Bitcoin’s status as a hard asset is growing clearer by the day. It has even resulted in the cryptocurrency forming a striking correlation to gold, silver, and other traditional “safe havens.”

One byproduct of this has been a degrading correlation to the stock market, which may ultimately bode incredibly well for the benchmark cryptocurrency – despite the equity market’s current strength.

While speaking about these shifting BTC correlations, one analyst explained that this is a highly bullish trend that is likely to provide its price with a boost in the days, weeks, and even months ahead.

This also comes as gold’s price rallies past $2,000 per ounce – marking a fresh all-time high for the yellow metal.

From a technical perspective, analysts are also noting that the cryptocurrency appears to be incredibly strong.

This means that it may just be a matter of time before Bitcoin revisits its all-time highs of $20,000.

Bitcoin Shows Signs of Strength as It Builds a Correlation to Gold

At the time of writing, Bitcoin is trading up over 3% at its current price of $11,600.

The cryptocurrency has been caught within a clear uptrend throughout the past couple of weeks that has led it up to its current price levels from lows of $9,000.

The climb from these lows has been slow and steady and is far from the types of uptrends that allowed the crypto to post gains in late-2017 and mid-2019.

This does indicate that this growth is more organic and sustainable than that seen previously, and may mark BTC’s attempt to build a solid foundation for its next parabolic movement.

One factor that may also bolster Bitcoin’s next big move higher is its growing status as a “hard asset.”

While speaking about this, one analyst explained that the cryptocurrency has been forming a heightened correlation to gold in recent weeks as its connection to the stock market degrades.

“Recent movements in Bitcoin correlations show that investors are perceiving BTC as an inflation hedge which is a highly positive development. It is no longer simply performing as a risk asset. Blue = BTC/GLD correlation coefficient. Red = BTC/SPY correlation coefficient,” he said.

Image Courtesy of Lucid.

BTC’s Technical Outlook Grows Brighter as Connection to Gold Builds

Because gold is currently one of the best-performing assets, Bitcoin’s mounting correlation to it is likely to provide it with an upwards tailwind.

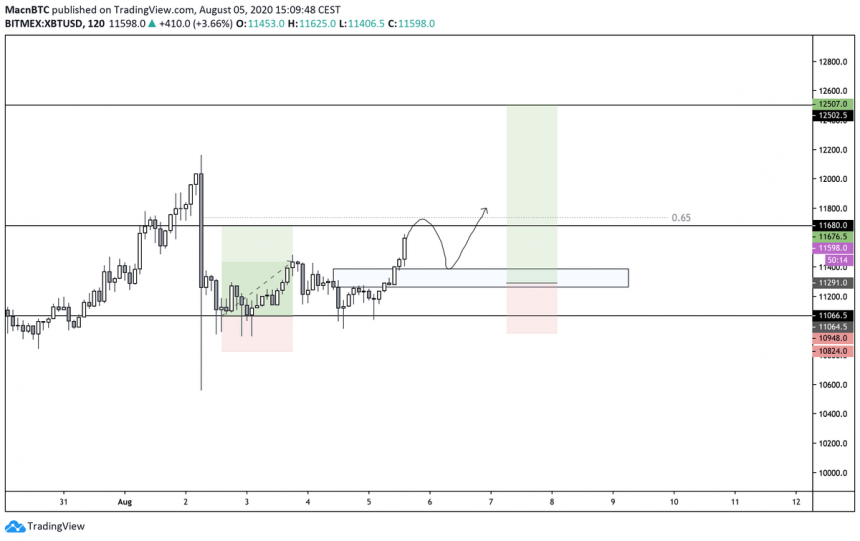

From a technical perspective, analysts expect BTC to see some further near-term upside. One analyst explained that although he anticipates a brief retrace, a movement to fresh yearly highs of $12,500 is imminent.

“BTC – Funding reset back to 0, Likely to retrace at 0.65, but base looks solid. Longing retrace/flip to $12,5k,” he said.

Image Courtesy of Mac. Chart via TradingView.

How Bitcoin trends in the coming weeks should offer greater clarity into just how bullish its growing connection to gold will be for its price.

Featured image from Unsplash. Charts from TradingView.