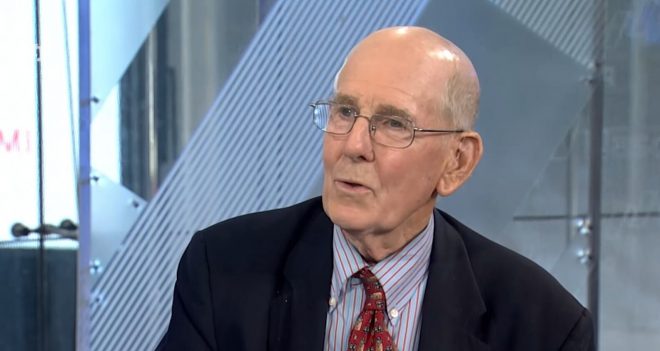

Renowned investor Gary Shilling believes Bitcoin is a black box. And he prefers to stay away from it.

Speaking to Business Insider, the American financial analyst admitted that the digital currency is too opaque and complicated for him to invest in — and he will not invest in anything that he does not fully understand. Shilling also clarified that while he had attempted to learn about bitcoin’s economic model, he eventually found that the asset is “not transparent,” primarily because its creator Satoshi Nakamoto remains unidentifiable.

“I’m just very suspicious of things that are not very transparent,” he said. “And if I can’t understand it, I don’t want to invest in it.”

The criticism came after bitcoin exhibited one of its most depressive market performance in 2018. The digital currency had established its peak point at $20,000 during Q4 2017 but corrected its course later by falling more than 80%. At press time, it was trading inside the volatile range of $3,550 and $4,000.

Shilling compared the price performance of bitcoin to that of the South Sea Bubble. The infamous stock scam, which took place during the early 1700s, saw the stocks of the UK-based South Sea Company appreciating wildly based on rumors, false claims, and speculations, before crashing and eventually becoming worthless. According to Shilling, bitcoin is following the same course of events — that of guesswork and a crash which could lead its value all the way down to zero.

Would Satoshi Dump His Bitcoins?

Gary Shilling gives his opinion on bitcoin, calling it a ‘black box’ pic.twitter.com/3jEe1pzgve

— Business Insider (@businessinsider) January 4, 2019

Shilling further explained his anti-bitcoin position with an excerpt from a Charles Mackay’s non-fictional book, titled “Extraordinary Popular Delusions, The Money Mania,” in which an anonymous person had put an ad in a London newspaper. It read, “Great Discovery, Wonderful Investment. But I Won’t Tell You the Details.”

“A lot of suckers in London invested in this,” Shilling said. “And the last line was ‘This guy collected all the money, closed up, left for the continent that evening never to be heard of again.’”

According to him, Satoshi Nakamoto, who reportedly holds 980,000 bitcoins — almost equal to $3.712 billion at press time — could one day sell out all his holdings for fiat and run-off like the Londoner mentioned in Mackay’s book. Bitcoin’s total market capitalization at press time is close to $66.876 billion, according to CoinMarketCap.com, distributed among 503,000 active addresses. According to BitInfoCharts, a total of 603 bitcoin addresses hold assets worth more than $10 million.

Would Bitcoin Ever Go to Zero?

Hypothetically, the big whales in the bitcoin market would need to come together to orchestrate a crash. That means any individual or group holding more than $100,000 worth of bitcoins in their wallets. Small investors would likely tail the trend and short their holdings, adding more to the negative direction. Bitcoin would reach zero only when the entire activity around its industry came to a halt, which means everything from mining to trading to payments.

But if such a scenario appears, the fiat liquidity would matter the most. Crypto exchanges would need to call off their operations due to insolvency, which would leave many would-be sellers left holding their coins.

But, according to Jameson Lopp, a renowned cypherpunk, bitcoin as an industry is growing in almost every aspect despite the market crash. His latest study found:

“Bitcoin is at the forefront of an increasingly complex ecosystem that continues to grow in a variety of ways. And for the tenth straight year, it stubbornly refused to die,” he wrote while providing evidence of its growth among researchers, developers, and venture capitalists.

Shilling has been a legendary investor if one looks at his earlier predictions. In 1969, he was among the only few analysts that had predicted a recession at the year’s end. He was also the single voice that forecast a monolithic international inventory-building fling which followed one of the most severe recessions since the Great Depression of the late 1920s.

The investor has admitted that he does not understand bitcoin — much like Warren Buffet, the famous investment tycoon, who was once bearish on Amazon and Google stocks. He later admitted that his prediction about the two of the leading technology firms was wrong — because he could not understand them back at the time.

Gary Shilling image from YouTube