The market for tokenized U.S. Treasury debt is booming. The market value of Treasury notes tokenized through public blockchains like Ethereum, Polygon, Valanche, Stellar and others has crossed above $1 billion for the first time, data tracked by Tom Wan, an analyst at crypto firm 21.co, show. Tokenized Treasuries are digital representations of U.S. government bonds that can be traded as tokens on the blockchain. The market value has risen nearly 10-fold since January last year and 18% since traditional finance giant BlackRock announced Etheruem-based tokenized fund BUIDL on March…

Tag: Notes

Bitcoin’s retreat from $70k sparks concerns among tradfi investors, Bitfinex notes

Bitcoin’s decline prompts caution among traditional investors, emphasizing the importance of forthcoming flow data to gauge market sentiment. Traditional investors (tradfi) are starting to exercise caution as Bitcoin’s (BTC) price experiences a decline pulling back over 12.5% from its recent all-time high reached on Mar. 14. In a recent research report Bitfinex notes that the latest retreat “was one of the largest price dips” since the introduction of spot Bitcoin exchange-traded funds (ETFs) earlier this year. Despite the surge in inflows into spot Bitcoin ETFs, which surpassed a billion dollars…

As Bitcoin updates highs, community enters euphoria zone, Glassnode notes

Bitcoin’s surge to new all-time highs signals its entry into the euphoria zone, accompanied by substantial capital inflows driven by the success of spot Bitcoin ETFs. Bitcoin has finally entered the fourth cycle in its history as its price keeps growing beyond the $70,000 mark, Glassnode analysts said, adding that the interest surrounding the cryptocurrency appears to be transitioning it into the euphoria zone. Bitcoin’s euphoria zones by cycles | Source: Glassnode According to on-chain data analysis, the Bitcoin Realized Cap, a measure of the total wealth stored in BTC…

UK Regulators Greenlight Crypto-Based Exchange Traded Notes (ETNs) As Bitcoin Hits New All-Time High

Financial regulators in the United Kingdom are allowing applications for crypto-based exchange-traded notes (ETNs), according to a new announcement. In a Monday press release, Britain’s Financial Conduct Authority (FCA) said that it has approved the sale of crypto and Bitcoin (BTC) ETNs for professional investors. ETNs in the UK are defined as bonds issued by financial institutions that track the performance of underlying assets. According to the FCA, any potential crypto retail ETNs will not be available for retail investors as it would be unsafe and “ill-suited” for them. Says…

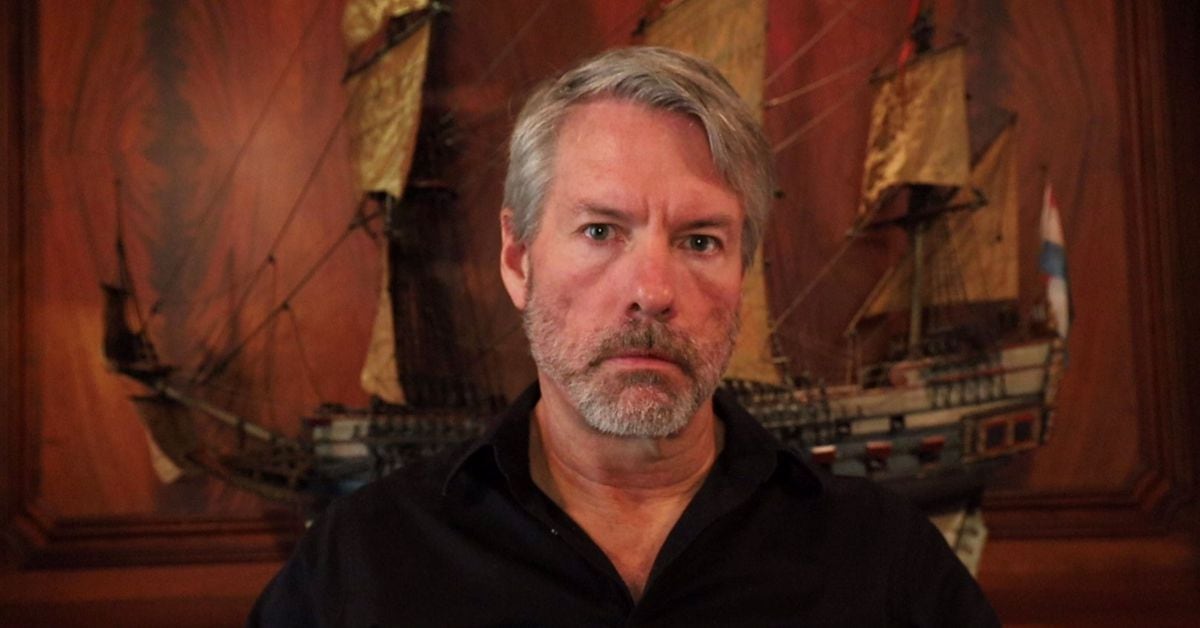

MicroStrategy Acquires 12,000 More BTC With Convertible Senior Notes Proceeds

The software firm, founded by staunch bitcoin advocate Michael Saylor, now holds 205,000 BTC worth around $14.7 billion. MicroStrategy acquired its latest batch of BTC for ~$68,477 per coin, Saylor said in a post on X on Monday. In total, the company acquired the bitcoin for $821.7 million, using the proceeds from the debt raise and excess cash. Source

Bitcoin (BTC) Logs Biggest Single-Day Gain Since October, Market-Neutral Bets Yield 3x That of Treasury Notes

Cash and carry arbitrage is a market-neutral strategy that seeks to profit from price discrepancies in spot and futures markets. The arbitrageur combines a long position in the spot market with a short position in futures when futures trade at a premium to spot prices. As futures expiry nears, the premium evaporates, and on the day of the settlement, futures converge with spot prices, generating a relatively risk-less return to the arbitrageur. Source

Blockstream Preps New Sale of Notes Designed to Profit From Rebounding BTC Mining-Rig Prices

A pitch for the notes describes the investment strategy like this: “Leveraging Blockstream’s long track record, leading market position, substantial scale, broad expertise and strong relationships across the ASIC supply chain, the BASIC structure plans to acquire and warehouse new and unused ASICs at attractive prices, and to eventually strategically sell them back into the market as the industry rebounds within the next 12-24 months.” Source

Robinhood (HOOD) Broadens Crypto Service to Europe, Notes Region’s Digital Asset Regulation

“The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans,” Robinhood Crypto’s general manager Johann Kerbrat said in the blog post. Source

Bitcoin (BTC) Prices Tops $37,000 as Milei Becomes Argentina President; Fed Meeting Notes Pose Risks

Milei, a self-described anarcho-capitalist, has been supportive of bitcoin, calling it “the return of money to its original creator, the private sector.” He has not, however, proposed making the world’s largest cryptocurrency legal tender in the country. Original

Elon Musk says posts busted by Community Notes won’t earn revenue share

Posts corrected by X’s community-driven fact-checking feature will be “ineligible for revenue share,” to stem the flow of misinformation and sensationalism, says Elon Musk. In an Oct. 29 X post, the executive chairman said misleading or inaccurate posts “corrected” by Community Notes — manned by X’s crowdsourced fact-checkers will not be eligible for revenue share. Musk said the change would “maximize the incentive for accuracy over sensationalism” and claimed any attempted weaponization of the feature would be “immediately obvious” as the data is open source. Making a slight change to…