Solana’s (SOL) price edged up on Monday in the wake of a market-wide price rally led by Bitcoin (BTC), its total volume locked (TVL) hitting record highs and a promising technical setup.

Bitcoin triggers market-wide rally

SOL climbed by more than 6% to hit an intraday high of around $214. The SOL is now up a little over 35% over the past week, pushing it closer to its record high of about $222 set in early September.

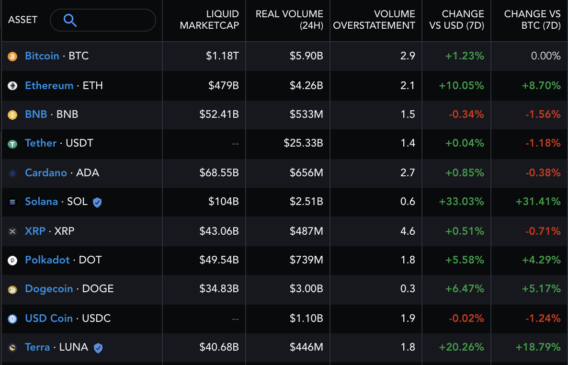

Bitcoin’s run-up to its new record high of $67,000 last week resulted in the total crypto market capitalization passing the $2.5 trillion mark in the last seven days, a new milestone for the cryptoc

That helped push Solana higher, with its rival cryptos, including Ether (ETH) and Cardano (ADA), also jumping by over 10% and 1%, respectively.

Solana TVL hits record high

The Solana price rally also appeared as the TVL of all the decentralized finance (DeFi) projects built on its blockchain reached a new record high of $13.53 billion, as per data aggregator service DeFi Llama.

The most dominant DeFi project on the Solana blockchain was Saber, an automated market maker (AMM) protocol that enables Solana users and applications to trade between stable pairs of assets efficiently and earn yields by providing liquidity to the platform.

Its contribution to the Solana liquidity pool was $2.05 billion at press time.

Meanwhile, there are four other DeFi projects with a TVL of more than $1 billion. These include Raydium ($1.91 billion), Sunny ($1.73 billion), Serum ($1.69 billion), and Marinade Finance ($1.63 billion).

Solana also declared that it would add more DeFi projects to its list after the completion of its “Ignition” hackathon on Oct. 18. Users would need to hold SOL tokens to use these applications, to pay for transaction fees, thus raising the prospect of the token’s higher demand in the future.

SOL price technicals

SOL’s latest price rally came as part of a breakout move out of what appears like a Bullish Pennant. As Cointelegraph reported earlier, the technical outlook aims to send SOL to levels equal to the maximum distance between the Pennant’s upper and lower trendline around $85.

As a result, adding $85 to the breakout level around $158, the SOL price’s Pennant target is $243, i.e., almost $250. Meanwhile, a retest of the pennant’s upper trendline as support would risk invalidating the bullish setup.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.