Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied New on-chain data has picked out activity surrounding Binance’s consolidation transactions. As observed, the latest batch of these transactions has been subjected to a replaced-by-fee (RBF) shift, escalating from 13.5 sats/vb to 56.4 sats/vb. It is despite these transactions failing to “signal BIP125 replaceability”, suggesting that Binance, the world’s largest exchange, could be running a Full-RBF Peering Bitcoin core advocated by Peter Todd. RBF is a standard protocol in the Bitcoin network allowing the sender to increase the…

Tag: Data

Crypto markets rebounded by 83% in Q1 2023 data shows

On-chain data released by Messari, focusing on the layer-1 blockchain ecosystem analysis during Q1 2023, show that the market capitalization of the leading chains rebounded by 83%. Ethereum and BNBChain emerged as the most deflationary networks in Q1 2023. Ethereum leads rebound The cryptocurrency market experienced a rebound in Q1 2023, witnessing an average increase of 83% quarter-on-quarter (QoQ) in the market capitalization of the featured layer-1 blockchains. However, despite this recovery, their market cap remains down by 58% year-on-year (YoY), the researchers note. Among the featured L1s, Ethereum emerged…

Why Did Bitcoin’s BTC Price Rise on Friday? BTC Hovers Over $27K as Crypto Investors Shrug Off Hot Jobs Data

Almost without exception, other major cryptos spent the day solidly in positive territory with ADA and SOL, the tokens of the Cardano and Solana smart contract platforms, recently rising more than 4% and 3.5%, respectively. Meanwhile, a bevy of small DeFi focused protocols were the big gainers of the past seven days, according to the CoinDesk Market Index, a measure of crypto markets overall performance, with Lido (LDO), Synapse (SYN), and PancakeSwap (CAKE), climbing 15%, 13%, and 12%, respectively. The CMI was recently up 1.6%. Original Source 27KBitcoinsBTCCryptodataFridayHOTHoversInvestorsJobsPriceRiseShrug CryptoX Portal

Japan Sends Warning to ChatGPT Creator OpenAI about Collecting Private User Data without Consent

Through its privacy commission, Japan issued a warning and threatened to take action against OpenAI if it violates any privacy regulation. Japan’s privacy agency has announced it issued a warning to OpenAI on using or collecting user data. The Personal Information Protection Commission (PPC) urged the ChatGPT creator to only collect sensitive information with consent from users. In the statement, the privacy watchdog suggests it is currently not investigating OpenAI for any breach of privacy or unauthorized collection of user data. However, it called on the company to “reduce the risk to…

OpenAI gets warning from Japanese regulators on data collecting

Officials in Japan are beginning to tighten their stance toward artificial intelligence (AI) after the country’s local privacy watchdog warned ChatGPT’s parent company about its data collection methods. On June 2, Japan’s Personal Information Protection Commission issued a statement asking OpenAI to minimize the sensitive data it collects for machine learning purposes. Additionally, it stresses not to do so without people’s permission. The commission also highlighted the need to balance its privacy concerns with allowing room to foster innovation and the potential benefits of AI. However, it did warn that…

How to access Bitcoin network data without advanced IT skills

The Bitcoin network is home to a variety of data that can offer investors, academics and fans useful insights. However, those without significant IT abilities might find it difficult to obtain this data. The good news is that anyone may explore Bitcoin network data without having substantial technical knowledge thanks to the user-friendly tools, platforms and techniques that are readily available. This article will walk you through how to access Bitcoin network data through various mediums. Related: Top 5 Bitcoin documentaries to add to your watchlist Bitcoin Core The original software…

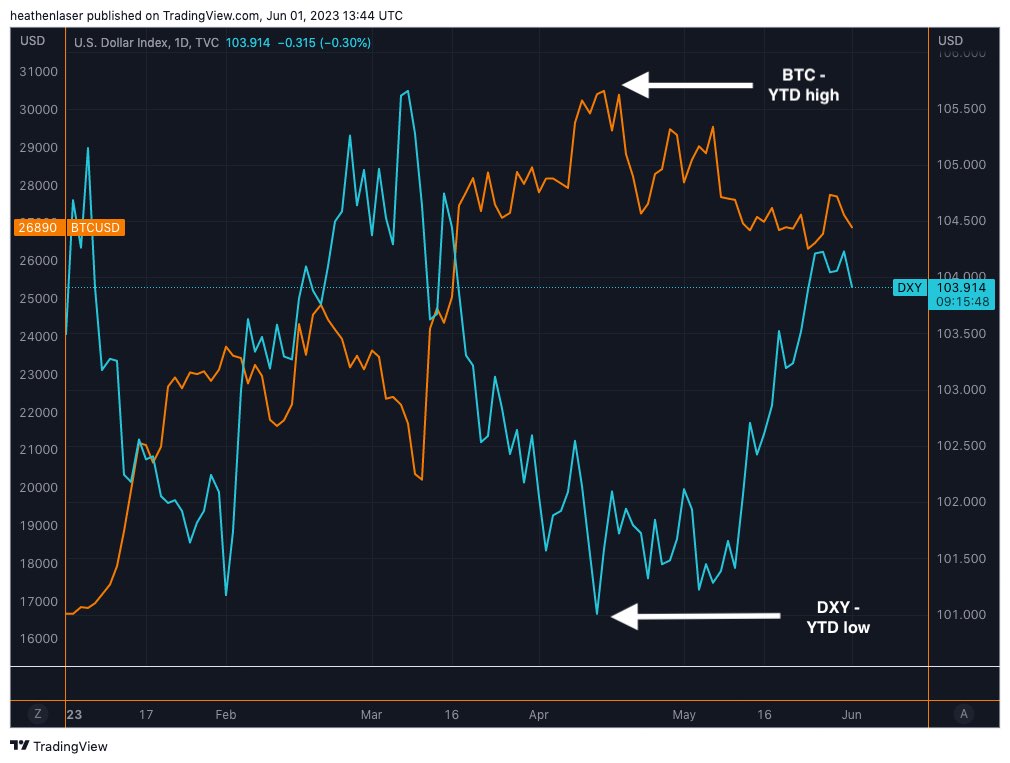

Bitcoin price slips under $27K, but data shows BTC whales counter trading DXY strength

As the summer season arrives, an unexpected heatwave is gripping financial markets This heat is coming in the form of the US Dollar (DXY) which has been on a remarkable uptrend since late April, reaching levels unseen since early March’s banking crisis when the dollar wrecking ball wreaked havoc on asset prices. This surge in the dollar has raised concerns among market participants due to its high inverse relationship with Bitcoin (BTC), a topic many macro and crypto analysts have discussed repeatedly in 2023. The implications of this inverse correlation…

Data suggests bull run for bitcoin despite the price decline

Share Share on Twitter Share on LinkedIn Share on Telegram Copy Link Link copied Bitcoin (BTC) has been moving in uncertainties as the exchange reserves started declining in the first week of May. New data, however, suggests that a bull run might be on the way for the digital gold. According to data from the on-chain analysis platform CryptoQuant, the value of exchange reserves in bitcoin has fallen by roughly $7 billion over the past month. “At least the amount of Bitcoin circulating on exchanges has decreased in the past…

Researchers propose new scheme to help courts test deanonymized blockchain data

A team of researchers from Friedrich-Alexander-Universität Erlangen-Nürnberg recently published a paper detailing methods investigators and courts can use to determine the validity of deanonymized data on the Bitcoin (BTC) blockchain. The team’s preprint paper, “Argumentation Schemes for Blockchain Deanonymization,” lays out a blueprint for conducting, verifying and presenting investigations into crimes involving cryptocurrency transactions. While the paper focuses on the German and United States legal systems, the authors state that the findings should be generally applicable. Bitcoin-related crime investigations revolve around the deanonymization of suspected criminals, a process made more challenging…

Bitcoin on-chain and options data hint at a decisive move in BTC price

Bitcoin’s volatility has dropped to historically low levels thanks to macroeconomic uncertainty and low market liquidity. However, on-chain and options market data allude to incoming volatility in June. The Bitcoin Volatility Index, which measures the daily fluctuations in Bitcoin’s (BTC) price, shows that the 30-day volatility in Bitcoin’s price was 1.52%, which is less than half of the yearly averages across Bitcoin’s history, with values usually above 4%. According to Glassnode, the expectation of volatility is a “logical conclusion” based on the fact that low volatility levels were only seen for 19.3%…