The following is a guest post

A very short definition of Crypto

I wanted to write an article for presentation purposes and easy overview for some time. I felt that information provided in public media is presented out of context and in a simplified way. The world of Crypto is filled with dark and mysterious events (like evil from Black Crypt), but so is true that there lies great potential and thousands are hunting for use-cases (quest for killer DApp).

Crypto (of Distributed Ledger Tech type) is a transparent P2P infrastructure secured by cryptography with potential to become a rich ecosystem. The 3 fundamental pillars are:

- Transactions

- Trust-less system (no middlemen)

- Consensus mechanism (way of transaction validation).

People consider tokens to be an alternative of established currencies, I believe that economic mechanism behind is different. Traditional currencies can however be easily interpreted on chains (tokenized, tethered) in order to perform banking-like operations, combining both worlds.

Common CryptoCurrency perception (Fear)

- „It is all Ponzi scam and wannabe currency, and it is so volatile to be useful“

- „It has no purpose, it is too slow, and transactions are too expensive“

- „Mining operations destroy environment, and I can’t buy latest graphic card to play games“

- „It was created by NSA/CIA/FBI to take over the world and enslave working class“

- „Bubble has popped, all coins will go to 0, there is no underlying value“

- „I do not understand the purpose and problem that should be solved”

- “There is no central authority I can trust and there is no a way to reverse transactions“

- “It endangers status quo of current establishment“

- “Can’t wait for quantum computers to end this nonsense!”

Is the truth somewhere out there (Hope)?

- 10+ years on the market in challenging business environment and unclear regulations

- Many new ideas and concepts have been created, see next chapters

A very brief history & future

What was the possible spark for Bitcoin in the first place?

- Do you trust bankers?

- Anonymity, way to avoid censorship, decentralization (bittorrent, TOR..)

- Impact of 2007–2008 Financial crisis

- Unhappiness with fractional-reserve banking

- Expensive and time consuming international money transfers

- Unavailable banking services in developing countries

Stone Age 2008-2014 (Phase 1)

- Bitcoin Genesis Block was created to establish “trust-less” network secured by PoW consensus

- Users interact with wallet (similar to online bank account) and can participate on consensus to receive rewards (validate transaction)

- Value is soon defined by market offer/demand

- Forking of new chains

- Early applications: speculative trade and black-market

- CEX creation – Public Centralized Exchanges (Mt.Gox was first used for Magic: The Gathering Online cards trading)

Notable events:

- 2010 Buying 2 Papa John’s pizzas for 10 000 BTC (commercial application)

- 2011 Wikileaks accepts BTC donations

- 2013 Virgin Galactic Announces they will accept Bitcoin for space travel trips

Golden Era 2015-2017 – Bull Market, Era of rapid improvements (Phase 2)

- Concept of tokenization – Everything could be traded on exchange

- Smart contracts – Execution of pre-programmed agreements in virtual environment

- DEX – Decentralized Exchanges (no KYC, no central authority)

- Initial Coin Offering for start-up funding. Airdrops

- Proof of Stake consensus and variations, staking

Notable events:

- 2017 Binance CEX profits higher than Deutsche Bank

- 2017 Market Cap Exceeds $100 Billion, BTC for 20 000 USD (.. 100 000 000$ for 1 pizza)

- 2017 CryptoKitties kitten sold for 170 000$ (or 600ETH)

- 2017 1000+ different cryptocurrencies in the market, exposure to the whole world

170 000$ CryptoKitty

Modern Era 2018-2019 – Bear Market, Crypto Winter (Phase 3)

- Fiat-Crypto gateways, anchors and AML/KYC procedures (business compliance)

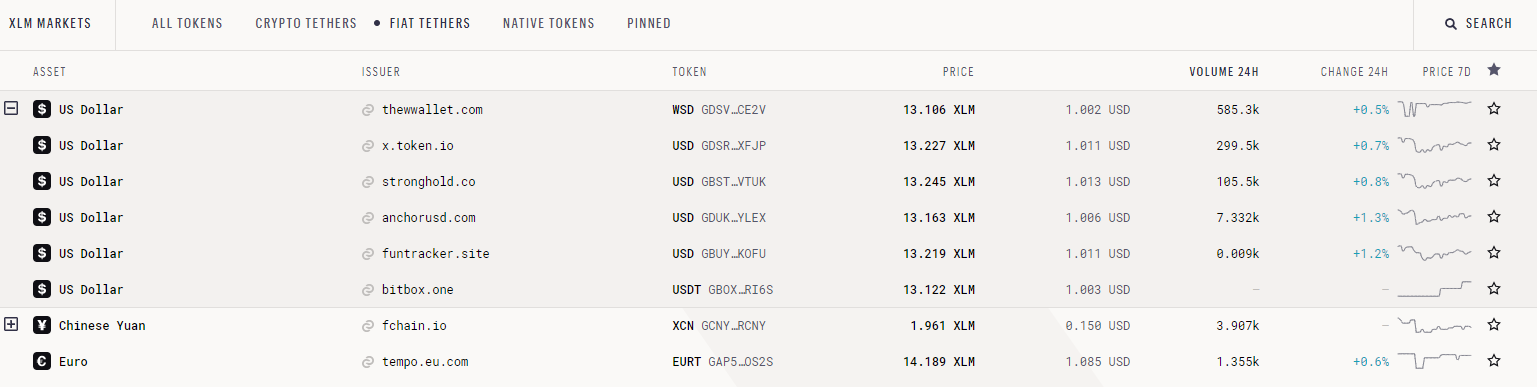

- Stable coins (tokenized national currencies)

- Asset tokenization with liquidity and instant settlements (creating alternative to stock exchanges?)

- Atomic swaps (you can buy piece of house for piece of rock on exchange, can it be that simple and generic?)

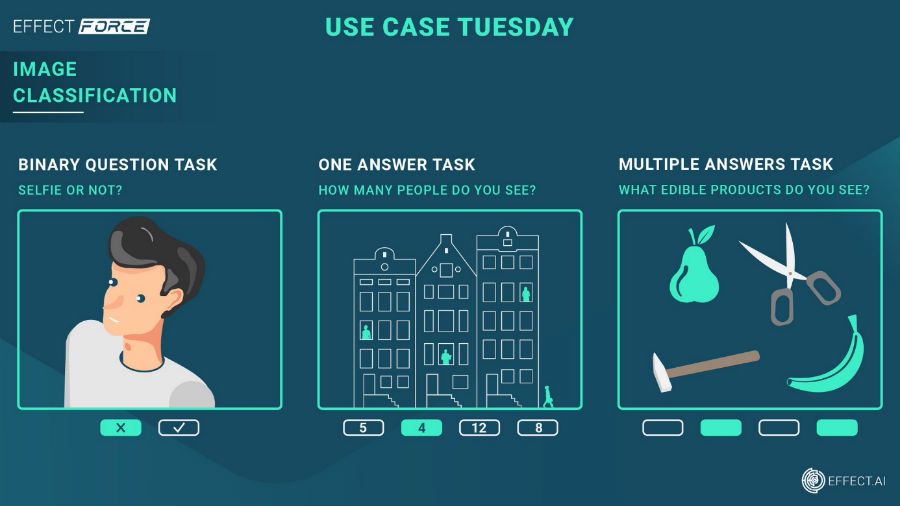

- AI, IOT and applications in smart devices are interacting with DLT

- Public Voting on proposals or transaction validation representatives

Notable events:

- 2018 4000+ Bitcoin ATMs worldwide

- 2019 BTC lost 85% of all-time high value

- 2019 Venezuela Bitcoin market does 157x the volume of their largest stock exchange

- 2019 JPMorgan Chase announces JPM Coin to speed-up settlements

StellarX FIAT anchors

StellarX FIAT anchors

What’s the future?

I could imagine:

- Instant transfers with minimal fees

- Tokenized business with connection to World Top Exchanges

- Change of traditionally non-liquid assets to liquid

- Assets extended bank accounts

- Transparent management of public funds

- Tracked and verified goods

- Rewards for driving data by your car manufacturer

- Distributed workforce

- Investment platform

- Incentives for system resources

Related references (2019Q1):

- Money Transfers & FIAT Exchanges (Stellar, Ripple)

- Games (Tron, Ethereum)

- Rewards for participation, Internet content (BitTorrent)

- Distributed human assisted AI classification (Effect.AI)

- Property and assets tokenization (Smartlands)

- Remittance services (SureRemit)

- Goods tracking & The Internet Of Vehicle Information (VeChain)

- Object detection including medical diagnosis (Matrix AI Network)

- Digital advertising (BAT)

- Charity (well, there is for example BiblePay project)

Effect.AI – Image Classification

Effect.AI – Image Classification

A very brief & simple practical cases

For any business to be viable there should be clear business case and source of revenue to finance operations. Blockchain is not magical solution for every issue, but can be used in many ways to enhance current business, fund it, or interconnect with other services. For the sake of simplicity we will not consider legal regulation that may have impact on how particular activities have to be performed.

Case #1 – Farmer’s Dream

Old Sir John Block live in cottage house and takes care of 5 sheep. If only he had spare money to purchase more of them and then some machinery to process wool & milk. Then brilliant idea hit his beautiful daughter’s mind – tokenize sheep and raise capital through ICO to cover initial investment for expansion. The investors will be able to buy sheep tokens and while staking them, share profits from selling sheep products. Dividends will be payed monthly and we expect to start operations within 3 months. Access to spending/revenue reports will be provided.

Case #2 – Fintech Bank

Features of our new F-Bank:

- register and login to Fintech Bank web page

- pass KYC/AML procedure to be compliant with legislative

- deposit fiat money to our regular bank account that will be credited in service account as tethered tokens

- withdraw tethered tokens back to regular bank account

- transfer tethered tokens to any crypto account

- trade on exchange

- store other crypto assets

- PSD (Payment Services Directive) integration

A very brief list of important knowledge

Questions everybody should ask before putting money in Crypto

- Do I have back-up of my keys?

- Have I triple-checked the transaction I am going to execute?

- Do I understand the risks of storing coins on exchange or third-party wallet?

- Can I afford to lose substantial part of investment?

- Am I good at trading and finance management?

- Will I FOMO when the price is high (buy)? Will I feel FUD when the price is low (sell)?

How to create own tokens

You can always start own blockchain project, or you can use guide for the most popular networks:

Basic Dictionary

- CEX vs DEX – Centralized vs Decentralized exchanges. Google for differences

- Order Book – List of waiting orders when users create offers to buy/sell

- DApp – Decentralized App as name suggests is an app executed on blockchain

- Token, Minting – Token is a representation of value. It is minted on specific chain.

- FIAT – Paper money currencies

- KYC/AML – Know Your Customer / Anti-Money Laundering

- HODL – is slang for holding the cryptocurrency rather than selling

- FUD/FOMO – Fear, Uncertainty,Doubt / Fear Of Missing Out. See more here

- Satoshi Nakamoto – Creator of Bitcoin

- Private Key/Public Key/Seed/Keystore – Simply explained, public key is your account number where tokens can be sent or viewed, private key serves as access key to execute transactions. Seed is human memorable sequence of words from which private key can be generated. Keystore is an encrypted version of private key

- Complete Dictionary here

Guest Post – Author notes

This article was meant to be short with brief explanation of cryptocurrencies. It should capture possible applications and reasons why there still could be future for this tech, without denying associated uncertainty and risk. The author owns some coins, but article is not intended to promote particular ones.