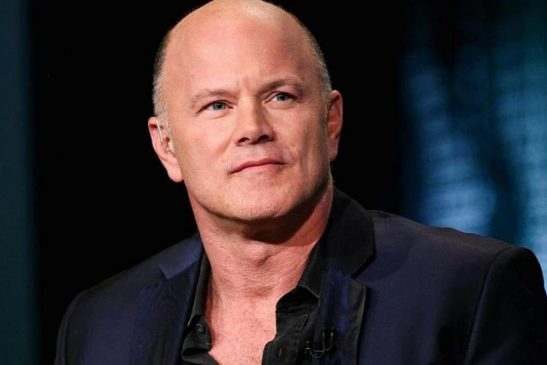

Mike Novogratz, the chief executive of the TSX-listed Galaxy Digital, made a surprising remark that came straight out of left field saying that he doesn’t understand why large macro funds don’t have a 1% position in Bitcoin (BTC).

Except Bakkt, there is a platform for trading and storing cryptocurrency – Fidelity Digital Asset Services, which is at the final stage of testing. And Bitcoin ETF, which has not yet been approved by the US Securities and Exchange Commission.

In a tweet issued on Saturday, Mike Novogratz, the chief executive of the TSX-listed Galaxy Digital, made a surprising remark that came straight out of left field. The former Fortress Investment and Goldman Sachs executive, who has become a full-on crypto diehard, explained that he doesn’t understand why large macro funds, such as Ray Dalio’s Bridgewater Associates, don’t have a 1% position in Bitcoin (BTC).

Bear in mind that, surprisingly, in the last 48 hours, the Bitcoin price recovered beyond the crucial $3,500 support level and avoided a further drop below $3,000.

Don’t understand why all the big macro funds out there don’t have a 1 percent position in $btc. Just seems logical even if your prone to be a skeptic. @RayDalio #goldproxy #animalspirits #greatriskreward

— Michael Novogratz (@novogratz) February 9, 2019

He also said:

“It won’t go there ($20 trillion) right away. What is going to happen is, one of these intrepid pension funds, somebody who is a market leader, is going to say, you know what? We’ve got custody, Goldman Sachs is involved, Bloomberg has an index I can track my performance against, and they’re going to buy. And all of the sudden, the second guy buys. The same FOMO that you saw in retail [will be demonstrated by institutional investors].”

The valuation of the cryptocurrency market increased from $110 billion to $120 billion, by just over $10 billion.

Analysts’ Expectations for the Latter Half of 2019: Bitcoin Will Rise

Generally, analysts expect Bitcoin and the rest of the cryptocurrency market to begin recovering in the latter half of 2019.

For example, Winton, a British investment management firm, estimates that hedge funds worldwide hold a minimum of $3 trillion in assets. Thus, a ubiquitous 1% allocation would see $30 billion rush into BTC at the bare minimum, which would push the cryptocurrency likely beyond its late-2017 high due to fiat multipliers.

While this would be crazy in and of itself, some argue that this is just the tip of the iceberg. In an installment of Off The Chain, Anthony Pompliano of Morgan Creek Digital Assets claimed that “every pension fund (valued at ~$4.5 trillion) should buy Bitcoin.” Pompliano explained that a potential solution to solve the pension crisis, whereas such funds will likely default on some, if not most of their payments, is to simply buy cryptocurrencies. Bitcoin, for one, is a non-correlated asset, with Pomp even calling it “the holy grail of any portfolio.”

Kling, a former Point72 portfolio manager even likened Bitcoin to a credit default swaps (CDS) against central banks’ enamorment with printing money. The Ikigai head, who made a sudden U-turn at the peak of 2017’s crypto boom, as he downed a red pill to foray into cryptocurrencies, remarked that he’s wary of the build-up of debt on government balance sheets. Kling even stated that the monumental rise of enlisted quantitative easing (QE) strategies is “how you would write the script” for the adoption of cryptocurrencies, especially ones that are fully decentralized, the world over.

For Dan Morehead who is the CEO of Pantera, he believes that those with short-term mindsets should relax. He believes that Bitcoin and the crypto industry has experienced this in the past.

He said:

“In the previous one, I had more of a worry in the pit of my stomach about whether blockchain was actually going to work. With this one, the underlying fundamentals are much, much stronger than they were in the 2014-2015 Crypto Winter”.

Though the crypto market isn’t looking good in the last year, the ex-Goldman Sachs partner Mike Novogratz already at the beginning of this month addressed the bad state of the crypto market.

He then tweeted:

Realizing having tweeted about crypto in a while. It’s a grind. Don’t think we head north for at least a few more months. Always take longer for institutions to move. Very confident they will. Tons of activity under the hood. Stay the course.

— Michael Novogratz (@novogratz) February 1, 2019

Despite regulatory challenges, in November 2018, Novogratz believes that the price of Bitcoin is at $10,000 by the end of the first quarter of 2019. He also believes that Bitcoin is set to go over $20,000 this year. But now that Bitcoin and the rest of the crypto market aren’t looking good, does it mean that he is changing his outlook?

Cryptocurrencies like EOS and Litecoin demonstrated gains in the range of 15 to 30 percent in the past three days against the U.S. dollar.

On the day, Litecoin recorded yet another 5 percent increase in value and Binance Coin, which has consistently outperformed both Bitcoin and U.S. dollar in the past month, rose by over 6 percent.

But of course, we are still early in 2019 and there are around 11 more months left for the year.