Decentralized finance (DeFi) coins have undergone an extremely strong recovery from last week’s lows. As of last night, at the highs of the recovery rally, there were a large number of top coins in the space that was up 100% from their lows.

While some of these gains have since been reverted, DeFi is holding up relatively well. Popular coins pertaining to this space including Aave (AAVE), Thorchain’s RUNE, and Synthetix’s Synthetix Network Token (SNX) are up 10% in the past 24 hours despite the drop in the price of Bitcoin.

Bitcoin is down $800 from its local highs and continues to range as it has seemingly formed a correlation with gold an inverse correlation with the U.S. dollar.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom

DeFi Coins Hold Up

Even after Bitcoin’s rapid flush lower, which would have conventionally caused pain in the altcoin markets, DeFi is up. While BTC is down 2.5% in the past 24 hours, top coins in the space are anywhere from 1-20% higher over that same time frame.

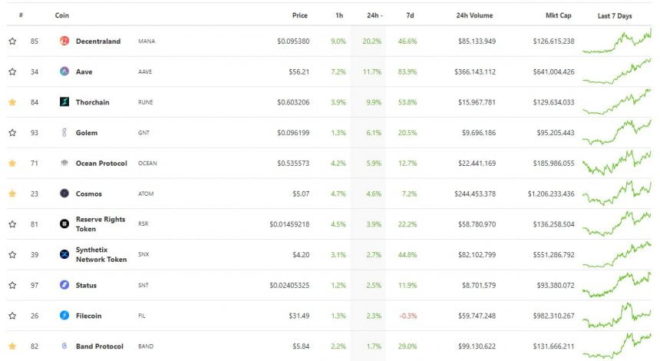

Below is a screenshot from CoinGecko that depicts this trend of strength in coins pertaining to the DeFi ecosystem:

Top ~10 cryptocurrencies in the top 100 by market capitalization over the past day from CoinGecko.

AAVE seems to be pulling away as the best large-cap cryptocurrency of the past week. As the data above shows, it is up 83% in the past seven days alone, having bounced strongly from its local lows.

DeFi coins faced a strong correction when Bitcoin began to rally, though capital has since spread out to include altcoins.

Related Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin

Strong Fundamentals

Strong fundamentals are underpinning growth in the DeFi space.

The total value locked in all DeFi contracts, in fact, just set a new all-time high at $12.5 billion. This is far above the $500 million figure seen closer to the start of the year.

The TVL of the DeFi space has remained consistently high, even amid the correction that was seen over the past two months.

This is largely due to the search for yield in DeFi and in traditional markets, which is forcing investors to keep their capital in pools and other yield farming opportunities to earn returns.

Innovation in the DeFi space also continues at a rapid clip. A number of developers in the space are releasing applications that will expand the reach that this space has in finance.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt, snxusd, snxbtc, snxeth, aaveusd, aavebtc, aaveeth, runeusd, runeeth Charts from TradingView.com DeFi Coins AAVE, RUNE, SNX Hold Up Despite Bitcoin Correction