Bitcoin recently exploded above $13,000 and came dollars way from setting a higher high and confirming a new uptrend. Altcoins, however, haven’t responded as well, and one cryptocurrency capital manager has a theory as to why.

Su Zhu believes that because most altcoins haven’t delivered on the promises from three years ago, that when Bitcoin breaks out into a new bull market, newcomers and investors from the last cycle won’t be so easily duped again.

Su Zhu: Crypto Newcomers Won’t Fall For Altcoin “Failed Promises”

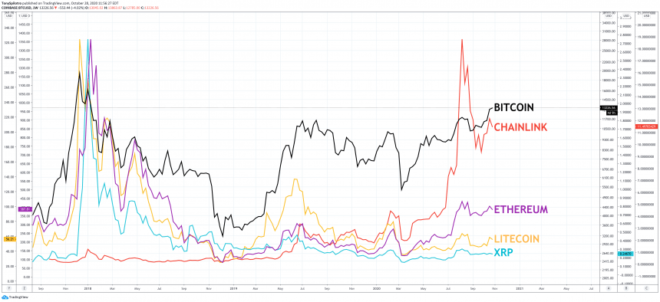

During the 2017 crypto bubble, Bitcoin rising to over $20,000 caused widespread retail investor FOMO. Because by that time the top cryptocurrency was trading well above $10,000, smaller time investors wanting to own a full coin or find the next Bitcoin turned to altcoins like Ethereum, XRP, Litecoin, and more.

The illiquid and low market cap assets began to explode in valuations as money poured in without a second thought about what it was and if it had value. What it did have, was promise.

Related Reading | Crushing Bitcoin Dominance Could Decimate Altcoins Through Q1 2021

More and more promise also poured into the market to catch the wave of money coming in, and an explosion of ICOs created thousands of more crypto projects.

Most coins, ultimately dropped 99% or more when the bubble popped, with only altcoins with a shred of promise hanging on to some of their gains.

The top projects mentioned above retained their value well compared to coins lower down the list, which were decimated during the bear market. Many of them, many never trade near all-time high levels again.

Crypto capital manager, Su Zhu, a veteran in the industry, claims that newcomers won’t fall for the same act again.

ppl who expect dominance (flawed a metric as it is) to get anywhere near 2017 lows forget that pretty much everything nonBTC has now exhibited 3yrs of failed promises and anti-lindyness

this fact will not be lost on newcomers when they contemplate what to buy

— Su Zhu (@zhusu) October 27, 2020

DeFi Could Prove That Dumb Money Will Fall For The Same Tricks Next Cycle

Too many crypto projects are now defunct, have exit scammed, or are too worthless for investors to even consider if another bull market begins. Newer coins, as DeFi has shown, will always be the most attractive in a speculative assets class.

Related Reading | Crypto Analyst: Altcoins To “Tank” While Bitcoin Runs For All-Time High

Negative sentiment surrounding XRP or Litecoin, for example, have kept them underperforming Bitcoin and Ethereum, while Chainlink has exploded into the top ten.

Chainklink shows shiny and new is still best in crypto | Source: LINKUSD on TradingView.com

Chainlink, however, is an example that not all new projects are empty promises, and the DeFi trend itself could prove Zhu’s theory incorrect.

While a full bull run isn’t here, uneducated investors will likely once again buy up the excrement left behind, as they just were while DeFi was at its hottest. Food-named coins fresh out of the oven surged, then in a flash left late investors burned.

The scenario sounds all too familiar and could suggest that when there’s a bull market in a speculative asset class, there’s no stopping dumb and money from being departed.

Featured image from Deposit Photos, Charts from TradingView.com