The fundraising also involved Multicoin, Hack VC, ParaFi Capital, Nascent, Draper Associates, Primitive Ventures, Asymmetric Ventures and Dan Held, and DCF God, Thesis said Tuesday. Mezo is a “permissionless Bitcoin economic layer that leverages a neutral smart contract infrastructure” to offer a wide range of applications for users, Thesis said. It is designed to amplify the Bitcoin blockchain’s infrastructure and provide cheap and fast transactions by allowing users “to access applications that use Bitcoin for everything, enabling a thriving circular economy,” the venture firm said. Mezo will go live with…

Tag: Pantera

Pantera Capital Plans $250M Solana (SOL) Buy, Analyst Predicts Record Rally Toward $1000

Pantera Capital, a prominent crypto-focused asset manager with assets totaling $5.2 billion, has launched a fundraising campaign to purchase discounted Solana (SOL) tokens from the bankrupt estate of crypto exchange FTX. According to Bloomberg, the initiative, known as the Pantera Solana Fund, offers investors the opportunity to purchase up to $250 million worth of SOL tokens at a significant discount to the FTX estate. Solana Token Acquisition Plan Pantera Capital’s marketing materials, shared with prospective investors in February and reviewed by Bloomberg, outline the opportunity to purchase SOL tokens at…

Pantera Looks to Buy Discounted SOL From FTX Estate With New Fund: Bloomberg

The firm is floating the Pantera Solana Fund to investors, stating it has an opportunity to buy up to $250 million of SOL tokens at a 39% discount below a 30-day average price of $59.95, Bloomberg said, citing documents sent to potential investors last month. Source

Pantera Capital Predicts ‘Strong’ Crypto Bull Market Over Next 18-24 Months

American hedge fund Pantera Capital has predicted “a strong bull market” for cryptocurrencies over the next 18-24 months. “With the halving expected to occur in late April 2024, we believe the convergence of these positive things will provide strong tailwinds for the next bull market,” said Pantera founder Dan Morehead. Pantera’s Bull Market Prediction Pantera […] Source CryptoX Portal

Defi on BTC blockchain could accumulate $225b, Pantera Capital says

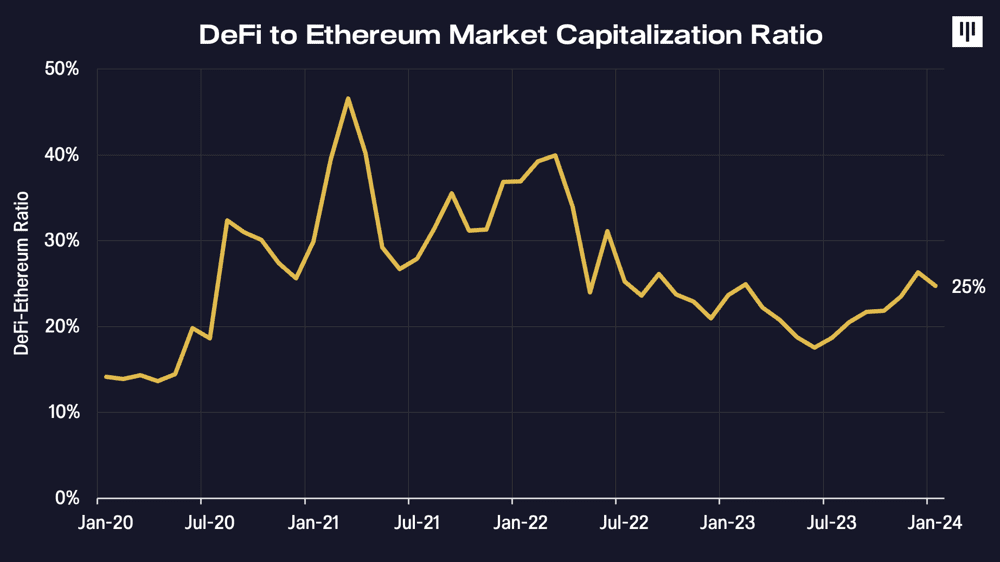

Analysts at Pantera Capital see a half-trillion-dollar opportunity in bringing decentralized finance to Bitcoin, potentially making Bitcoin-based decentralized apps top assets in crypto. Pantera Capital analysts have identified a significant opportunity worth over half a trillion dollars in bringing decentralized finance (defi) to the Bitcoin blockchain, potentially positioning Bitcoin-based decentralized applications as leading assets in the crypto space. In a recent email newsletter, Pantera Capital highlighted the potential for Bitcoin to accumulate $450 billion in liquidity through defi projects, particularly if they achieve similar market shares as those that can…

Pantera Capital-backed NFT lending startup Arcade to airdrop 3m ARCD tokens

Lending platform for digital collectibles Arcade will airdrop 3% of the total supply of ARCD tokens to holders of select NFT collections. In a Medium blog, Arcade unveiled its “Clash of Clans” airdrop initiative, aiming to distribute ARCD tokens among 4,000 wallets, each eligible to claim 750 ARCD tokens. On Feb. 19 at 8:00pm UTC, the team will take a snapshot, with token distribution divided into two phases: whitelist and public claim. Security Reminder. Beware of impersonator accounts & DO NOT click on links that appear to be from @Arcade_xyz…

Pantera Capital expects altcoins with proven protocols to outperform in upcoming cycle

Crypto investment firm Pantera Capital says tokens with promising underlying protocols and product market fit are set to outperform in the upcoming cycle. According to a new report from Pantera Capital, tokens with promising underlying protocols and a demonstrated product-market fit are expected to outperform in the upcoming cycle “just as one would expect across other asset classes like equities.” Although Pantera Capital did not name specific tokens, the firm said that over the long term, token selection will be “paramount because outperformance will be on a case-by-case basis and…

Pantera, VanEck prepare to make investment following spot Bitcoin ETF approval

Four potential spot Bitcoin ETF issuers have disclosed initial seed capital exceeding $10 million before the SEC decides on bids. Per individual filings with the U.S. Securities and Exchange Commission (SEC), VanEck has outclassed BlackRock in direct investment into its spot Bitcoin ETF. VanEck has seeded its bid with $72.5 million. Crypto investment firm Bitwise seeded its Bitcoin (BTC) ETF with $500,000 but noted an additional $200 million cash injection expected from Pantera Capital if the SEC approves applications. BlackRock and Fidelity seeded their BTC funds with $10 million and…

Coinbase (COIN), Fidelity, Pantera, a16z Cryptocurrency Outlooks

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In November 2023, CoinDesk was acquired by Bullish group, owner of Bullish, a regulated, institutional digital assets exchange. Bullish group is majority owned by Block.one; both groups have interests in a variety of…

Spot Bitcoin ETF Is ‘A Buy The News’ Event: Pantera Capital CEO

The potential approval of a spot Bitcoin ETF in the United States has stirred considerable attention in recent weeks. Dan Morehead, CEO and founder of Pantera Capital, has now shared valuable insights on this matter in his latest “Blockchain Letter”, emphasizing the unique circumstances surrounding this event. Morehead challenges the traditional Wall Street mantra, “Buy the rumor, sell the news,” questioning its relevance in the current spot ETF context. He reflects on how this adage played out historically, specifically citing the CME Futures launch and Coinbase’s public listing. Both instances…