Bitcoin’s price is slipping while the amount ether parked in DeFi is in neutral.

- Bitcoin (BTC) trading around $11,397 as of 20:00 UTC (4 p.m. ET). Slipping 1.3% over the previous 24 hours.

- Bitcoin’s 24-hour range: $11,313-$11,730

- BTC below its 10-day and 50-day moving averages, a bearish signal for market technicians.

Bitcoin’s price was able to crack $11,700 in the past 24 hours, going as high as $11,730 on spot exchanges such as Bitstamp. The world’s largest cryptocurrency by market capitalization then trended downward, dipping to as low as $11,313 before settling at $11,397 as of press time.

Despite bitcoin’s downward move Tuesday, Cindy Leow, portfolio manager for multi-strategy trading firm 256 Capital Partners, said its overall upward price trend since Oct. 8 has created a new bullish price floor. Leow’s analysis shows bitcoin above $11,000 signals a longer-term bull trend. However, if bitcoin’s price goes below that “support” level, she maintains, a long-term bear market could develop.

“Since its break upwards at the end of last week, bitcoin’s support now squarely rests on the average price paid for BTC since the early September peak at $12,000. This new support is at $11,000,” Leow told CoinDesk.

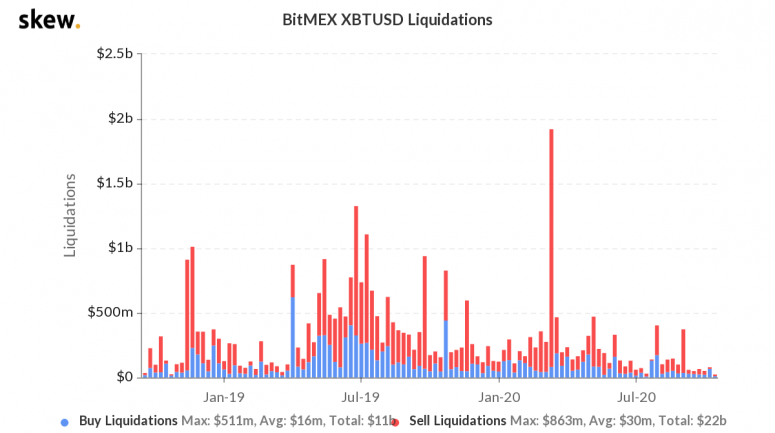

The declining influence of Seychelles-based derivatives venue BitMEX, which is mired in a myriad of regulatory and legal issues, appears to have had a positive impact on the market, Leow noted.

“With BitMEX and its aggressive liquidation engine slowly becoming less relevant, bitcoin’s sudden $1,000 wicks are growing more infrequent, another healthy sign for BTC,” she added. Wicks are the vertical lines that appear at the top and bottoms of candles in technical charts that indicate the total price range during a specific trading period.

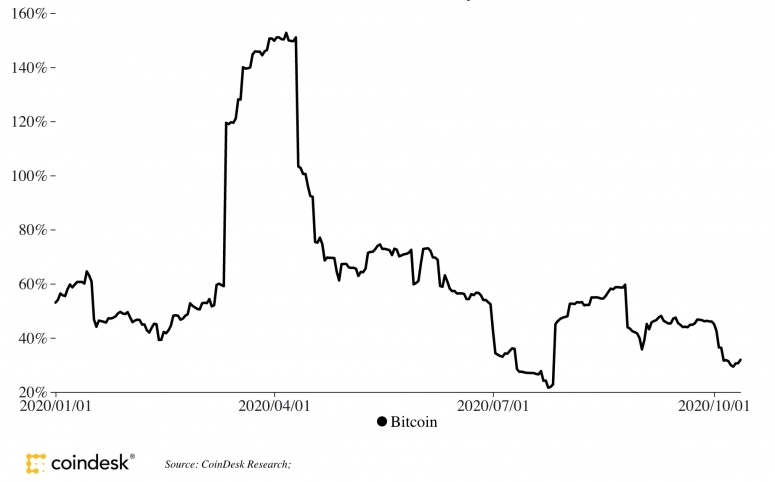

Indeed, bitcoin’s implied volatility, which forecasts price gyrations and is used often by options traders to analyze trading strategies, is at a low not seen since July.

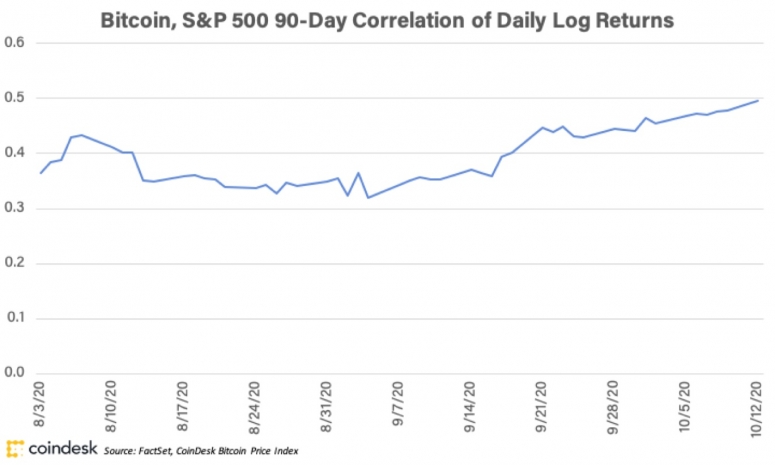

Alessandro Andreotti, an over-the-counter trader based in Italy, notes that bitcoin has been operating in tandem with the stock market. Increasing correlation with the S&P 500 based on data from the CoinDesk Bitcoin Price Index seems to back this up.

Bitcoin’s 90-day correlation of daily log returns with the S&P 500.

Andreotti predicts bitcoin’s price could hit fresh 2020 highs should stocks also continue to rise. “If the S&P 500 can break into all-time highs, bitcoin could move up to $13,000.”

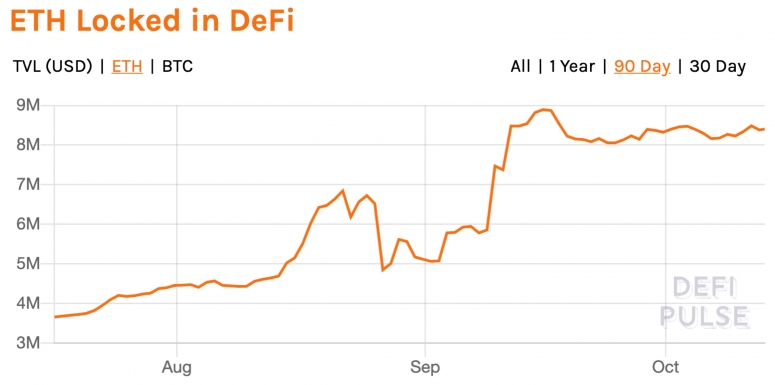

Ether locked in DeFi stalls

The second-largest cryptocurrency by market capitalization, ether (ETH), was down in Tuesday trading at around $378 and slipping 2.3% in 24 hours as of 20:00 UTC (4:00 p.m. ET).

Since Sept. 18, the amount of ether “locked” in decentralized finance, or DeFi, has remained relatively flat, averaging around $8.26 billion. Ether holders park the cryptocurrency in various smart-contract based protocols on the Ethereum network and receive a “yield” in return.

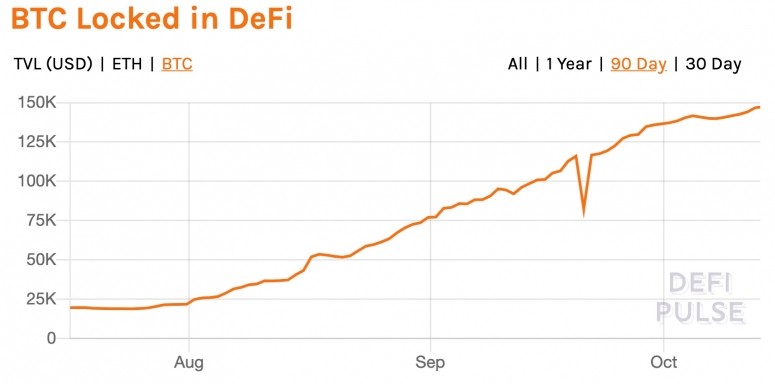

By contrast, the amount of bitcoin locked in DeFi has for the most part steadily increased, and is now closing in on 150,000 BTC.

Brian Mosoff, chief executive officer of investment firm Ether Capital, said bitcoin holders may be seeing a powerful DeFi use case for the world’s oldest cryptocurrency that didn’t exist until recently.

“Until recently, bitcoin was isolated from the power and flexibility of Ethereum,” Mosoff said. “Now, bitcoin holders can wrap their BTC and interact with a decentralized exchange, or borrow against a stablecoin. The Ethereum community has been able to natively do these things since day one.”

Other markets

Digital assets on the CoinDesk 20 are mixed Tuesday, mostly in the red. Notable winners as of 20:00 UTC (4:00 p.m. ET):

Notable losers as of 20:00 UTC (4:00 p.m. ET):

- Oil was up 1.7%. Price per barrel of West Texas Intermediate crude: $40.19.

- Gold was in the red 1.5% and at $1,893 as of press time.

- U.S. Treasury bond yields all fell Tuesday. Yields, which move in the opposite direction as price, were down most on the on the two-year, dipping to 0.143 and in the red 7.6%.