The Bitcoin Stock to Flow (S2F) model created by the pseudonymous analyst “PlanB” has been a controversial subject over the past year. A majority of cryptocurrency investors on Twitter seemingly believe in the model, though it’s increasingly come under fire.

Debate about PlanB’s work has come to a head over the past few days as prominent commentators have chimed in.

What Is the Stock to Flow Model?

The S2F model is an econometric formula released by PlanB in March of 2019. The pseudonymous analyst is a Dutch institutional investor that manages a multi-billion balance sheet, though he moonlights as a Bitcoin proponent.

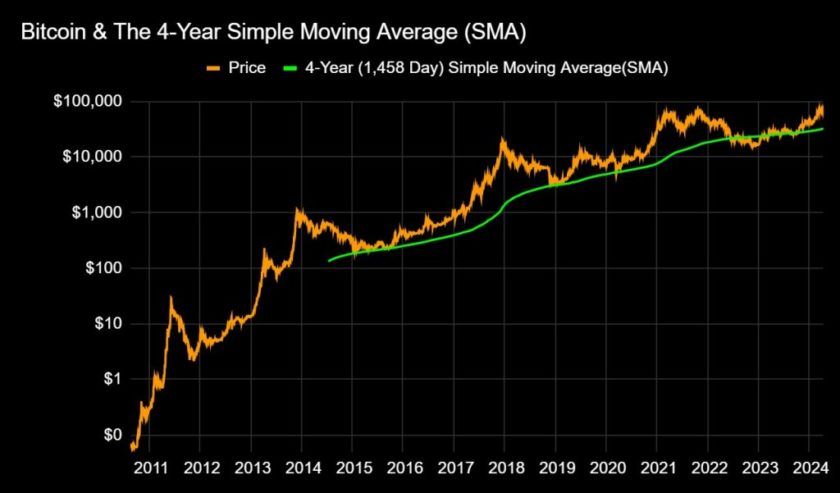

PlanB’s analysis suggests that the value of Bitcoin and other precious goods, namely gold and silver, can be valued by their scarcity. The image below is the model’s first iteration.

BTC S2F model (first iteration) by analyst "PlanB" (@100trillionusd on Twitter).

The model predicts that after 2020’s block reward halving, BTC will rise to a market capitalization of $1 trillion. That corresponds with approximately $55,000 per coin.

The predicted market value for bitcoin after May 2020 halving is $1trn, which translates in a bitcoin price of $55,000. [This money will come from] silver, gold, countries with negative interest rate, countries with predatory governments, billionaires and millionaires hedging against quantitative easing (QE), [and more].”

It has since been updated with a new regression formula that suggests Bitcoin will reach $100,000 in 2020 or 2021.

PlanB’s updated iteration of the model has a high R squared value of ~95% and is purportedly “cointegrated” with BTC’s price. Statistics lingo aside, the S2F model’s proponents say that this is a confirmation that the model has credence.

Not everyone thinks that’s the case, unfortunately for BTC bulls.

Some Bitcoin Proponents Call Out Criticism

The S2F model has recently been supported by a number of Bitcoiners.

Bitcoin educator/programmer Jimmy Song wrote the following message on July 2nd, arguing that it is well too soon to “dunk” on the model:

“Why are people dunking on the s2f model just a few difficulty adjustments past the halving? The prediction was that BTC will be $100k before the end of 2021. Declaring victory now is like declaring victory 5 minutes into the game.”

Why are people dunking on the s2f model just a few difficulty adjustments past the halving?

The prediction was that BTC will be $100k before the end of 2021.

Declaring victory now is like declaring victory 5 minutes into the game.

— Jimmy Song (송재준) (@jimmysong) July 2, 2020

The Keiser Report co-host Max Keiser, one of BTC’s earliest public bulls, agreed with the sentiment put forth by Song.

He said that the arguments “‘debunking’” the S2F model “appear to be just random word-salads by attention seekers.” Keiser added that he thinks the model is a “valid and vital analysis” that gives “excellent insight” into Bitcoin.

So far, the arguments “debunking” S2F for BTC appear to be just random word-salads by attention seekers.

S2F is a valid and vital analysis of #Bitcoin price that provides excellent insight into the market. https://t.co/diqJfThIg3

— Max Keiser (@maxkeiser) July 3, 2020

Keiser’s and Song’s statements of support for the econometric model come as it has come under fire from a few angles.

Namely, Nico Cordeiro, the CIO of Strix Levithan, released a report entitled “A Chameleon Model – Why Bitcoin’s Stock-to-flow Model is Fatally Flawed.”

The investor said that gold hasn’t been correlated with its S2F ratio over the past decade. Cordeiro added that he thinks the model is illogical due to it predicting $200 million by 2045.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Sparks Fly as Critics Question BTC Model Predicting $100,000 by 2021