The total crypto market cap gained $29.5 billion over the seven-day period and now stands at $172.1. The top ten currencies all saw double-digit gains over the same time frame with Bitcoin Cash (BCH) and Litecoin (LTC) leading the recovery with 77 percent and 40 percent respectively. At the time of writing, bitcoin (BTC) is trading at $5,054 while ether (ETH) stands at $162 and Ripple’s XRP is at $0.344.

BTC/USD

Bitcoin closed the trading day on March 28 at $4,092 on the Bitfinex daily chart or $10 lower than the previous session. It moved 2.17 percent higher on March 29 and formed a green candle to $4,178 successfully breaking above the January high of $4,169.

The weekend of March 30 to 31 started with a small correction to $4,163 on Saturday. The BTC/USD pair peaked at $4,208 during the day and was just $3 shy of the year high of $4,211.

On March 31, BTC remained flat but still managed to close the seven-day period and the month of March with a 3.2 and 8.1 percent increase respectively.

Bitcoin started the new week by confirming its position above the January high of $4,167. The BTC/USD pair stopped at $4,195 and managed to get back to the uptrend corridor started on February 8.

In the early hours of April 2, the most popular cryptocurrency made an unprecedented move and stormed past the psychological level of $5,000, peaking at $5,108. In the short period between 23:00 CET on April 1 and 04:00 CET on April 2, bitcoin added more than $900 or 21.5 percent to its value and reached a level not seen since November 2018.

The coin closed the day session at $4,918 and extended its winning streak to $4,976 on April 3.

South Korean crypto exchange Bithumb was once again hacked, the company announced on March 30. According to the press release, at around “10:15 pm on the 29th, we detected abnormal withdrawal of the company’s cryptocurrency through Bithumb’s abnormal trading monitoring system.”

It was later revealed that three million EOS tokens (worth $13 million) and 20 million XRP tokens (worth $6 million) were transferred out of the exchange’s “hot wallet.” Bithumb confirmed the attack was an apparent inside job and is a direct result of the lack of verification of internal staff. All stolen funds were owned by the company, while customer funds remained safe in their cold wallet. Deposit and withdrawal services were temporarily disabled.

On June 19, 2018, Bithumb lost over $30 million worth of cryptocurrency after suffering a hacking attack.

One of the most popular cryptocurrency exchanges, Coinbase, announced on March 29 a new staking service for its institutional customers. The American company launched staking support for Tezos on its Coinbase Custody platform with the idea to add MakerDAO in the coming weeks.

The crypto staking process on Proof of Stake (PoS) blockchains allows users to earn passive income by helping secure the network and participate in the validation process of transactions by delegating some amount of their coins to run a blockchain node.

Additionally, Coinbase users are now able to send and receive funds internationally on their Coinbase wallet with zero fees using XRP and USDC. The transfers are instantaneous and are available for all Coinbase users in supported countries including Mexico, Philippines, and India.

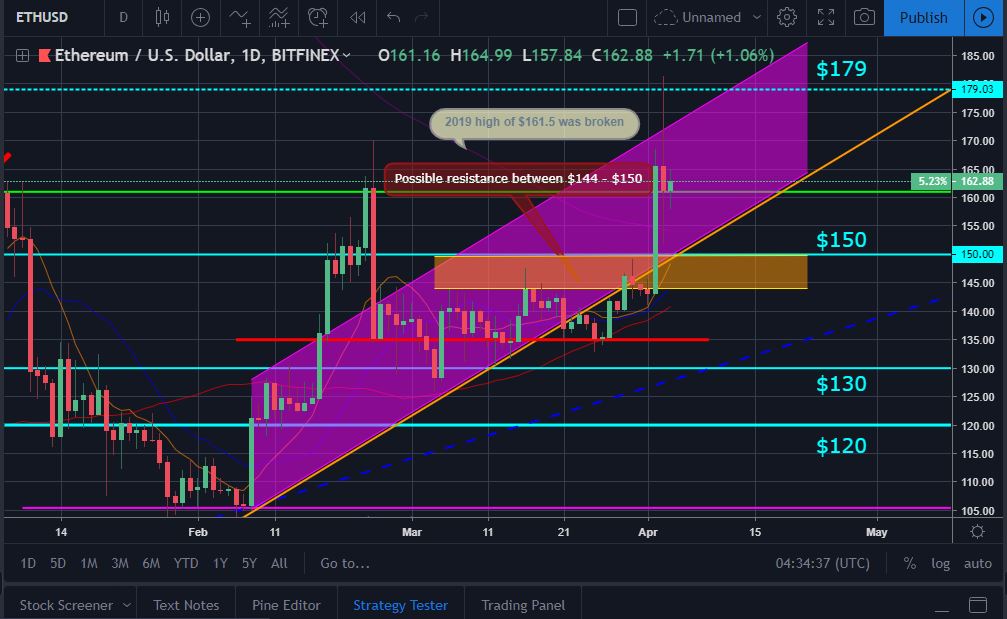

ETH/USD

The Ethereum token dropped from $142 to $140 on March 28 but managed to break above the first resistance line at $144 one day later. It closed at $146 with a 4.2 percent price increase.

Ether was trading in the $142 to $149 zone on March 30 and formed a red candle to $144.5 without being able to cross the $150 line. It moved even lower to $143.5 on the last day of the week and ended the period with a 4.5 percent price increase. It was 5.3 percent up on the monthly basis.

The ETH/USD pair started the new month by dropping down to $143 after trading in $140 to $145 range during the day session.

Just like the majority of leading cryptocurrencies, however, ether made an unexpected movement upwards on April 2 and in the matter of just one hour jumped from $143 to $155, which represented a price increase of more than eight percent. It eventually closed the session at $165, breaking the 2019 high of $161.

On April 3, ether broke above $180 during the day, but bulls were already running out of fuel, so it made a slight correction to $161.

XRP/USD

The XRP/USD pair is still struggling to finds its direction and after more than a month in the $0.325 to $0.305 zone, it is not able to establish a trend.

After climbing to $0.3147 on March 27, Ripple’s XRP token lost one percent of its value and dropped to $0.3112 on March 28. As predicted, it found support at the $0.309 level and formed a new green candle to $0.313 on March 29. The popular altcoin was trading in the $0.309 to $0.315 range during the day.

The weekend of March 30 to 31 started with a second consecutive day of gains on Saturday, as XRP successfully climbed to $0.316 in a highly volatile trading session during which it peaked at $0.323.

On March 31, it made a slight movement downwards to $0.313, closing the week with no change compared to the previous one. XRP was one percent down for the month of March.

On Monday, April 1, the Ripple token moved North to $0.317 erasing all losses from the previous session. On the next day, it virtually exploded and reached $0.355 in a 12 percent bull rally. The XRP/USD pair dropped back down to $0.342 on April 3, but was still able to hold above the important $0.34 level.

Federal Bank, one of the leading commercial banks in India, announced a new partnership with Ripple on March 28. The institution, which handles approximately 15 percent of India’s inward remittances will use the company’s network for cross border remittance.

According to the official press release “the Ripple platform ensures cross-border transactions much safer and secured” through its blockchain-based solution. India’s remittance market is the world’s largest with transfers of more than $80 billion for 2018.

Switzerland’s principal stock exchange, SIX Swiss Exchange, has listed the “world’s first” XRP Exchange traded product (ETP). As of April 2, users can invest in the Amun Ripple XRP (AXRP) ETP, developed by the crypto derivate company Amun.

SIX already offers three crypto-based ETP products for trading ether, bitcoin and a basket of cryptocurrencies.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4