After plunging on Sunday morning, Bitcoin has mounted a strong comeback over the past two hours that has seen it reverse the earlier losses.

In the past 30 minutes, the cryptocurrency has rallied from $9,540 to a high of $9,800 — a 2.7% move. And since the daily lows of ~$9,370, the asset is up just shy of 5%.

The rally to $9,800 comes just hours ahead of the close of BTC’s weekly chart candle.

Bitcoin price chart over the past day from TradingView.com.

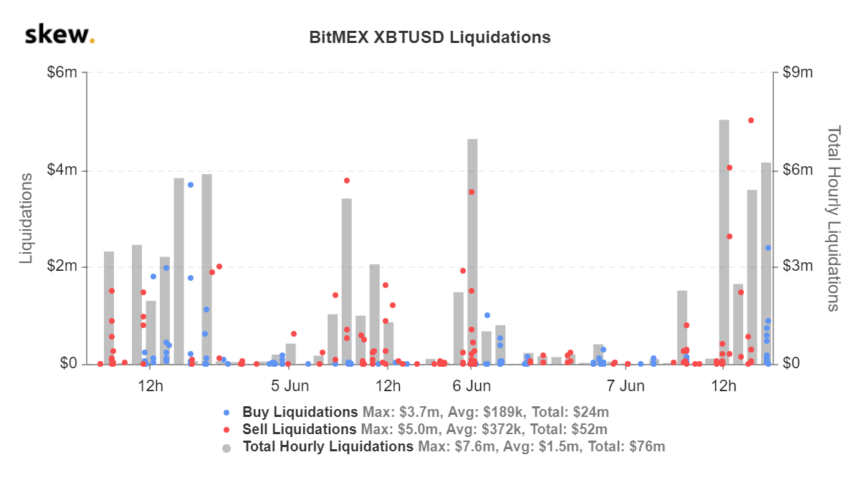

Traders were largely caught off guard by this move. Data shared by crypto derivatives tracker Skew.com shows that over the past four hours, more than $15 million worth of positions on BitMEX alone has been liquidated.

Considering that the liquidation data from Skew.com only captures BitMEX, millions more, maybe dozens of millions more, worth of positions were likely liquidated on other margin exchanges.

Despite the surge, funding rates on Bitcoin futures exchanges are still trading around the baseline of 0.00%. This suggests that neither longs nor shorts are overleveraged, leaving room for BTC to continue to rally to the upside should spot or futures buyers step in.

Related Reading: Crypto Tidbits: $200M of Bitcoin Liquidated, Ethereum DeFi Adoption Limited, Bloomberg Is Bullish

Bitcoin Still Precarious From Medium-Term Perspective

Bitcoin analysts are not yet convinced that the cryptocurrency will embark on a full-blown bull run just yet.

One analyst recently shared the chart below with the following comment:

“What’s the difference between the top at 19k, 13k, 10.5k and now?”

What he’s referring to is the fact that Bitcoin is nearing the top of the Bollinger Bands (shaded in turquoise in the chart below).

The last time this happened was in February 2020, which was when prices topped at $10,500 before plunging to the March lows of $3,700. The time before that was when BTC topped at $14,000 in June. And the time before that was at the peak of 2017’s crypto bubble, when Bitcoin plunged towards the $3,000s after peaking at $20,000.

Bitcoin and Bollinger Bands macro price chart shared by cryptocurrency trader “Crypto_y_tho” (@BTC_y_tho on Twitter).

Adding to this, analysts have observed that Bitcoin’s price action over the past six weeks looks much like a schematic outlining by the late technical analyst Richard Wyckoff. The schematic suggests that Bitcoin is poised to fall back towards the $8,000s and $7,000s.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Tens of Millions Liquidated as Bitcoin Surges 5% Higher Ahead of Weekly Close