The U.K. government believes implementing the reporting framework could draw in 35 million pounds ($45 million) from 2026. Source

Tag: OECD

OECD introduces tax reporting framework for crypto industry

The Organization for Economic Cooperation and Development (OECD) has introduced a new tax framework specifically designed for crypto. OECD unveiled its Crypto-Asset Reporting Framework (CARF) at the end of a two-day ministerial-level meeting of its council held between June 7 and 8. Our new international tax transparency standards cover the updated Common Reporting Standard and the new reporting framework for crypto assets, further strengthening efforts to tackle tax evasion in a digitalised & globalised world economy. ➡️ https://t.co/GMcvZOQXCc pic.twitter.com/8Z595Vutrn — Mathias Cormann (@MathiasCormann) June 8, 2023 Alongside amendments to the…

New OECD report takes lessons from crypto winter, faults ‘financial engineering’

The Organisation for Economic Cooperation and Development (OECD) analyzed the crypto winter in a new policy paper titled “Lessons from the crypto winter: DeFi versus CeFi,” released Dec. 14. The authors examined the impact of the crypto winter on retail investors and the role of “financial engineering” in the industry’s current problems and found a lot not to like. The paper from the OECD, an intergovernmental body with 38 member states dedicated to economic progress and world trade, concentrated on events in the first three quarters of 2022. It placed…

OECD releases framework to combat international tax evasion using digital assets

The OECD said it planned to present the Crypto-Asset Reporting Framework to a meeting of G20 finance ministers and central bank governors on Oct. 12-13. The Organisation for Economic Cooperation and Development, or OECD, has published a framework aimed at having tax authorities achieve greater visibility on crypto transactions and the users behind them. In an Oct. 10 announcement, the OECD said it planned to present the Crypto-Asset Reporting Framework, or CARF, to a meeting of G20 finance ministers and central bank governors on Oct. 12-13. The crypto tax framework…

OECD Approves Crypto Tax Reporting Framework

The framework, which was approved in August, ensures “the collection and automatic exchange of information on transactions for relevant crypto,” the report said. The definition of crypto assets “includes assets that can be held and transferred in a decentralised manner, without the intervention of traditional financial intermediaries, including stablecoins, derivatives issued in the form of a crypto-asset and certain non-fungible tokens,” the report said. Source

OECD opens proposal on tax transparency framework for crypto to public comment

The Organisation for Economic Cooperation and Development, or OECD, has suggested additional requirements on reporting crypto transactions and identifying users aimed at increasing transparency for global tax authorities. In a public consultation document released on Tuesday, the OECD opened for public comment a proposal that would require crypto service providers to better identify users and report on certain transactions. The organization said that under current reporting requirements, tax authorities do not have “adequate visibility” for transactions dealing with crypto assets. According to the OECD, the crypto market posed a “significant…

Crypto Providers Would Have to Swap Transaction Details Under OECD Tax-Dodging Proposal

Crypto exchanges would have to share details about the identity and transactions of their users with foreign tax authorities under plans submitted for stakeholder comment Tuesday by the Organization for Economic Cooperation and Development (OECD), which is seeking to avoid foreign digital assets being used to hide wealth. Source

OECD tax director says international crypto tax standards are coming in 2021

Pascal Saint-Amans, the director of the OECD’s Centre for Tax Policy and Administration, has asserted that the 37-nation organization will introduce a common reporting standard, or CRS, for crypto assets in 2021. According to Law360, Amans stated that the crypto tax standard “would be roughly equivalent to the CRS” developed by the Organisation for Economic Co-operation and Development to combat tax evasion. The director attributed the likely development of the crypto tax CRS to a desire to introduce stronger standards surrounding crypto regulations among its member-countries: “The timeline to deliver…

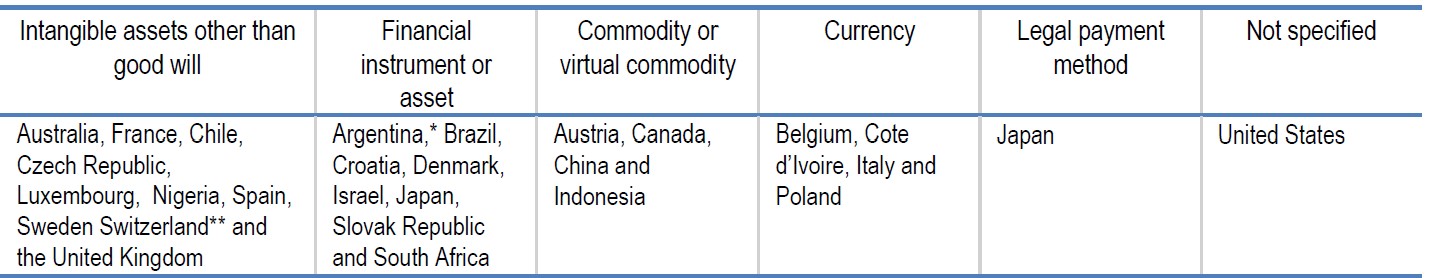

OECD calls out countries for their inconsistent rules on crypto taxation

A study of cryptocurrency taxation regimes from around the world by the Organization for Economic Co-operation and Development, or OECD, found that global crypto taxation laws are highly inconsistent. Source: OECD Report. The way crypto assets are defined vary greatly by jurisdiction. Cryptocurrency is most commonly defined as a “financial instrument or asset”, followed by a “commodity or virtual commodity.” In the U.S., the asset class remains mostly undefined for tax purposes. Source: OECD Report. The same inconsistency is observed when it comes to determining the first taxable event for…

ICO Deputy Commissioner appointed OECD working party chair

The ICO’s Steve Wood has been appointed as chair of the OECD’s Working Party on Data Governance and Privacy. The working party plays an important role in the OECD’s international work to bring policy makers together, inform future policy and develop international standards. The working group’s focus areas include: Supporting the OECD work, including reviewing recommendations on protecting children online, promoting digital transformation and monitoring the implementation of privacy guidelines, supported by government, industry and civil society experts. Considering measures to enhance access and sharing of data standards internationally. Studying…