Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Bitcoin Cash (BCH) is poised to reach $514.69 by April end, and Stellar (XLM) is anticipated to surge to $0.211 following Validation’s announcement. Rebel Satoshi’s RECQ gains traction with a potential 525% growth in the ICO. Bitcoin Cash: Experts predict a BCH pump soon A mysterious and substantial transfer of 235,300 BCH tokens, valued around $62.38 million at the time, occurred on February 26, moving from an undisclosed wallet…

Tag: Sideways

Ethereum Technical Analysis: Sideways Movement as ETH Eyes Break Above $2,500

With its price positioned at $2,485, ethereum’s daily fluctuations have ranged from $2,309 to $2,541, highlighting a market that is both dynamic and erratic. The current market capitalization of ether is approximately $299.25 billion, and in the last 24 hours, ethereum has seen a global trading volume of $6.91 billion. Following a peak in the […] Source CryptoX Portal

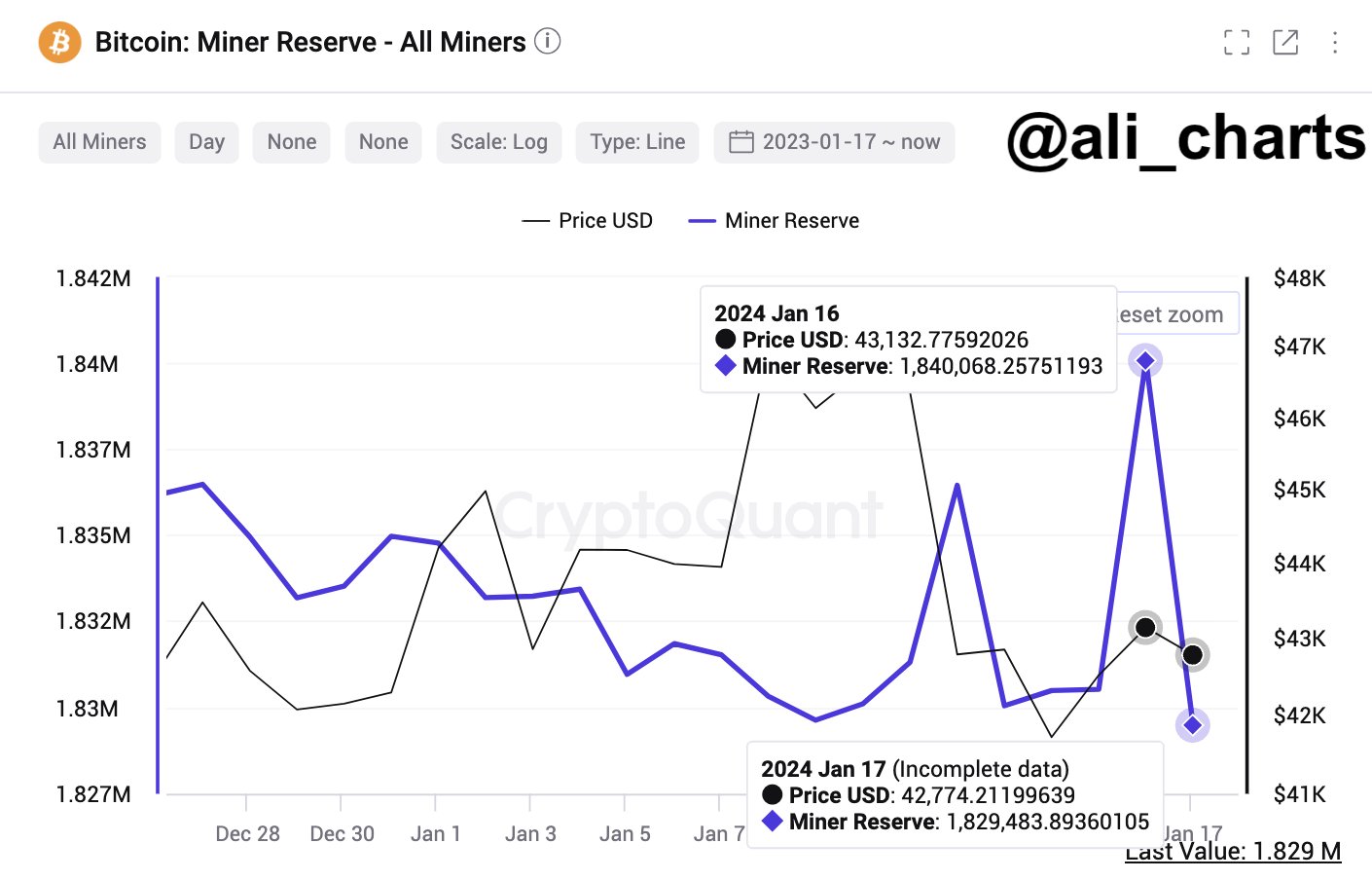

Why Is Bitcoin Price Trading Sideways? 3 Key Factors

The Bitcoin price has been experiencing a phase of stagnation over the past days, leaving investors and analysts searching for the underlying causes. Three key factors can be seen as central to explaining Bitcoin’s current sideways trading trend: #1 ETF Inflows Are Offset By GBTC Selling, But For How Much Longer? The spot Bitcoin ETFs continue to be the dominant theme on the market, and Grayscale in particular, with its GBTC, remains the focus of analysts. While the ETF inflows continue to be record-breaking, the Bitcoin price remains flat. One…

BNB Trading Sideways – Is Stagnation Likely Until October?

Binance Coin (BNB) finds itself in a state of limbo as it extends its sideways pattern on the lower timeframes. BNB has been treading water for nearly a month, caught in a tight range between the support at $205 and a stubborn resistance zone spanning $220 to $225. While on-chain metrics hint at the potential for a short-term price surge, BNB bulls are grappling with the challenge of breaking free from this extended sideways pattern. As of the latest data from CoinGecko, BNB is currently priced at $216.74, with a…

Bitcoin’s sideways price action leads traders to focus on SHIB, UNI, MKR and XDC

Bitcoin (BTC) is on track to form two successive Doji candlestick patterns on the weekly charts but a positive sign is that the price is sustaining above the 20-week exponential moving average ($28,072). This suggests that the bulls have not lost their grip. Popular trader TechDev used the three-week timeframe to show that Bitcoin’s compression above the 20-period moving average was approaching values seen only four times since Bitcoin’s creation. Interestingly, on all three previous occasions, the expansions happened to the upside, suggesting that history favors the bulls. Crypto market…

Bitcoin Sees Surge In Demand Despite Price Sideways Movement

Summary: The count of new addresses trading BTC has rallied. This jump has occurred despite the strong resistance faced at $30,000. As BTC’s price continues to trade sideways, many holders have taken to coin distribution. New demand for leading coin Bitcoin [BTC], continues to climb despite its sideways price movement within the $28,000 and $30,000 regions since April, data from Glassnode revealed. Source: Glassnode An assessment of the coin’s daily new addresses count on a 30-day moving average revealed an uptick since 22 May. Since then, the daily count of…

Deribit’s Bitcoin volatility index hits lifetime lows, hinting sideways action

Crypto options exchange Deribit’s future-looking Bitcoin (BTC) volatility index — used as a crypto fear gauge of sorts — has reportedly reached its lowest level in two years, indicating a possible lack of price turbulence for Bitcoin in the near future. On July 24, crypto derivatives analytics platform Greeks Live noted that the volatility index for both Bitcoin and Ether (ETH) has fallen to a multi-year low of 37%. Furthermore, the current implied volatility level has fallen to the lowest level in crypto’s history according to the DVOL algorithm, it added.…

Bitcoin price ‘sideways boredom’ may last 18 months — New research

Bitcoin (BTC) faces up to one-and-a-half years of “boredom” as the bull market gathers steam, a new prediction says. In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode predicted an “arduous” period for BTC hodlers next. Glassnode: Bitcoin hodlers set for 12 months’ “gradual accumulation” After gaining 70% in the first quarter of 2023, but struggling to hold its ground recently, Bitcoin is dividing opinions when it comes to future price action. With the 2024 block subsidy halving in sight, some believe a dramatic uptick…

A sideways Bitcoin price could lead to breakouts in ETH, XRP, LDO and RNDR

Altcoin prices crumbled after the United States Securities and Exchange Commission (SEC) announced lawsuits against Binance and Coinbase at the start of the week. Apart from the action against the two biggest crypto exchanges, investors seem to be nervous because the SEC labeled 23 cryptocurrencies as securities in the two lawsuits. That brings the total number of cryptocurrencies termed as securities by the SEC to 67. Among the mayhem, a minor positive is that Bitcoin (BTC) and Ether (ETH) have held out relatively well. This suggests that institutional investors are…

Bitcoin Moves Sideways at $27.5K as Investors Await CPI Inflation Reading

Equities slid. Investors will be watching Wednesday’s release of the April Consumer Price Index for clues about the Federal Reserve’s next monetary policy decision. Original