When gauging its performance in February, Nvidia said its revenue for the fiscal first quarter, which ends in May, would total $5.3 billion. However, the company revised the data provided at that time and concluded that its potential is much better than this figure.

GPU manufacturer Nvidia Corporation (NASDAQ: NVDA) showed impressive performance on the market yesterday. The company’s stock closed 5.62% up, at $608.36 per share. The rise of Nvidia stock followed the company’s launch of new products as well as the announcement about the anticipation of larger than beforehand expected fiscal Q1 results.

Nvidia’s New Line of Products

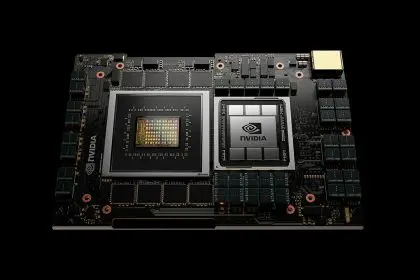

On April 12, Nvidia introduced a range of eight new NVIDIA Ampere architecture GPUs for next-generation laptops, desktops, and servers. According to the company’s press release, the new GPUs allow professionals to work from wherever they choose, without sacrificing quality or time. In addition, Nvidia presented new solutions for self-driving cars. One of them is a next-generation AI-enabled processor for autonomous vehicles, NVIDIA DRIVE™ Atlan. As Nvidia has stated, it will deliver more than 1,000 trillion operations per second (TOPS) and target automakers’ 2025 models. Notably, DRIVE Atlan will include Nvidia’s next-generation GPU architecture, new Arm CPU cores, as well as deep learning and computer vision accelerators.

With its NVIDIA DRIVE, the company will power next-generation AI-based autonomous vehicles. Volvo Cars, Zoox, and SAIC are already among those using NVIDIA DRIVE.

Apart from that, Nvidia also announced new systems for running artificial intelligence on servers. The company rolled out software for running chatbots and speech recognition as well.

Nvidia Q1 Fiscal 2022 Outlook that Pushes NVDA Stock Higher

At its annual Investor Day that took place on April 12, Nvidia also shared its expectations of first-quarter income. As the company said, it is likely to surpass previous estimates. Nvidia stock rose following this announcement about Q1 performance.

In particular, when gauging its performance in February, Nvidia said its revenue for the fiscal first quarter, which ends in May, would total $5.3 billion. However, the company revised the data provided at that time and concluded that its potential is much better than this figure.

Nvidia’s CFO Colette Kress stated:

“While our fiscal 2022 first quarter is not yet complete, Q1 total revenue is tracking above the $5.30 billion outlook provided during our fiscal year-end earnings call. We are experiencing broad-based strength, with all our market platforms driving upside to our initial outlook.”

The company has explained such an opinion with the growing demand for microchips. Kress said:

“Overall demand remains very strong and continues to exceed supply while our channel inventories remain quite lean. We expect demand to continue to exceed supply for much of this year.”

Nvidia’s market platforms include Gaming, Data Center, Professional Visualization, and Automotive. For the chips alone, Nvidia is expecting to report as much as $150 million in income within the first fiscal quarter. Previously, this estimate was $50 million.

Daria is an economic student interested in the development of modern technologies. She is eager to know as much as possible about cryptos as she believes they can change our view on finance and the world in general.