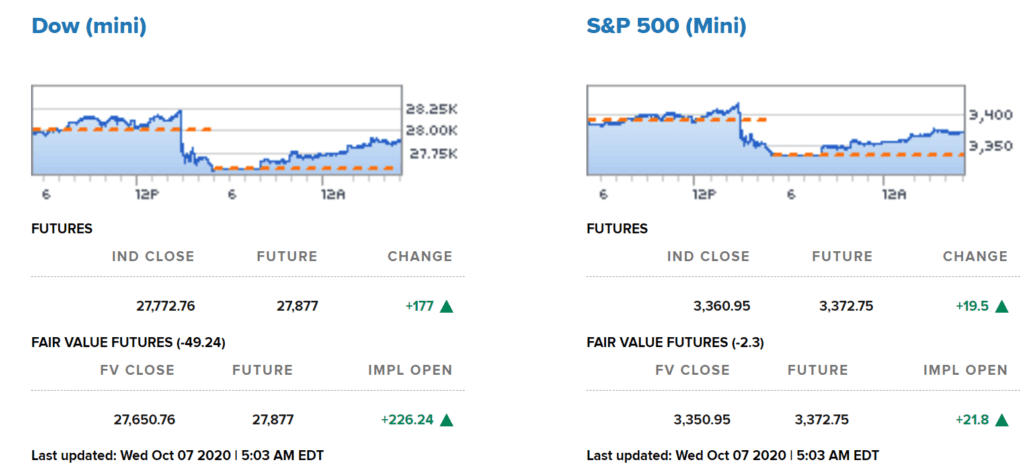

- The U.S. stock market is showing weakening momentum as investment firms shift their focus to Asian stocks and markets.

- On October 6, U.S. President Donald Trump officially ended stimulus talks until the election occurs.

- The fear of no stimulus and limited direct fiscal support has rattled the markets.

Credit Suisse, Invesco, Nikko Asset Management, and many investment firms are compelled by Asia’s stock market as U.S. stocks stagnate.

Fund managers are worried about the weakening momentum of the U.S. stock market, particularly after the stimulus woes.

On October 6, U.S. President Donald Trump reaffirmed that he would not negotiate on stimulus until after the election.

The canceled stimulus talks added additional pressure to an already battered stock market. Now, investment firms are looking elsewhere, possibly to offset the gloomy U.S. market outlook.

Why Key Investment Firms and Funds Are Optimistic in Asia’s Stock Market, Not U.S.

Much of the excitement around the U.S. stock market in the fourth quarter was hedged on the stimulus.

The absence of a stimulus package caused the dollar to decline and the U.S. economic recovery to slow.

Although the Federal Reserve has put considerable efforts to calm the stock market, its limit is favorable fiscal policies. The central bank cannot do more than what it has done since March.

Acknowledging the trouble in the stock market and the economy, the Fed has called for more fiscal stimulus. In a rare encouraging statement to Congress, Fed chair Jerome Powell said on September 23:

“Many borrowers will benefit from these programs, as will the overall economy. But for others, a loan that could be difficult to repay might not be the answer, and in these cases, direct fiscal support may be needed.”

But the U.S. government has failed to deliver the stimulus. Now, the only possible scenario is a stimulus after the election.

Consequently, investment firms have started to look at alternative markets as the U.S. stock market outlook worsens.

According to Nikko Asset Management’s chief global strategist John Vail, he expects Asia-Pacific to outperform for the next six months.

On CNBC’s Street Signs Asia, Vail stated that the fund is not scared to place risk positions.

Emphasizing that the Asia-Pacific stock market remains compelling for long-term investors, he said:

“For the most part, yes, we’re quite happy to have risk positions on in Asia-Pacific. [We expect] all of Asia-Pacific to outperform in the six months ahead period. We’re not afraid, especially for long-term investors, to have to put positions on now in Asia-Pacific.”

Similarly, top Swiss bank Credit Suisse’s Suresh Tantia said the Asian stock market is more attractive in the foreseeable future.

Tantia noted that there are clear risks in the U.S. market, including high valuations and the presidential election.

Considering the two potentially negative factors, he said Asian markets are more “interesting.” He explained:

“Given the election risk in U.S. and more expensive valuations, I think the Asian markets look more interesting – (there is) strong economic recovery, strong earnings and much cheaper valuations compared to the U.S. equity market.”

China’s economy and assets are recovering after the pandemic-induced correction. Watch the video below:

U.S. Stocks Face Two Key Risks

Primarily due to the lacking stimulus, U.S. stocks face two significant risks in the short term.

First, investment firms still gauge the U.S. stock market as highly valued despite the recent pullback. That raises the probability of a prolonged cautious stance from institutions.

Second, the growing demand for Asian markets, mainly from institutions, could leave U.S. stocks vulnerable heading into 2021.