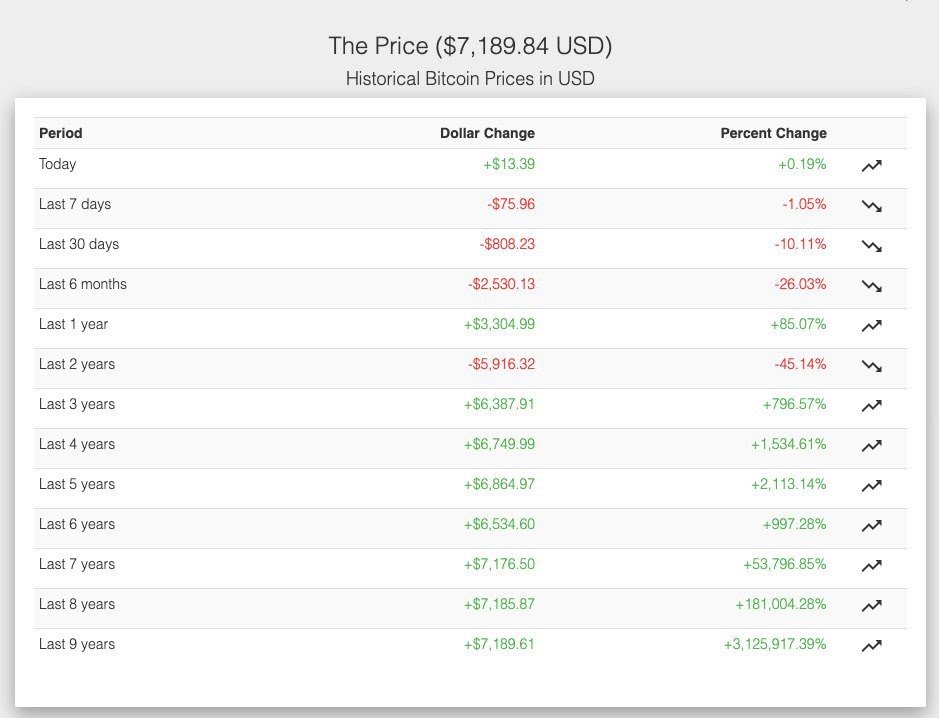

Year-on-year, Bitcoin returns have been similarly impressive. At current price levels around $7,150, Bitcoin investors made 85% profits versus December 2018.

With 2017 as an exception, they remain in the green every year since the beginning.

Bitcoin profits over different time frames. Source: Coin Dance

BTC hodlers lie in wait

As Cointelegraph reported, a recent analysis of wallets has shown that Bitcoin “hodlers” have in fact remained highly disciplined in 2019, despite this year producing a bull-run from lows of $3,100 to almost $14,000.

The phenomenon supports the perception of BTC as an investment tool, suitable for savers with a low time preference who wish to preserve wealth for the long term.

As Saifedean Ammous summarized in his popular book, “The Bitcoin Standard,” that characteristic will continue to pit Bitcoin directly against “easy” forms of money, including fiat currency.

Over the New Year period, the U.S. Federal Reserve alone will add an extra $425 billion in fiat value to the economy — more than three times Bitcoin’s market cap that is essentially money created out of thin air.