According to Investopedia, the first paper money in the U.S. was issued on February 3, 1690 by the Massachusetts Bay Colony. Less than two hundred years later, Americans were able to trade $20.67 for an ounce of gold. In other words, the U.S. dollar was backed by gold.

This was an effective system as it limited the monetary supply. In 1933, President Herbert Hoover famously quipped,

we have gold because we cannot trust governments.

Sadly, it is also the same year that the U.S. started to abandon the gold standard.

By 1971, the connection between gold and the U.S. dollar was completely severed. What ensued was almost fifty years of dollar devaluation.

Central Banks Create Inflation

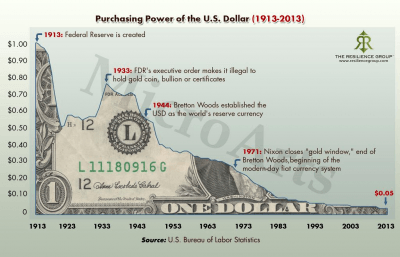

In 1913, the U.S. government created the Federal Reserve. The purpose of this institution is to oversee monetary policy and help stabilize the economy. It also has the power to print more money digitally by issuing credit to major banks.

This is how inflation takes place. Without any asset backing the dollar that could limit monetary supply, the Federal Reserve can simply introduce more fiat currency into the economy. Over time, the value of the dollar declines as the central bank injects more money into the system.

In the image above, you will see that the purchasing power of the U.S. dollar has plummeted by 95% since the creation of the Federal Reserve.

This is bad news for every citizen. You may not feel it but your wealth is slowly losing value over time. However, there’s an escape. The solution for wealth preservation works so well that the elite call it rat poison due to fear and lack of understanding.

Venture Capitalist: We Now Have the Opportunity to Exit the Monetary System

If you have a million dollars today, it wouldn’t have the same value next year. In other words, you’re losing money due to the inflation stimulated by the central banks. But now, you have the chance to preserve your wealth.

Nic Carter, a partner in Castle Island Ventures and a former cryptoasset analyst at Fidelity, spoke to CCN on how bitcoin can help citizens preserve their wealth. He said,

You’re defaulted into using the local sovereign currency, even if it’s highly inflationary. Most normal savers do not have other options, and much of the time have to deal with capital controls so they cannot exit to other currencies or assets.

The venture capitalist added:

Bitcoin gives us, for the first time, the option to exit our local monetary system with our funds intact. They can no longer default every local citizen into their potentially ruinous monetary schemes.

Before the existence of bitcoin, people bought properties, gold, and other precious metals to shield their wealth against inflation. However, Nic Carter said that these stores of value are harder to obtain and store. Thus, he noted that cryptocurrencies are low-friction assets; they are easier to buy and can be stored safely through a hardware wallet.

At the end of the interview, Nic Carter stressed,

For the first time [governments] face low-friction outflows if they adopt too inflationary a policy.

It may be possible that in the future, those who call bitcoin rat poison would eventually have to seek financial refuge in the cryptocurrency.

Last modified (UTC): September 13, 2019 2:04 PM