The bearish candle will have to penetrate and close below the support level of $3,679 before BTC price will experience bearish breakout and this may return it to its previous low of $3,247.

Key Highlights:

- Consolidation is ongoing on the Bitcoin market;

- the break out is imminent on the market;

- bearish breakout may return the Bitcoin price to its previous low.

BTC/USD Long-term Trend: Ranging

Resistance levels: $4,249, $4,715, $5,424

Support levels: $3,679, $3,247, $2,765

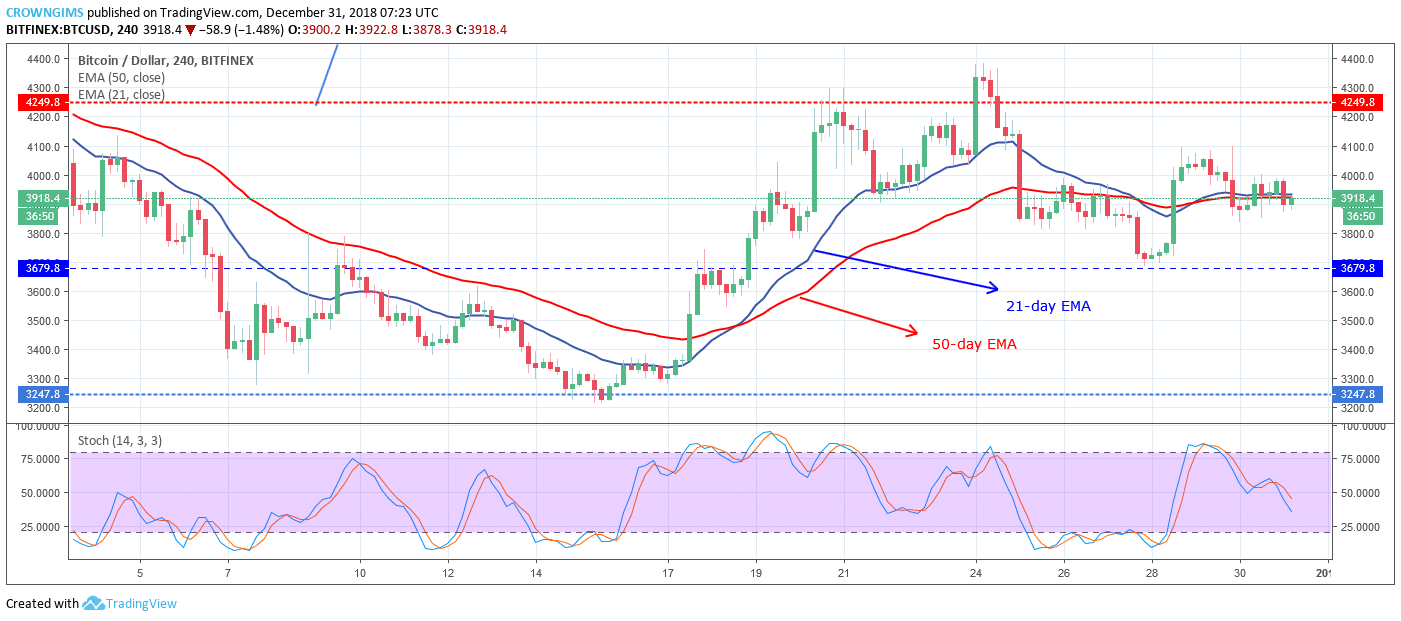

BTC/USD is ranging on the long-term outlook. The Bulls lost their pressure that took the BTC price up to $4,249 on December 24. The bullish pressure could not break up the dynamic resistance level of 50-day EMA. The shooting star candle pattern formed confirms the bearish reversal movement during an uptrend which dropped the BTC price at the support level of $3,679. It is this kind of zigzag movement within the range of $4,249 resistance level and $3,679 support level Bitcoin price experienced last week.

BTC price is flipping around the 21-day EMA within the range. In other words, the coin is currently trading in-between 21-day EMA and 50-day EMA. It is certain that there would be either bullish or bearish breakout. The bearish candle will have to penetrate and close below the support level of $3,679 before BTC price will experience bearish breakout and this may return it to its previous low of $3,247. Meanwhile, the Stochastic Oscillator period 14 is at 60 levels with signal lines pointing down is an indication of a sell signal.

BTCUSD Medium-term Trend: Ranging

BTC/USD is ranging on the medium-term outlook. Bitcoin price topped above the resistance level of $4,249 on December 24 with the bullish momentum that started on December 17; the bears returned to the market with full force, this was noticed as the evening star candle pattern formed at the same price level on 4-Hour chart. The bearish pressure broke downside the $4,249 price level, extended down by penetrated the two dynamic support levels and bottomed at $3,679 on December 29 after which it started sideways movement

The Bitcoin price is trading around 21-day EMA and 50-day EMA with the two EMAs interlocked which connotes that consolidation is ongoing. However, the Stochastic Oscillator period 14 is below 50-levels with the signal lines pointing down indicate sell signal. In case a bullish candle penetrates and close above the resistance level of $4,249, then, a bullish trend may commence and have its target at $4,715.