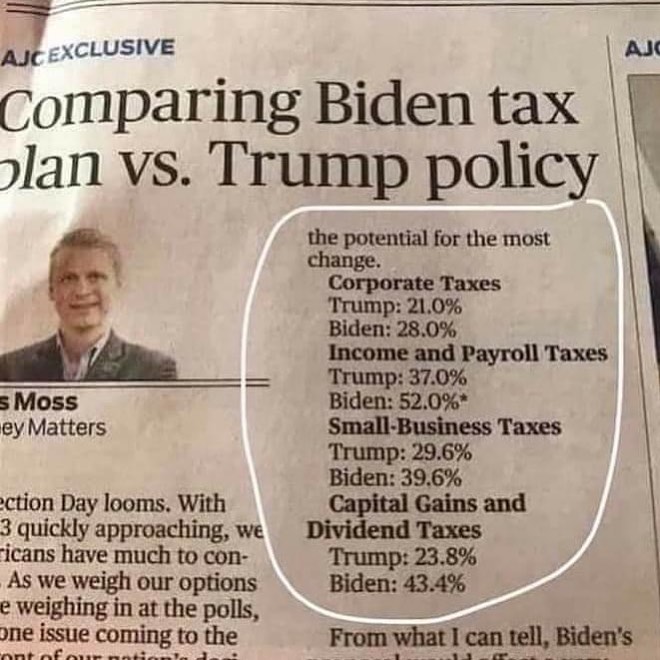

The U.S. presidential election is only 14 days away, and a number of bitcoin proponents have been discussing the capital gains tax implications Joe Biden plans to invoke if he wins the American presidency. According to Biden’s plan, capital gains will be raised from 21% to 39.6% for certain income brackets. Two weeks ago, the current U.S. president, Donald Trump, floated the idea of cutting long-term capital gains cut down to 15%.

In just two weeks, the U.S. may see a new president or it may get another four years of Donald Trump if the incumbent wins the election. This week a number of people have been discussing what taxes will be like in the U.S. if Joe Biden was elected president.

For instance, hip-hop mogul 50 Cent tweeted that he was going to vote for Trump after seeing how Biden plans to tax wealthy individuals in New York. Additionally, a number of bitcoiners have been discussing Biden’s tax increases and the direct form of taxation known as capital gains.

When people discuss the term “capital gains tax,” they are talking about the levy taken by the state when someone makes gains on the sale of any asset after the original purchase. Long-term capital gains apply to levies taken by the state after the asset is retained by the owner for more than 12-months.

Biden’s economic plan is a classic hit from the Dems… pic.twitter.com/FPiKlezqzB

— Bitcoinerisms – Buy Bitcoin (@BitcoinCensus) October 20, 2020

The popular crypto pundit, Mike in Space, discussed 50 Cent’s commentary on Twitter and said: “Come election day, a lot of people are going to realize they prefer not going broke to being woke.”

Another individual on Twitter this week is also disgusted with Biden’s tax proposals and stressed:

Biden wants to raise the capital gains tax significantly. This screws over the majority of seniors who live on fixed income. It also impacts anyone taking profits from bitcoin or any investments for that matter.

According to Biden’s tax plan, the long-term capital gains taxes for individuals who make $1 million per year or above will increase from 21% to 39.6%. Making matters worse, some reports show Biden’s proposal could increase capital gains taxes as high as 43.4% because of an added 3.8% payroll tax. However, even though online fact-checkers and mainstream media outlets try to claim that the income bracket proposal is concrete, the Biden tax plan is not 100% set in stone.

In fact, The Hill contributor Naomi Jagoda’s recent report notes that Biden has “repeatedly said” that the increased taxes and capital gains hike will not affect certain income brackets (under $400k to $1M). However, Jagoda’s report also implies that Biden’s tax proposal has not yet been “tailored to meet that objective.” The fact of the matter is Americans cannot take any politician’s promises seriously, and Biden could change the capital gains requirements on a whim.

On Facebook, Openbazaar and BCHD developer, Chris Pacia, complained about Biden’s capital gains hike proposal. “Really getting tired of Joe Biden claiming he won’t raise taxes on ordinary people,” Pacia wrote. “His capital gain tax increase from 23.5% to 43.4% would directly hit my life savings. It’s complete bullsh*t to claim he isn’t taxing ordinary people.”

Meanwhile, a team of Goldman Sachs analysts led by Arjun Menon wrote a note to investors saying that Biden’s capital gains hike could also spark a massive stock sell-off. Goldman’s investors note detailed that the last time the capital gains taxes were increased in 2013 it fueled a massive $100 billion stock sell-off.

On Twitter, a number of other cryptocurrency investors have expressed dissatisfaction with Biden’s proposed capital gains increase.

“If you’re invested in crypto or stocks and you’re voting for Biden, you need to re-evaluate your life decisions,” one individual wrote. “Biden is going to raise capital gains tax from 23.8% to 43.4%,”

Another bitcoiner wrote how it was a toss-up between Trump and Biden for different reasons. “Trump doesn’t like bitcoin,” the individual said. “Biden will probably raise taxes on capital gains. IDK…”

Many progressives wholeheartedly believe that Biden’s plan will only affect rich people. However, Biden supporters don’t realize that due to the Federal Reserve’s reckless inflation creation, the income bracket between $400k and $1 million could represent a lot more people in the very near future.

For example, the average American income in 1979 was $16,530 and it only took two decades to increase 431.54% thanks to rapid inflation. In 2020, the average American income of $87,864 only needs to jump 355% in order to meet Joe Biden’s $400k tax requirement.

Mainstream media has been attempting to publicize Donald Trump’s tax plan, but the incumbent president has yet to release any official tax proposal details thus far. Although, people predict that Trump aims to cut the current capital gains tax, as the president made a pledge on August 13 to cut the top federal tax for capital gains down to 15%.

What do you think about Joe Biden’s proposed capital gains hike? Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Businessnews@ajc.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.