TRON has been recently in the spotlight for all the wrong reasons. First, we hear news of police raiding TRON’s offices in Beijing on accusations that the TRON Foundation is running a scam.

Police raids at #Tron offices in Beijing? Additionally, there’s many angry people gathered there who are saying things like “Tron is a scam”. $trx #trx @justinsuntron pic.twitter.com/qFykQErQu6

— Hayden Otto (@haydenotto_) July 8, 2019

While the rumor was quickly addressed by the blockchain company citing that the police presence was for crowd dispersion, the events put the cryptocurrency in the negative light. Consequently, TRON significantly plunged against bitcoin.

As if the crypto token’s woes were not enough, TRON’s chief executive Justin Sun recently fanned the flames by canceling his $4.6 million lunch appointment with Warren Buffett. This fueled theories that the cryptocurrency’s top honcho is being detained by Chinese officials over accusations of illegal fundraising and money laundering.

With all the bad publicity, the only consolation for the crypto token is that bitcoin is starting to lose momentum. This weakness may give TRON the breathing room to recoup some of its losses against the No. 1 cryptocurrency.

Bitcoin Local Top Is Likely In

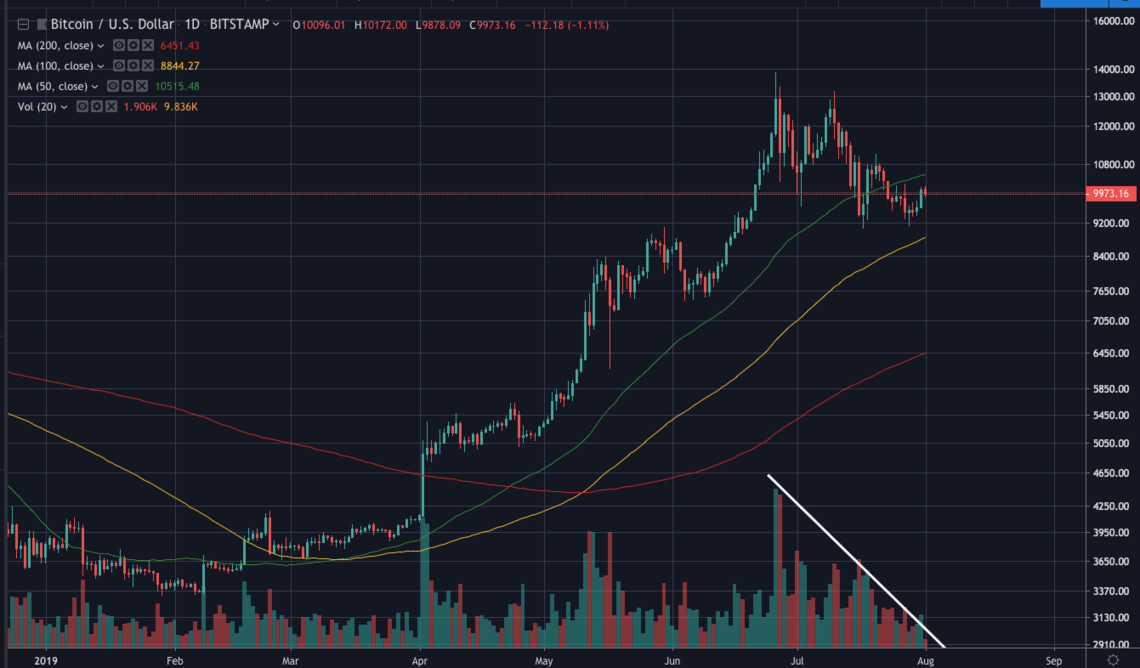

Throughout July, participants were cheering on the king of cryptocurrencies to seal $10,000 as support and print a fresh 2019 high above $14,000. However, the digital coin is doing the exact opposite.

It appears to be sealing $10,000 as a resistance since the price is struggling to stay above that level. In addition, volume has become anemic since July. This indicates that bulls are no longer interested in buying at current levels.

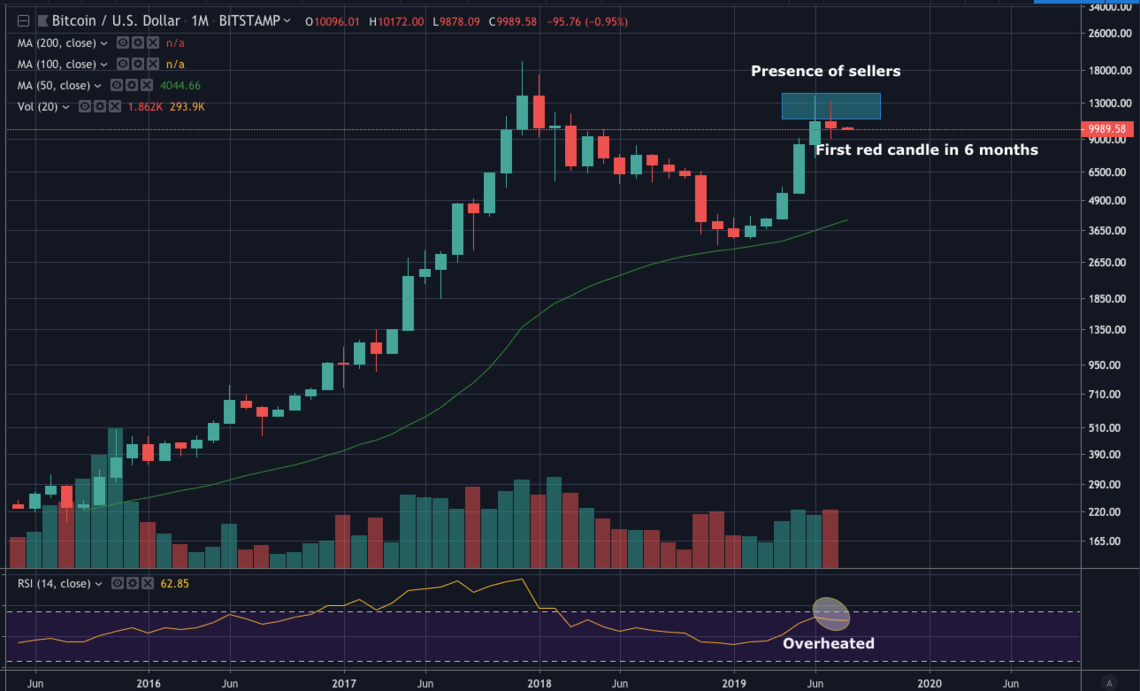

A quick look at the monthly chart affirms our short-term bearish view. The last two monthly candles have long wicks above their bodies, which indicates the emergence of sellers. In addition to that, bitcoin printed its first monthly red candle in six months. This tells us that there might be more pain soon.

Finally, bitcoin is almost overheated on the monthly time frame. This means that for now, the leading cryptocurrency is overvalued. Thus, expect to see more selling in the next few weeks.

This is good news for coins that have been clobbered such as TRON.

The Smart Money May Take Bitcoin Profits to Capitalize on TRON’s Weakness

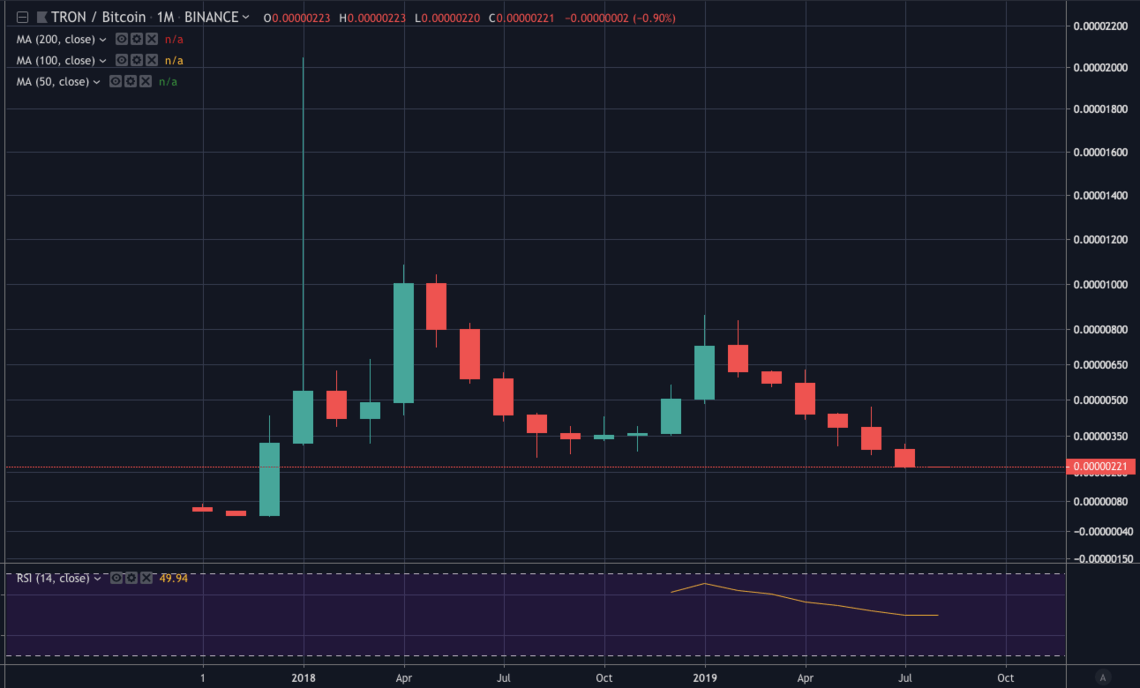

TRON has not seen a green monthly candle against bitcoin in more than half a year. As a result, the market dropped from the 2019 high of 863 satoshis to lows of 215 satoshis on July 16. That’s a plummet of over 75 percent in seven months.

With bitcoin losing strength, capital may trickle into altcoins that offer a lot of upside but with minimum risk. One superb candidate that fits the criteria is TRON.

Even with the negative publicity, the cryptocurrency appears to be showing signs of a reversal.

A look at the daily chart shows that the cryptocurrency is managing to hang onto its parabolic support of 220 satoshis. This is a key level for the market as it has never been breached since December 2017. Thus, bulls have a chance to bottom out at this price area.

The good news is that the market is printing a large bullish divergence on the daily RSI. This indicates that bulls are gathering momentum close to the parabolic support. Also, TRON is trading at the apex of a large falling wedge.

All in all, it appears that TRON is gearing up for a bounce.

Bottom Line: Consider Buying TRON on the Breakout

Investors who agree with our assessment might want to consider buying once TRON takes out resistance of 280 satoshis. The breakout will ignite a bounce that will likely send the cryptocurrency to our targets of 434 satoshis and 600 satoshis.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.