The crypto market may have stagnated, but this industry’s innovators have continued to incessantly beat the “BUIDL” drum, as pro-crypto developments were as present as ever throughout the past week.

Crypto-Friendly Governors Elected In Colorado, California

To many crypto savants, the modern political scene, which promotes centralization and censorship in some cases, is far from a topic of importance. But, as Tuesday’s U.S. midterm results have rolled in, the ears of cryptocurrency enthusiasts have metaphorically perked, as it was revealed that two pro-Bitcoin/crypto politicians have been sworn into office in the nation’s highest levels of government.

Colorado’s Jared Polis (Democrat), who is America’s first openly gay governor, was the first crypto-friendly politician to be elected into Congress. Polis, who is arguably one of the most progressive governors on America’s political stage, has long been a fan of cryptocurrencies and is open to aiding the asset class on a regulatory stage.

In 2014, the Boulder, Colorado native explained that he would do everything in his power to hamper the propagation of anti-Bitcoin policies, whether it be through rallying against governmental agencies or touting the benefits of crypto assets and its associated technologies. And even in spite of the relative age of the aforementioned claim, the politician’s pro-crypto views have persisted well into 2018, even to this day.

In February of this year, NewsBTC reported that the Colorado governor requested for Congress to draft a guideline for crypto holding disclosures. Although this could be seen as an anti-crypto move, especially considering that this industry values pseudonymity, at the time, the lawmaker claimed that the growing legitimacy of crypto necessitated the body to take appropriate action.

Alongside Polis is Gavin Newsom (Democrat), one of the first politicians to open his war chests to accept Bitcoin (BTC). Newsom, similarly to Polis, is now governing California.

Considering that California is a hotspot for innovation, with the Bay Area and Silicon Valley being world-renowned for its proclivity for all things tech (crypto included), Newsom’s office could catalyze the widespread use of blockchain technologies and crypto assets in the region.

Although two is far from a crowd, and Newsom’s acceptance of BTC donations is far from all-in, these governors could be the match that sparks regulatory change in favor of crypto assets.

Binance Aims To Attract Institutions

Although Binance is primarily for being the biggest crypto exchange platform in the world, on Thursday, the Malta-based company revealed that it would be launching Binance Research, a division focused on providing consumers with “quality analysis on cryptocurrencies and the blockchain projects they represent.”

The launch of its new arm, which was preceded by Binance Info and Binance Academy, will allow the company to embark further on its goal to spread the good word of blockchain technologies. And, as put by an official blog post pertaining to the matter:

“The main goal is to increase transparency and accuracy of information in the cryptocurrency and blockchain space. We believe delivering consolidated, comprehensive reports for cryptocurrency tokens and projects will be a huge step forward in leading the blockchain community to deeper understanding and more insights.”

Just a day after the startup’s aforementioned announcement, Binance revealed its plans to lay the groundwork for the arrival of institutional investors and the capital that they manage. In an announcement outlining Binance’s plans, it was explained that the firm intends to further its ambition to build the technological foundation for institutional adoption, while also offering unique benefits and rewards for Corporate Accounts.

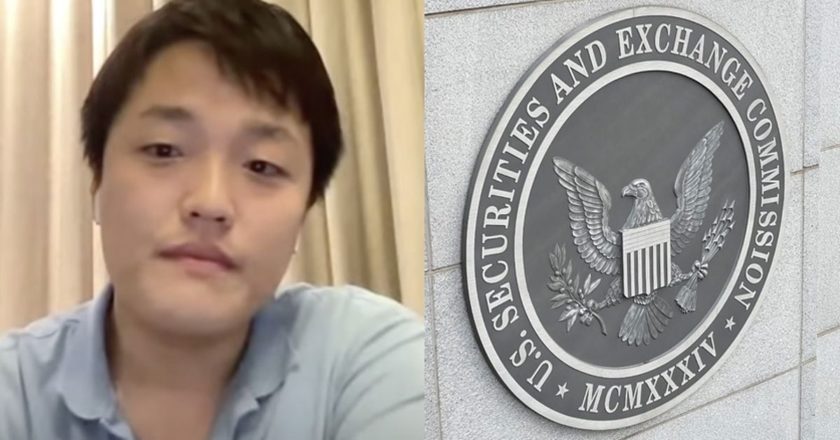

SEC Fines EtherDelta Founder, Regulatory Concerns Mount

In a regulatory action straight out of left field, the U.S. Securities and Exchange Commission (SEC) has formally charged Zachary Coburn, the founder of EtherDelta, for operating an unregulated and unlicensed securities exchange.

Per a press release from the governmental agency, EtherDelta’s move to support ICO Ethereum-based tokens, which the SEC classifies as securities as per the agency’s 2017 DAO report, resulted in this harsh regulatory stance. Although supporting ICO tokens may be fine in some cases, EtherDelta was never officially registered or licensed with the SEC. Stephanie Avakian, Co-Director of the SEC’s Enforcement Division, spoke on the matter, noting:

“EtherDelta had both the user interface and underlying functionality of an online national securities exchange and was required to register with the SEC or qualify for an exemption.”

Coburn will reportedly have to pay a $300,000 disgorgement fee, along with $13,000 in prejudgment interest and a $75,000 penalty, to satisfy the SEC’s needs.

However, some have argued that Coburn essentially got off scot-free, as he was fined a total of $388,000 for facilitating upwards of 3.6 million transactions, which amounts to less than $0.11 a trade. Regardless, this move underscores the sentiment that the SEC, coupled with other leading regulators, is seeking to crack down further on unregulated platforms, even ones that are supposedly decentralized and/or distributed.

Charlie Shrem Sued By Winklevoss Twins Over 5,000 BTC

Charlie Shrem, widely regarded as one of Bitcoin’s founding fathers, has just been sued by his fellow early adopters, the Winklevoss Twins, who accuse him of embezzling 5,000 BTC from their former business relationship. This marks yet another time that Shrem, who founded BitInstant, has come under regulatory pressure due to his dealings in the crypto industry. Previously, he was sentenced to prison for allegedly facilitating fiat-to-crypto transactions that were involved in the illicit trade.

After one year in the slammer, the BitInstant founder was reportedly released with less than $100,000 worth of assets, making it all the more suspicious when he purchased millions of dollars of assets and goods in the years that followed. This multi-million dollar shopping spree prompted the Winklevoss Twins, who currently operate the New York-based Gemini Trust, to seek 5,000 BTC that Shrem purportedly neglected to send following a business deal in 2012.

Since the twins’ lawsuit has been unsealed, Shrem’s lawyer, Brian Klein, has claimed that his client never stole the 5,000 BTC, which would be valued at $32 million today. Klein noted that the crypto under question existed, but belonged to an unnamed “prominent Bitcoin industry member,” not the Winklevoss Twins or any of their beneficiaries.

Others have come out to support Shrem, dubbed “Bitcoin’s First Felon,” as well, with many noting that his stints at Changelly, CryptoIQ, along with a number of other leading crypto startups, allowed the entrepreneur to fix his previously precarious financial situation.

Crypto Tidbits

- “Captain James T. Kirk” Defends Ethereum From Critics: William Shatner, the world-renowned actor behind the original Star Trek series’ Captain James T. Kirk, has just forayed further into crypto, taking to his well-followed Twitter page to defend the Ethereum project from its critics. In a number of tweets, Shatner, also known as Priceline’s de-facto figurehead, complemented Vitalik Buterin, used the terms “FOMO,” “FUD,” and “HODL,” and mentioned ERC standards and how Ethereum protocol activation works. Although Shatner is no Elon Musk when it comes crypto adoption, the former’s move to openly foray into this industry highlights a growing theme of traditionalists turning to cryptocurrencies and blockchain technologies.

- Blockchain Airdrops $125 Million Worth Of Stellar Lumens (XLM): Blockchain, in collaboration with Stellar, has just revealed that it will be airdropping $125 million worth of Stellar Lumens (XLM) to new users of its wallet service, which currently boasts a grand total of more than 30 million users. Explaining its reasoning behind this overtly philanthropic move, Blockchain, headed by Peter Smith, noted that it wanted to “add an entirely new way for users to get their first crypto.” Elaborating on this point, the well-known startup added that airdrops are a viable way to bolster adoption and decentralization.

- Basic Attention Token Launches On Coinbase.com: After launching Basic Attention Token (BAT) support on Coinbase Pro, on Thursday, the San Francisco-based startup revealed that it would be adding the popular Ethereum-based token on its consumer-centric platform. However, contrary to the so-called “Coinbase Effect,” BAT fell by upwards of 30% after it was listed on Coinbase Consumer, leading many to claim that this is a clear example of “buy the rumor, sell the news.” This addition comes just weeks after Coinbase unveiled support for ZRX and Circle’s USDC.

Featured Image From Shutterstock