Bitcoin (BTC) has had an interesting year, recovering from major sell-offs to eventually skyrocket to new all-time highs.

However, Bitcoin’s performance and cryptocurrencies increased adoption worldwide have still failed to bring some observers into the crypto camp.

Yet compared to other bull run years like 2017, 2020 has seen much less crypto criticism, with a number of Bitcoin naysayers appearing to have somewhat softened their stance towards digital assets.

As we look back on crypto in 2020, Cointelegraph has noted some of cryptocurrency’s biggest critics.

“Bitcoin has no future”: Russian politician Anatoly Aksakov

- Date of quote: Oct. 23, 2020

- Bitcoin price that day: $12,900

Anatoly Aksakov, a member of the Russian State Duma and a major representative of Russia’s crypto-related legislation efforts, was a noteworthy cryptocurrency critic in 2020.

The official is confident that the global adoption of payments in crypto like Bitcoin would result in a “destruction of a financial system.” In October 2020, Aksakov predicted that decentralized cryptocurrencies like Bitcoin have no future, arguing that central bank digital currencies, or CBDCs, are the future of the financial system.

While it remains to be seen what comes of Aksakov’s prediction about Bitcoin, some of his previous comments show that he isn’t exactly a prophet. In a May 2020 live stream talk with Maria Butina, Aksakov said that crypto mining “is becoming a thing of the past” due to Bitcoin’s third halving cutting the miner block reward from 12.5 BTC to 6.25 BTC.

“[Crypto mining] is not profitable anymore, and as far as I understand, this business is poised to disappear in future,” Aksakov argued. Despite this doom prediction, Bitcoin miners have come into some money over the course of 2020, with Bitcoin miner revenue surging to pre-halving levels as of early November.

In keeping with Russian authorities’ constant game of ping pong in regulating crypto, Aksakov regularly changes his stance on the industry. In early December, Aksakov called cryptocurrencies a “highly profitable business,” and stressed the need to legitimize it by recognizing crypto as property.

A member of Russia’s State Duma, Aksakov is also chairman of the National Banking Council at Russia’s central bank. In mid-October 2020, the Bank of Russia officially released its plans on the development of Russia’s CBDC, the digital ruble.

“Nothing is priced in Bitcoin or any other cryptocurrency”: Nouriel Roubini

- Date of quote: Nov. 7, 2020

- Bitcoin price that day: $14,900

Nouriel Roubini, a professor of economics at New York University’s Stern School of Business, is one of the world’s biggest crypto critics, often referred to as “Dr. Doom” in the crypto community.

Known for his claims that “cryptocurrency as a technology has absolutely no basis for success,” the award-winning economist has stayed firmly critical of crypto and Bitcoin in 2020 despite admitting that BTC “maybe is a partial store of value” in late 2019.

On Nov. 7, 2020, Roubini argued that cryptocurrency itself is a “misnomer,” because a currency needs to provide a unit of account. Roubini continued to bash Bitcoin, criticizing its apparent limited scalability:

“Nothing is priced in Bitcoin or any other cryptocurrency. You have to be a single numerator, and with so many tokens, you don’t have a single numerator. You have to be a scalable means of payment, and with Bitcoin, you can make only five transactions per seconds.”

At the same time, Roubini admitted Bitcoin’s potential function as a store of value. “It’s maybe a partial store of value, because, unlike thousands of other what I call shitcoins, it cannot be so easily debased because there is at least an algorithm that decides how much the supply of Bitcoin raises over time,” Roubini noted.

Bitcoin is “the biggest bubble I’ve seen”: Peter Schiff

- Date of quote: Oct. 28, 2020

- Bitcoin price that day: $13,200

Peter Schiff, a millionaire broker and CEO at Euro Pacific Capital, is another famous Bitcoin naysayer, criticizing Bitcoin as early as 2013. Also referred to as a “gold bug” in the crypto community, Schiff is also one of the world’s biggest proponents of gold investment.

Over the course of 2020, Schiff delivered multiple negative and controversial remarks about Bitcoin, predicting that gold will moon while Bitcoin will crash in the near future.

On Oct. 28, 2020, while gold plunged to yearly lows against Bitcoin, Schiff argued:

“If you measure the size of asset bubbles based on the level of conviction buyers have in their trade, the Bitcoin bubble is the biggest I’ve seen. Bitcoin hodlers are more confident they’re right and sure they can’t lose than were dotcom or house buyers during those bubbles.”

On Dec. 4, Schiff said that Bitcoin’s past performance does not guarantee its future success but rather “assures its future failure.”

Despite regularly criticizing Bitcoin, Schiff has not stayed away from the world’s largest coin completely. In January 2020, Schiff claimed that he lost access to his crypto wallet, noting that having BTC “was a bad idea.”

In August 2020, the gold advocate told people on Twitter to send BTC to his 18-year-old son, Spencer Schiff. “Since so many of you Bitcoin guys are ribbing me because my son bought Bitcoin, why not really rub it in by gifting him some as a belated birthday present,” Schiff wrote.

“I can trade bananas easier as a commodity than I can trade Bitcoin”: Mark Cuban

- Date of quote: April 24, 2020

- Bitcoin price that day: $7,500

Mark Cuban, a billionaire investor and owner of the NBA’s Dallas Mavericks, is another major crypto sceptic, calling Bitcoin a bubble back in 2017. While admitting that crypto could be a “reliable financial instrument,” Cuban did not stop criticizing Bitcoin in 2020 over its supposed complexity.

In an April 24 interview with Morgan Creek Digital’s Anthony Pompliano, Cuban reiterated his long-running stance that Bitcoin is too complicated to use. “It’d have to be completely friction-free and understandable by everybody first, and then you can say it’s an alternative to gold as a store of value,” he said.

Cuban stated that Bitcoin is a questionable means of exchange due to its apparent lack of fungibility for goods and services without converting into fiat currencies:

“I can trade bananas easier as a commodity than I can trade Bitcoin, and I can still eat that banana before it goes bad, and get all my potassium for my workout.”

Despite his criticism of Bitcoin, Cuban still owns a tiny bit of crypto. The billionaire investor claimed to have about $130 dollars in Bitcoin as of April 2020. Back in 2017, Cuban recommended investing up to 10% in cryptocurrencies like Bitcoin.

“I don’t think digital currencies will succeed in the way people hope they would”: Ray Dalio

- Date of quote: Nov. 7, 2020

- Bitcoin price that day: $15,500

In a Nov. 7 interview with Yahoo Finance, Ray Dalio, American billionaire hedge fund manager and founder of Bridgewater Associates, claimed that he doesn’t see digital currencies like Bitcoin succeeding the way other people do. He also expects global authorities to “outlaw” Bitcoin if its price goes too high.

Dalio also criticized Bitcoin for not being an effective medium of exchange and a store of value, stating:

“Theoretically, Bitcoin is good, but there are three basic things: a currency has to be an effective medium of exchange, a storehold of wealth, and the governments want to control it […] I today can’t take my Bitcoin yet and buy things easily with it.”

Dalio subsequently admitted that he “might be missing something” about Bitcoin:

“I can’t imagine central banks, big Institutional investors, businesses or multinational companies using Bitcoin […] If I’m wrong about these things I would love to be corrected.”

Dalio has significantly softened his stance to Bitcoin, claiming that it could be a diversifier to gold on Dec. 8. The hedge fund veteran previously called the top cryptocurrency a bubble back in 2017.

Less people criticized Bitcoin and crypto in 2020

Despite a select number of well-known critics bashing Bitcoin in 2020, it appears that the seminal cryptocurrency has drawn less public skepticism than in previous years.

Prominent naysayers like Warren Buffett, Bill Gates and Donald Trump have largely remained silent about Bitcoin and crypto this year. Nobel Prize winning economist Paul Krugman, who predicted a “total collapse” of Bitcoin in 2018, refrained from commenting as well.

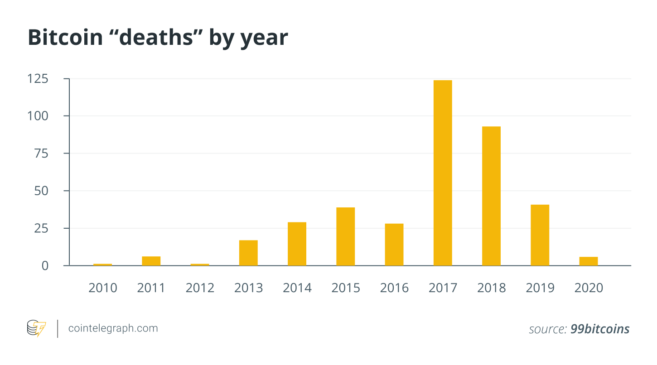

According to data by major Bitcoin-themed website 99bitcoins, 2020 has been the year with lowest Bitcoin “obituary” rate since 2013.

Only seven cases of “Bitcoin death” were reported in media monitored by 99bitcoins, compared to 41 “obituaries” in 2019, and 93 in 2018.

The biggest year for Bitcoin deaths was 2017, the last year in which Bitcoin saw a major bull run before 2020.

Whether one looks at Bitcoin’s withering critics, the growing interest of major banks and financial institutions in cryptocurrency, or the meteoric bull run this year, one thing seems clear: crypto is here to stay.