Many had speculated that the rally in the crypto market was going to wane following the Spot Bitcoin ETF rumors fading out. That hasn’t been the case, though, and a recent revelation from a prominent crypto analyst suggests that the two largest cryptocurrencies by market cap, Bitcoin and Ethereum, could continue to see an upward trend. New Liquidity Coming Into The Market Could Boost Bitcoin, Ethereum In a post shared on his X (formerly Twitter) platform, Crypto analyst Ali Martinez revealed that the crypto market has seen close to $10.97…

Tag: OneYear

Grayscale Victory Sends Bitcoin Open Interest Surging After Hitting One-Year Lows

Over the last couple of weeks, the Bitcoin open interest had been on a downtrend that sent it toward one-year lows. However, with the Grayscale victory against the SEC coming on Tuesday, August 29, and sending a positive wave across the entire region, open interest in the digital asset has begun to surge once more. Bitcoin Open Interest Pulls A Quick Reversal On-chain data tracking platform Kaiko reported on Tuesday, August 29, that the Bitcoin open interest had been on the decline for a while. In the chart shared by…

Bitcoin BTC Price Soars to One-Year High at $31.7K as Investors Savor Partial Ripple Victory

The largest cryptocurrency by market capitalization was recently trading at $31,328, up 3.2% over the past 24 hours. Bitcoin shot as high as $31,700 near the close of traditional markets, a more than one-year high. With a few blips, BTC had been languishing between $30,000 and $31,000 for the past three weeks as some investors fretted over potential banking missteps to cure inflation and awaited a significant price catalyst. Original

GBTC Shares Surge to a One-Year High, Discount Drops to 30%

Investors are betting on GBTC because of the “BlackRock filing and optimism that [the firm] may have cracked the code on an ETF, giving hope that Grayscale could also convert and remove the discount,” Doug Schwenk, CEO of crypto data provider Digital Asset Research, said in a note to CoinDesk. Source

BCH Price Jumps to One-Year High Fueled by Spiking Social Interest, EDX Markets Support

The Bitcoin Cash network was forked from the original Bitcoin blockchain in July 2017 and aimed to serve as a payment network. Despite early optimism, the blockchain’s traffic is dwarfed by Bitcoin’s transaction numbers. Some $92 million in BCH has been transferred in the last 24 hours, compared to $11 billion in BTC, blockchain data by BitInfoCharts show. BCH is still 95% down from its $4,355 all-time high price reached in December 2017, according to CoinMarketCap. Source

Bitcoin Hits One-Year High, Soars Past $31.3K

The largest cryptocurrency by market capitalization has been surging this week after three financial services giants filed applications for spot bitcoin ETFs. Original

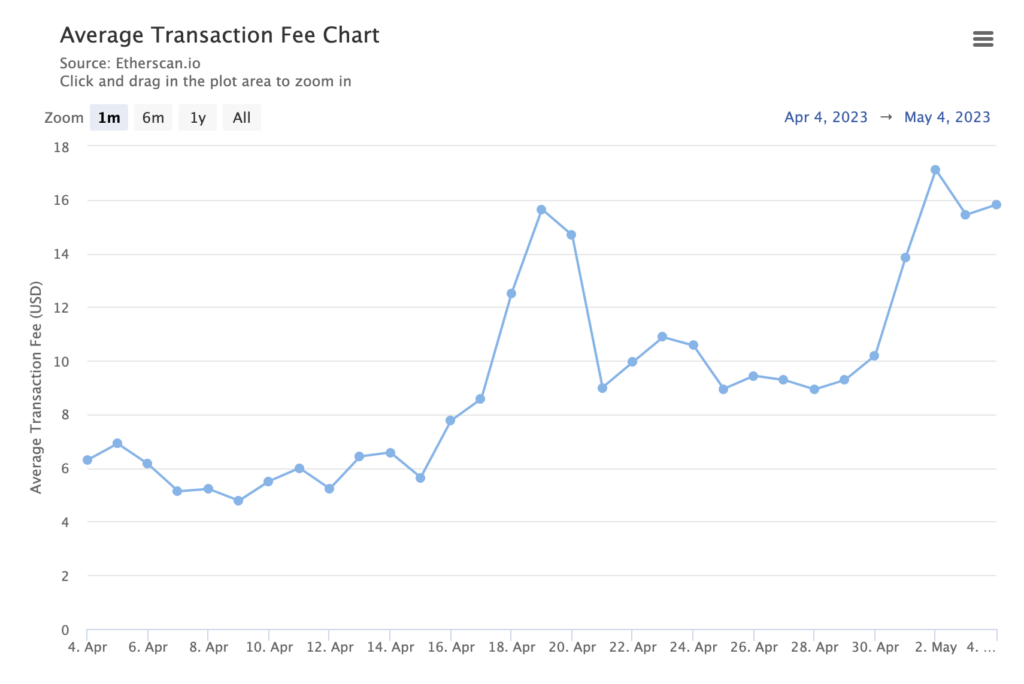

Ethereum gas fees spike to a one-year high amidst PEPE craze

On-chain data shows 31,700 ethereum (ETH) have been burned in the last week. The spike is due to the latest mania over pepecoin (PEPE). This development has pushed Ethereum’s transaction costs even higher. At the beginning of this week, the daily median gas price rose to a 12-month high of 87 gwei – equivalent to one billionth of an ether (ETH). 31.7K $ETH has been burned in the past seven days. To put that in perspective, since the merge (231 days ago), 152K ETH total has been burned. That’s ~21%…

NFT hype evidently dead as daily sales in June 2022 dip to one-year lows

Nonfungible tokens (NFT) took center stage in the year 2021 as artists, influencers, A-list celebrities and the sports industry finally came across a fan engagement tool that empowered the general public to cash in on their success. However, the hype around NFT did not manage to stand its ground as sales plummeted to one-year lows amid the ruthless bear market of 2022. The NFT boom, which started in early 2021, upheld its glory until May 2022 — supported by a healthy and bullish crypto ecosystem and positive investor sentiment. However,…

Bitcoin Institutional Outflows Near One-Year Highs, More Downside Coming?

With the price of bitcoin still trading below $40,000, institutional inflows into the digital asset have slowed significantly. This has now flowed into other digital assets in the space. But what is most significant is the outflow rate which has neared one-year lows. Bitcoin Outflows Grows For the past couple of weeks, the rate at which institutional investors have been pulling money out of bitcoin has been on an accelerated timeline. This is what has culminated in the outflows that were recorded for the digital asset last week. In the…

Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

In late March/early April, the bitcoin futures basis had mounted an impressive recovery that pushed sentiment back into the positive. This had come after months of a declining futures basis, so this recovery was a welcome development in the market. This would prove to be short-lived, however, as the futures basis had taken a sharp nosedive in mid-April. Now, it is falling towards one-year lows, leaving in its wake a trail of wary investors. Nearing One-Year Lows Bitcoin’s drop back into the $30,000 has had a profound impact on the…