Friday, Aug. 2 — Bitcoin (BTC) consolidated at around $10,500, while the top 20 coins by market cap are seeing mixed signals.

13 out of 20 top cryptos by market cap are seeing green at press time, with Texos (XTZ) recording the biggest gains in the list, up more than 6%, according to CoinMarketCap. On the other hand, Litecoin (LTC), the fourth biggest crypto, dropped the most, down more than 4% over the past 24 hours.

Market visualization from Coin360

Following a recent bullish move, Bitcoin continued to fluctuate at around $10,400 today, while its intraday high amounted to $10,654. At press time, the biggest cryptocurrency by market cap is up nearly 4% over the past 24 hours to trade at $10,478. Over the past 7 days, BTC is up around 6.5%.

Bitcoin 7-day price chart. Source: Coin360

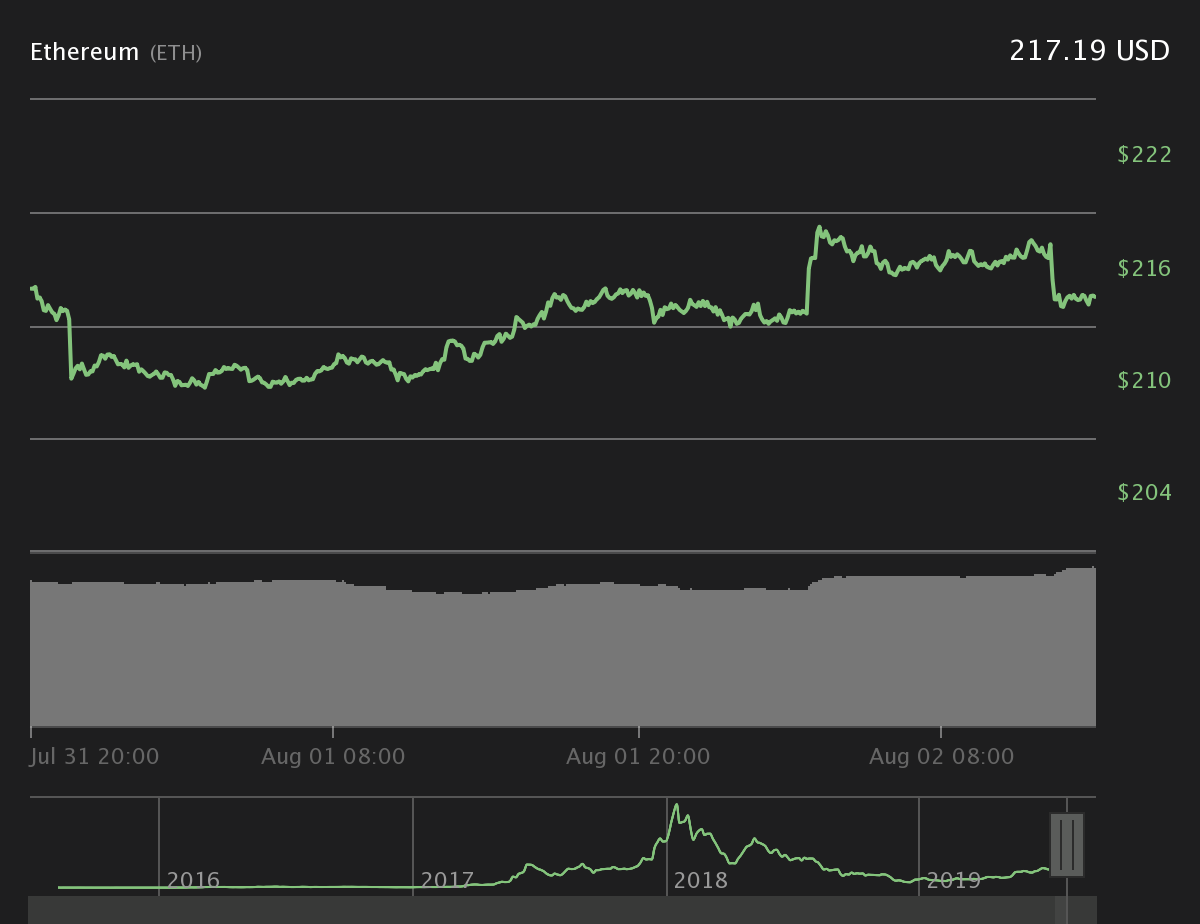

Ether (ETH), the second cryptocurrency by market cap, is up 1.1% to trade at $218. Over the past 7 days, Ether’s price is almost flat at press time, seeing a slight decline of around 0.2%.

Ether 7-day price chart. Source: Coin360

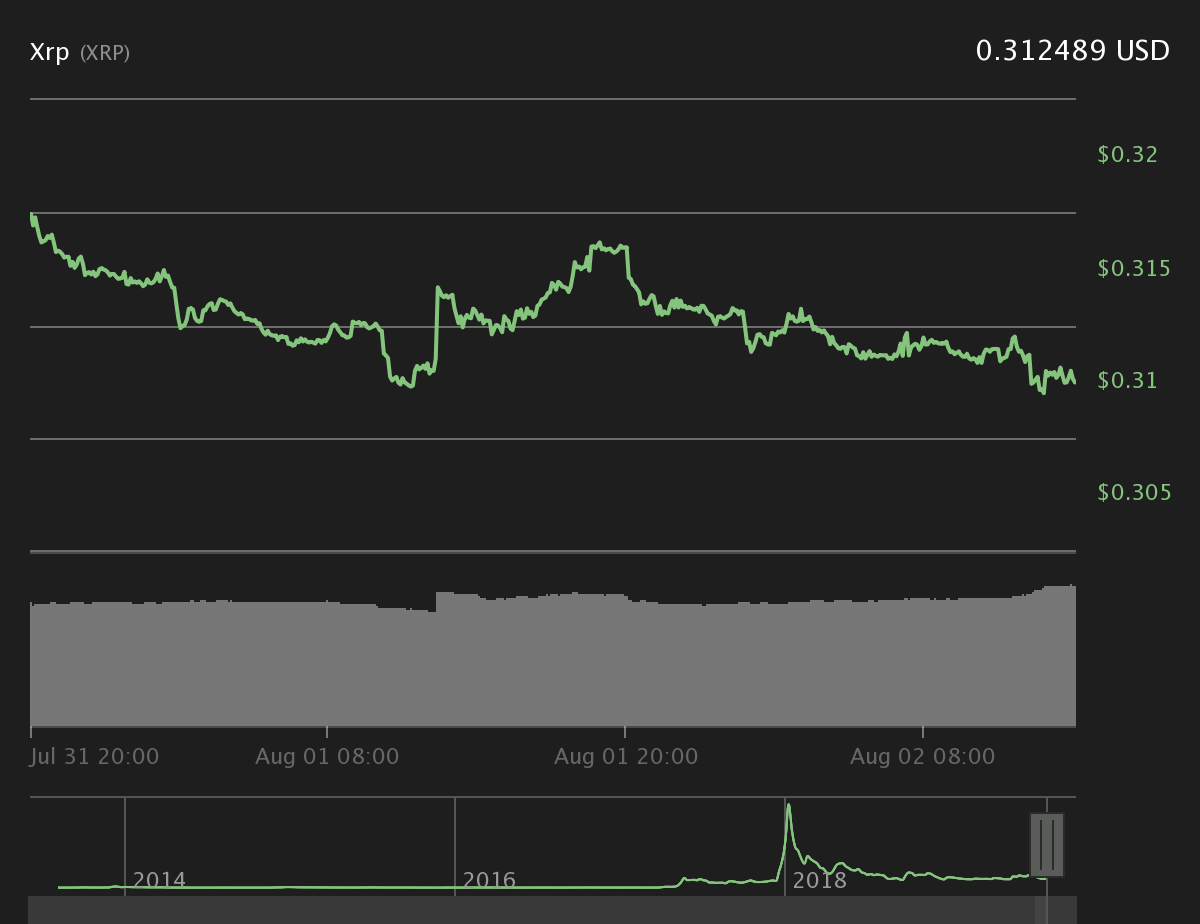

Ripple (XRP), the third top cryptocurrency by market cap, is down around 0.7% to $0.312. Over the past 7 days, the coin is down more than 2%.

Ripple 7-day price chart. Source: Coin360

Daily trading volume is up nearly $10 billion today

Total market capitalization has been hovering around $282 billion over the day, while daily trade volume of all cryptos surged from around $48 billion in the beginning of the day to $57 billion at press time, according to CoinMarketCap.

Yesterday, Cointelegraph reported on Digital asset research firm Delphi Digital releasing a research claiming that the macroeconomic landscape is creating the “perfect storm” to make Bitcoin’s price surge.

Earlier today, instant crypto loans firm Nexo announced the launch of a cryptocurrency credit card branded by global payment giant MasterCard.

U.S. stock market dropped below 50-day moving averages today

Meanwhile, the United States stock market dipped below their 50-day moving averages as President Donald Trump escalated U.S-China trade fears by announcing more tariffs while investors digested U.S. employment data, CNBC reports. At press time, Dow Jones Industrial Average is down 256 points or around 1%, while S&P 500 dropped more than 1%. Nasdaq Composite is down around 1.8%.

At the same time, oil prices rallied almost 3% today, seeing a partial rebound from their biggest daily drop in several years amid more tariffs announcements. West Texas Intermediate crude oil is up 3% at press time, while Brent crude gained 2.6%.

Similarly, gold prices edged up today, with U.S. gold futures up around 1.5% to $1,458 per ounce at press time, while spot gold was almost flat to trade at $1,445 per ounce.

Recently, a former exec at German multinational investment bank Deutsche Bank argued that Bitcoin is a leading indicator of hidden geopolitical tensions, which should not be ignored.