Monday, April 29 — after seeing moderate gains yesterday, crypto markets have tumbled at press time, with most of the top 20 coins by market cap in the red.

Bitcoin cash (BCH), the fourth top crypto by market cap, has dipped as much as 7.1% over the day to trade at $242 at press time.

While the majority of the top 20 are seeing sufficient losses, IOTA (MIOTA) has surged almost 18% over the past over the past 24 hours. The growth comes amidst the news that British car manufacturer Jaguar Land Rover today confirmed its partnership with Iota to use its blockchain network to reward drivers with crypto for data reporting.

Market visualization from Coin360

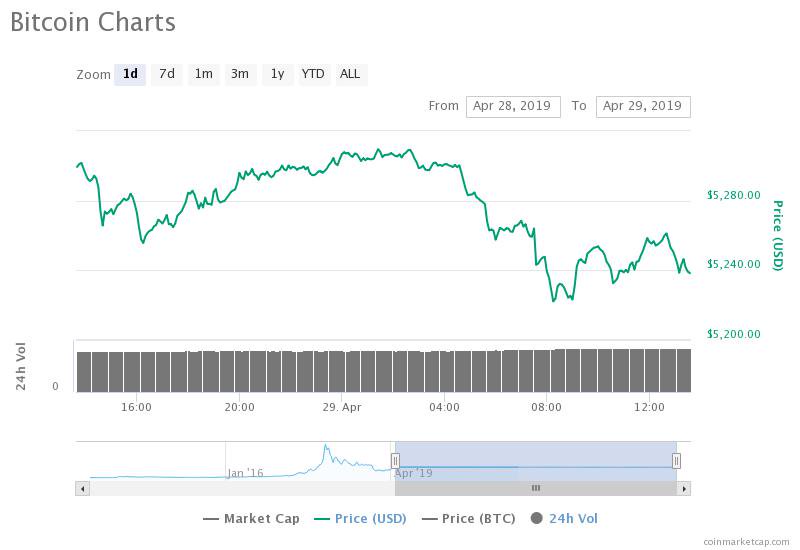

Bitcoin (BTC), the biggest cryptocurrency, is down 1.15% over the past 24 hours, and is trading at $5,240. Following slight gains yesterday, bitcoin climbed to an intraday high of $5,309 before dropping to as low as $5,222 earlier on the day. Over the past 7 days, the major currency is down 2.41%.

Bitcoin’s dominance on crypto markets is 54.9% at press time, slightly up from 54.5% at the beginning of the day.

Bitcoin 24-hour price chart. Source: CoinMarketCap

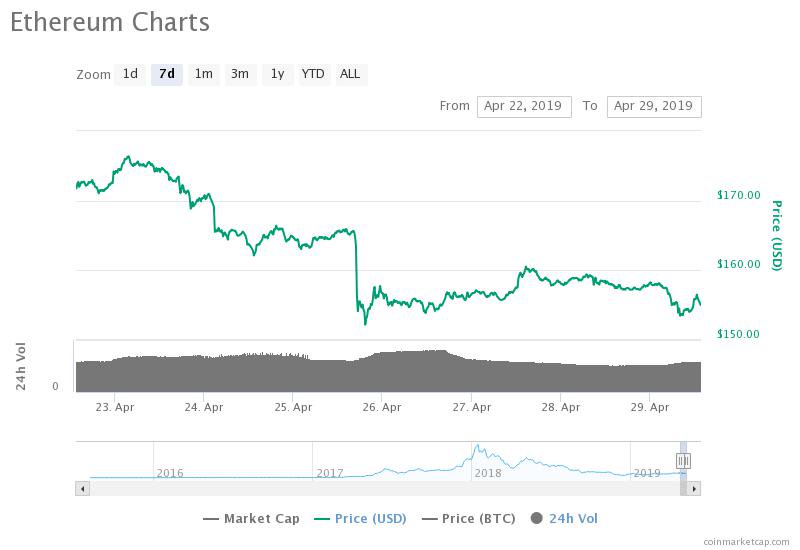

Ethereum (ETH), the second cryptocurrency by market cap, is down 1.79% over the day, to trade at $155 at press time. Over the past 7 days, the top altcoin is down 9.67%.

Ethereum 7-day price chart. Source: CoinMarketCap

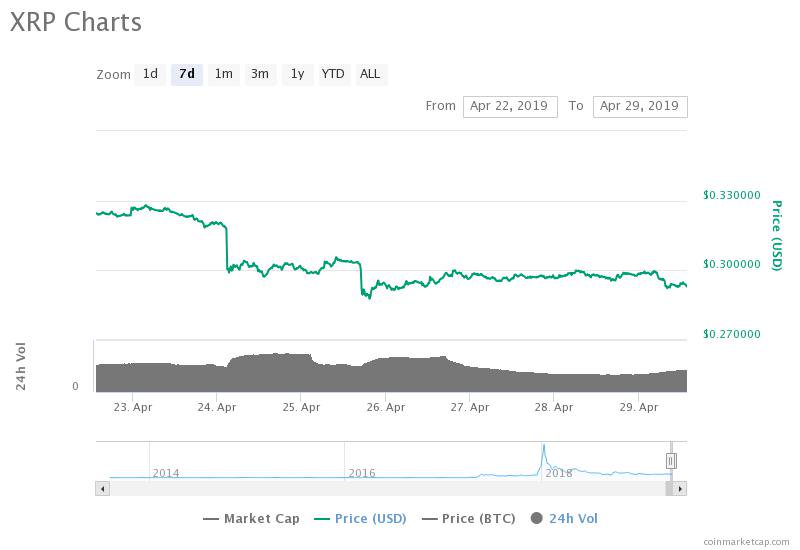

Ripple (XRP), the third top cryptocurrency by market cap, is down 1.35%, and trading at $0.293 at press time. XRP is down 9.67% over the past 7 days.

Total market capitalization is $168 billion at press time, while daily trade volume rose to $43 billion.

Total market capitalization 7-day chart. Source: CoinMarketCap

Earlier today, Intercontinental Exchange’s (ICE) institutional-grade crypto trading platform Bakkt announced an acquisition of a crypto custodian service Digital Asset Custody Company (DACC).

Also today, the United States Securities and Exchange Commission (SEC) announced it has temporarily halted securities trading on the Bitcoin Generation crypto exchange “due to concerns about the accuracy and adequacy of information in the marketplace.”

The United States stock market rose today, with both S&P 500 (SPX) and Nasdaq (NASDAQ) Composite reaching all-time highs, as CNBC reports. SPX broad index gained 0.3% to break above 2,940.90, while the previous high was recorded in September. At press time, SPX continues to grow to 2,947, while Nasdaq hit an all-time high of 8,164, up around 0.2%. Dow Jones Industrial Average (DJIA) gained 0.1% to 26,571.2.

Oil saw mixed signals today, with both West Texas Intermediate (WTI) and Brent crude rising around 0.4%, according to Oilprice.com. The growth followed a slight drop in the market on Friday after U.S. Pres. Donald Trump demanded that OPEC raise output to mitigate the impact of sanctions against Iran. At press time, OPEC basket is down 2.2%.

Gold prices dropped today as equities rose after a report that U.S. consumer spending surged, with the markets anticipating the U.S. Federal Reserve’s meeting for guidance on interest rates, according to CNBC. At press time, spot gold is down 0.5% to $1,279 per ounce, while June gold futures tumbled almost 0.6% to $1,281 per ounce.