Crypto valuations haven’t been the only casualties of this week’s market crash; crypto networks have also felt the strain. As onchain activity has ramped up in response to the market slump, fees have soared and the mempool filled on the BTC and ETH chains. Other crypto networks have operated smoothly, however, despite the pandemonium.

Also read: Market Update: Cryptocurrency Market Cap Sheds $90B, Margin Calls Spike, Futures Slide

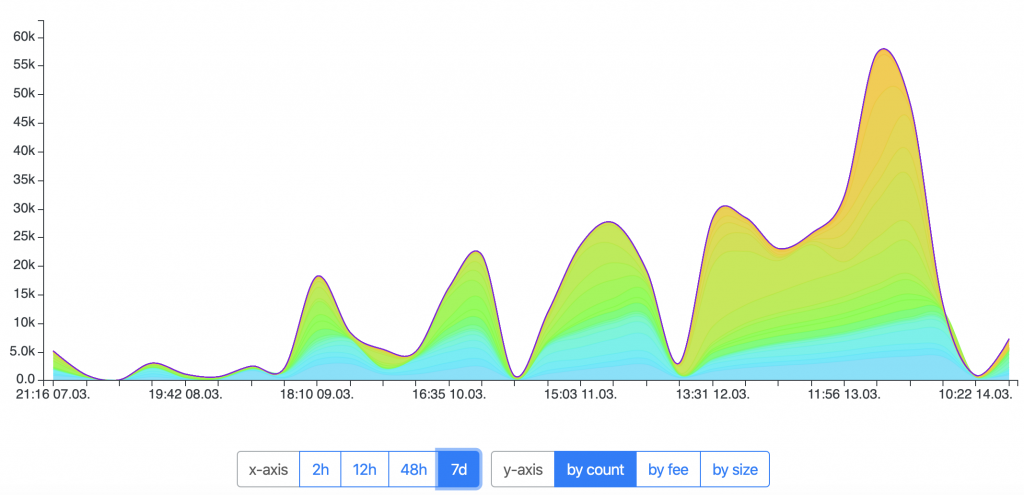

Mempool Fills on Bitcoin’s Most Volatile Day in a Year

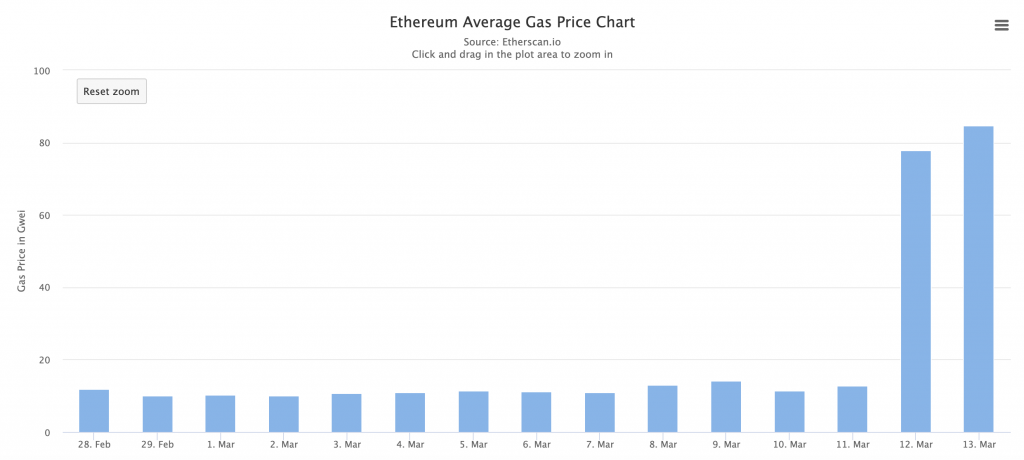

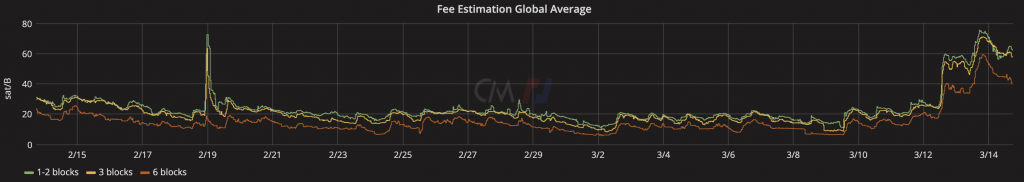

As bitcoin lost 50% of its value on Black Thursday, traders rushed to move coins out of cold storage and swap them for stablecoins on crypto exchanges. The increased network activity fueled a surge in BTC and ETH fees, which were significantly higher than usual on March 12-13.

On Thursday, gas prices passed $3.70 on Ethereum, while Bitcoin’s mempool was backed up with enough transactions to fill over 30 blocks. The congestion on both networks has since abated, with ETH gas prices back to just over 2 cents and the mempool down from 120,000 unconfirmed transactions on its March 12 peak to the daily average of 70,000 at press time. BTC fees, meanwhile, which rose to 75 sats/byte for 1-2 block inclusion on March 13, are down to ~60sats/byte, which is still more than double their weekly average.

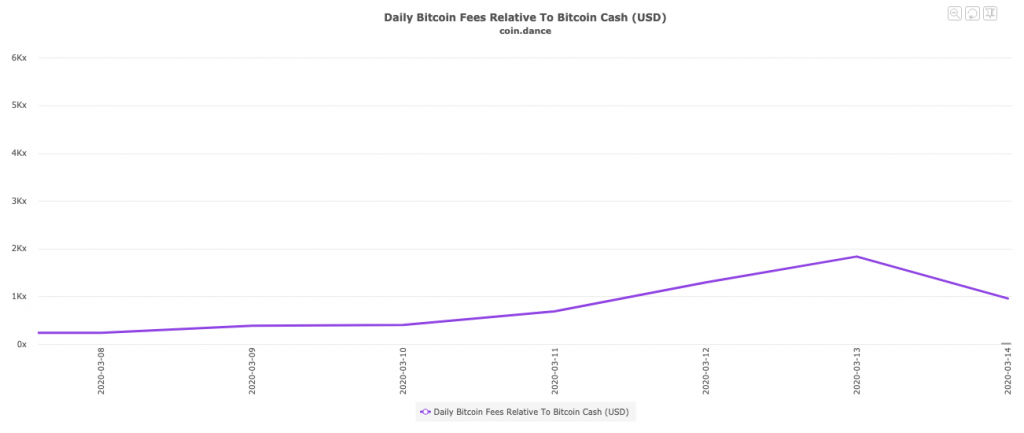

Bitcoin Cash and Dogecoin Networks Keep Ticking Over

Fees on Bitcoin Cash have remained low all week, despite the increase in exchange inflows and outflows. At press time, the BCH network is 1,420x cheaper than BTC when transaction fees are compared in USD. Over 18,000 BCH transactions were sent on March 12, rising to 20K the following day as the markets began to heat up.

Dogecoin has had a good week, holding up well as most other cryptos were shedding 50%. Dogecoin’s increased trade volume appears to have been in response to rising BTC and ETH fees, prompting traders to use DOGE to transfer value between exchanges, as was the case in 2017 when the crypto market was making violent moves in the opposite direction. On March 10, DOGE peaked at 33K onchain transactions, and has recorded 29K transactions in the last 24 hours, with a median fee of just $0.00168.

When the median fee for transacting on all measurable crypto networks is compared, BTC is the most expensive, at $0.117, followed by Lisk ($0.0836) and then Ethereum ($0.0409). Bitcoin Cash ($0.000831) and Dogecoin ($0.00169) are two of the cheapest according to Messari. The cheapest networks of all to transact on are the relatively centralized chains that do not utilize Proof of Work: Stellar ($0.000000385) and Ripple ($0.00000183). Panic selling was not the sort of mass adoption that crypto proponents had in mind. It has nevertheless proven a good test of how crypto networks hold up when the going gets tough.

Where do you see the markets going from here? Do you think traders have been using dogecoin to transfer value between exchanges? Let us know in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.