Most cryptocurrencies have bounced off their immediate support levels, a positive as this shows demand at lower levels.

BitMEX Research recently pointed out that the correlation between the S&P 500 and Bitcoin (BTC) has reached a new high, eclipsing the previous high recorded in March 2018. This shows that with all the money being printed to support the economy, a tiny bit might be finding its way into the crypto space, which is a huge positive.

Over the long-term, only a fraction of the total stimulus packages announced around the world are enough to boost the crypto market capitalization.

While many are bullish in the long-term, several investors want to catch the bottom. Earlier in the year veteran trader Tone Vays forecast that Bitcoin could bottom out closer to $2,800, but now he believes that the bottom might have been formed around $3,700. Vays does not expect Bitcoin to dip below the recent lows.

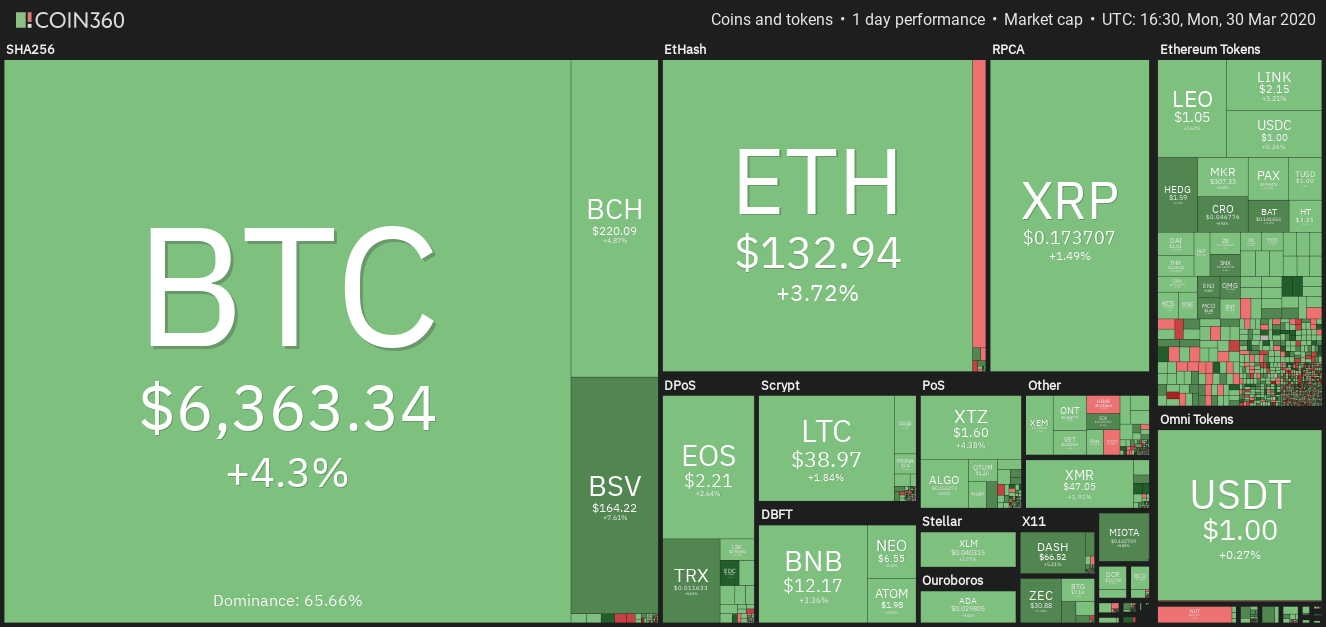

Daily cryptocurrency market performance. Source: Coin360

As traders, our focus is the price action. However, during these difficult times, it is heartening to see that various agencies and nations are taking the help of blockchain technology to fight the coronavirus pandemic. Along with helping with the technology part, we are very happy to note that the global crypto community has come together and is also doing its bit to help during this time of crisis.

The current crypto recovery is being led by Bitcoin as its dominance rate closes in on 66%. This raises the question of whether cryptocurrencies sustain the current relief rally and start a sustained uptrend? Let’s analyze the charts.

BTC/USD

The failure of the bulls to propel Bitcoin (BTC) above the overhead resistance of $7,000 attracted selling. That dragged the price below the immediate support of $6,435 but the bears could not break the next support of $5,660.47. This is a positive sign as it shows demand at lower levels.

BTC USD daily chart. Source: Tradingview

Currently, the bulls are again attempting to carry the price above $6,435 and the 20-day EMA at $6,520. If successful, a retest of $7,000 is possible. Above this level, a move to the 50-day SMA at $7,985 and above it to $9,000 is likely.

Contrary to our assumption, if the BTC/USD pair turns down from the 20-day EMA and slides below the support at $5,660.47, a drop to the long-term support line at $5,000 is possible. For now, the traders can protect their long positions with stops at $5,600.

ETH/USD

Ether (ETH) continues to trade between the $117.090-$155.612 range. The 20-day EMA is sloping down and the RSI is in the negative zone, which suggests that the bears have the upper hand.

ETH USD daily chart. Source: Tradingview

A break below the range can sink the ETH/USD pair to $100 and below it to $84.250. However, if the pair bounces off the support of the range, a few more days of consolidation is likely.

The pair will pick up momentum on a break above $155.612. Above this level, a move to the 50-day SMA at $198 is possible. Therefore, we retain the buy recommendation given in an earlier analysis.

XRP/USD

The failure of the bulls to sustain XRP above $0.17468 attracted selling. The bears attempted to resume the down move on March 29 but the bulls provided support close to $0.16 levels.

XRP USD daily chart. Source: Tradingview

If the bulls can propel the price above $0.17468 once again and sustain the level, the XRP/USD pair is likely to pick up momentum. The first target to watch on the upside is $0.22 and above it $0.25.

Contrary to our assumption, if the price turns down from $0.17468 once again, the bears will try to sink it to $0.1275. Hence, the stop loss on the long positions can be retained at $0.143 for now. We shall suggest trailing the stop to $0.16 after the pair rises above $0.19.

BCH/USD

Bitcoin Cash (BCH) turned down from the 20-day EMA on March 27 but the buyers stepped in just above the immediate support at $197.43. This is a positive sign as it shows demand on dips.

BCH USD daily chart. Source: Tradingview

The bulls will now try to drive the price above the 20-day EMA at $227 and the horizontal resistance at $247.95. If successful, the BCH/USD pair is likely to pick up momentum and rally to the 50-day SMA at $304 and above it to $350.

Hence, the traders can buy above $250 and keep a stop loss below $197. Our view will be invalidated if the pair plummets below $197.43. In such a case, a drop to $166 is likely.

BSV/USD

Bitcoin SV (BSV) turned down from the 20-day EMA on March 27. However, the bulls held the strong support at $146.96, which shows buying on dips. The 20-day EMA is flat and the RSI is just below the midpoint, which suggests a range formation for the next few days.

BSV USD daily chart. Source: Tradingview

We now anticipate the bulls to carry the BSV/USD pair to the overhead resistance at $185.87. If the price turns down from this level, the pair will extend its stay inside the range for a few more days.

A break above $185.87 will indicate strength. Above this level, a move to the 50-day SMA at $223 and above it to $260 is possible.

On the other hand, if the bears sink the price below $146.96, a drop to $120 is likely. Therefore, the stop loss on the long positions can be kept at $146.

LTC/USD

Litecoin (LTC) turned down from the 20-day EMA at $42.14 on March 27. The 20-day EMA is sloping down and the RSI is in the negative zone, which suggests that the advantage is with the bears. A drop below $35.8582 can drag the price to $30.

LTC USD daily chart. Source: Tradingview

Currently, the LTC/USD pair is attempting to rebound off the support at $35.8582. If the bulls can carry the price above the 20-day EMA at $41.12 and the horizontal resistance of $43.67, the pair is likely to pick up momentum.

The first target to watch on the upside is the 50-day SMA at $55.63. If this level is crossed, the up move can reach $63.8769. The traders can initiate long positions as suggested by us in an earlier analysis.

EOS/USD

EOS has been trading inside a tight range of $2.0632-$2.4001 since March 21. This shows that both the bulls and the bears are playing it safe and are not taking any large bets. The 20-day EMA continues to slope down and the RSI is in the negative zone, which suggests that bears have the upper hand.

EOS USD daily chart. Source: Tradingview

However, the bears have not been able to sink the EOS/USD pair below $2.0632, which shows a lack of sellers at lower levels.

If the bulls can propel the pair above the overhead resistance at $2.4001, a rally to the 50-day SMA at $3.32 and above it to $3.86 is possible. As the risk to reward ratio is attractive, we have retained the buy suggested in our earlier analysis.

BNB/USD

Binance Coin (BNB) turned down from the 20-day EMA at $13.27 on March 27. Though the bears were able to sink the price below the immediate support at $12.1111, they could not break below the next support at $10.8428.

BNB USD daily chart. Source: Tradingview

This shows that the buyers are keen to enter at lower levels. Currently, the bulls are again attempting to push the BNB/USD pair above $12.1111. If successful, the bulls will make one more attempt to climb above the 20-day EMA at $12.91. If successful, a move to the downtrend line at $15 is possible.

On the other hand, if the pair reverses direction from the 20-day EMA once again, the possibility of a break below $10.8428 increases. Below this level, a drop to $8.4422 is likely. Currently, we do not find any reliable buy setups, hence, we remain neutral on the pair.

XTZ/USD

Tezos (XTZ) broke below the trendline of the ascending triangle, which invalidates the pattern. A breakdown of a bullish pattern is a bearish sign. Currently, the altcoin is attempting a bounce off the immediate support at $1.4453.

XTZ USD daily chart. Source: Tradingview

If the XTZ/USD pair can re-enter the triangle, it will be a bullish sign as it will indicate buying at lower levels. The pair is likely to pick up momentum on a break above the 20-day EMA at $1.77 and the overhead resistance at $1.955.

Therefore, we retain the buy recommendation given in an earlier analysis. The pair will turn negative if the price turns down from the trendline and plummets below $1.4453.

LEO/USD

After consolidating between the $1-$1.04 range for the past few days, UNUS SED LEO (LEO) has broken out of $1.04. This is a positive sign. With both moving averages sloping up and the RSI in positive territory, the advantage is with the bulls.

LEO USD daily chart. Source: Tradingview

If the LEO/USD pair closes (UTC time) above $1.04, it will complete a bullish inverted head and shoulders pattern. This setup has a target objective of $1.27488 and above it $1.36. Therefore, the traders can buy as recommended by us in an earlier analysis.

Our bullish view will be invalidated if the price fails to sustain above $1.04 and turns down sharply. If the support at $1 breaks, the next level to watch out for is $0.95.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.