On April 25, cryptocurrency markets tumbled after the controversy between the New York Attorney General’s (NYAG) office, the stablecoin company Tether, and Bitfinex exchange. Since then, prices have slightly recovered and the entire cryptoconomy regained $4.3 billion after losing $10 billion last Thursday. Moreover, out of the top 10 cryptos by market capitalization today, bitcoin cash (BCH) leads the way by gaining more than 5% in the last 24 hours.

Also read: Bitcoiners’ Seastead in Deep Trouble With Thai Government

Crypto Markets Show Improvement After Last Week’s Price Dip

Over the last six days, the crypto community on social media has been all riled up over the Tether and Bitfinex controversy. Last week, the NYAG accused the cryptocurrency exchange Bitfinex of losing $850 million and allege the company used Tether to cover the loss. Following the announcement, nearly every cryptocurrency dropped in fiat value, losing 5-15% over the course of the day. Since then, however, there’s been some slight recovery as market prices are doing much better but global trade volume is lower. Today, the aggregated average across all of the popular exchanges shows bitcoin core (BTC) is sitting at roughly $5,369. However, there’s a huge spread between most spot exchanges (Bitstamp $5,292) compared to Bitfinex, which is $300 more and trading at $5,600 at press time.

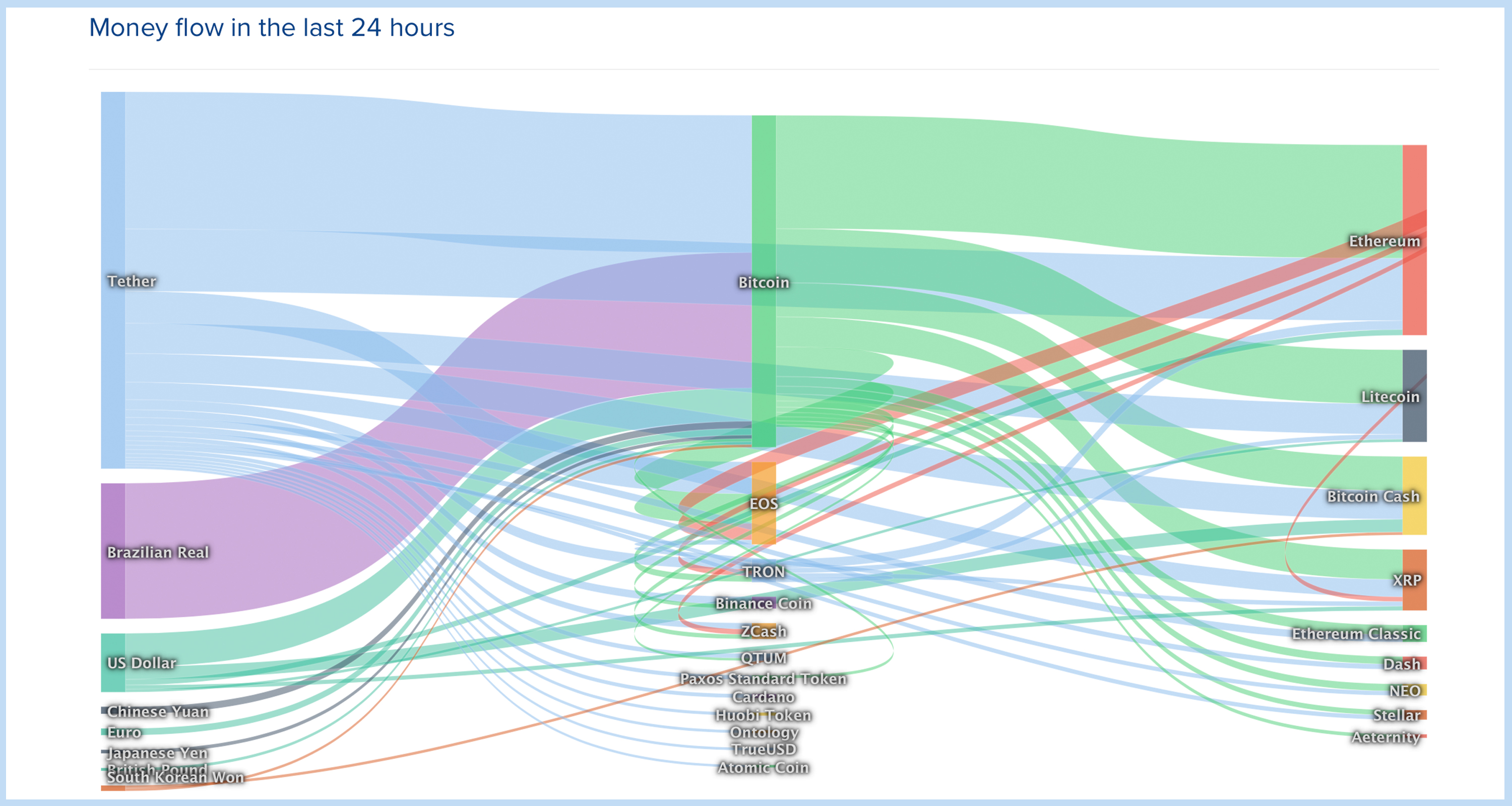

The second largest capitalization belongs to ethereum (ETH) as each coin is swapping for $160 per unit. Ripple (XRP) follows behind ETH and each token is trading for $0.30 per unit and markets are down 1.2% today. The fifth largest market cap still belongs to litecoin (LTC) and each LTC is currently $72. LTC markets have increased by 0.07% this Wednesday and around $3 billion in global trade volume in the last 24 hours. Across 18,094 markets there’s been about $44.9 billion in global trade volume for all 2,141 cryptocurrencies. Interestingly, data stemming from Coinlib.io details that there’s $1 billion worth of global trade volume between BTC and the Brazilian real.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) is the market leader today on May 1 out of the top 10 digital assets by market cap as the currency is up 5.4% today. Each bitcoin cash is currently trading for $266 per coin. BCH has an overall market cap of $4.7 billion and $1.82 billion worth of worldwide trade volume has changed hands over the last 24 hours. BCH is the sixth most traded currency, just below EOS and above XRP trade volumes. BTC is now the dominant pair traded with BCH today, leading by 43.7%, while tether (USDT) trails behind at 42.9%. This is followed by USD (5.4%), KRW (4.1%), and the JPY (1.3%). The top five trading platforms swapping the most BCH today are Lbank, Coinbene, P2pb2b, Bitmart, Hitbtc, and Binance.

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD chart stemming from Kraken shows most oscillators and moving averages are either signaling neutral or slight bullish sentiment. The Relative Strength Index (RSI) is impartial at ~56.99 and Stochastic is nonpartisan as well at 78.94. The two Simple Moving Averages (SMA 100-200) show the short-term SMA 100 dipped below the SMA 200 trendline. This indicates that the path toward the least resistance is currently the downside and bulls seem to be slowing down after meeting stronger hinderances these last few days. Although, the momentum oscillator MACd suggests a stronger buy signal and some more improvement is on the cards going forward.

Order books show BCH bulls need to muster strength and move past $275-290 again to gain better momentum. On the backside, if bears continue to exhaust the bulls they will be stopped around the $250 range and $230 as there are tougher foundations in these regions. BCH is now trading at the median after reaching an all-time high about a week and a half ago, and it’s likely we will see some consolidation patterns if bulls cannot penetrate upper resistance.

The Verdict: Stablecoin Controversy Lingers But Crypto Spring Is Still in the Air

Currently, traders still seem uncertain on which way the crypto market is going, especially after the stablecoin controversy and the possibility of it bringing more negativity in the near future. Still, market prices seem to reflect a bullish continuation is conceivable. For instance, on April 28, Fundstrat Global Advisors founder Tom Lee told CNBC he believes there are “signs that fundamentals are improving, technicals are improving, and now there’s real activity by, essentially, crypto hodlers.” Alongside this, the global economy shows traditional and tech stocks also spiked on Wednesday with Nasdaq, NYSE, and the Dow Jones showing strong improvements. In unison with the stocks and cryptocurrency gains on Wednesday, both gold and oil spot prices jumped in value as well, indicating a shifting trend throughout the globe on the first of May.

What do you think of the crypto markets improving and BCH leading the charge once again? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Bitstamp, Bitcoin.com Markets, Blockonomi, Anthony Xie, and Coinlib.io.

Want to create your own secure cold storage paper wallet? Check our tools section.