By CCN: Binance CEO Changpeng Zhao let the cat out of the bag on Twitter late last night: Binance is launching its own stablecoin.

Binance’s Last Mile: Its Own Liquidity Market?

A user hoped to see a true stablecoin, pointing out that all of the existing options were down at least 2%.

CZ responded that the exchange is currently in “testing” phases for its stablecoin product.

CZ Binance announced that the company is currently testing its own stablecoin, the BGBP, which only has 200 units issued currently. Source: Twitter

Fact is, when stablecoins see use in actual trading, demand might shift in either direction, occasionally creating a spread. The spread can sometimes be as extreme as 5-10%, depending on overall problems with the stablecoin.

Tether, beset with problems as it is, has often divorced notably from its $1 peg. None have done as bad as BitUSD, one of the first attempts at a stablecoin. Part of the BitShares network, BitUSD never much took off.

We were able to find the BGBP – Binance Great British Pound – on the Binance Chain block explorer. Just as CZ points out, only 200 units exist on one address: bnb1r4ag7kd90rptlhcuuc8trh60v4m4vvzrfyecta.

The same address holds about $25,000 in BNB and little else.

Binance Coin (BNB) started out as an Ethereum asset issued during the crowdfunding for the exchange. Until the launch of Binance Chain, the primary use of BNB was as a means to pay fees on the exchange. BNB has seen a massive rise since its initial offering, currently standing over $30 per unit.

Evolution of BNB

The token can now be used the same way ETH or EOS or TRX are used on their native chains: as the way to interact with Binance Chain. For example, the address that issued the BGBP recently had 1000 more BNB, but spent them to issue the asset.

This is in league with the token cost to launch a new smart contract on other chains.

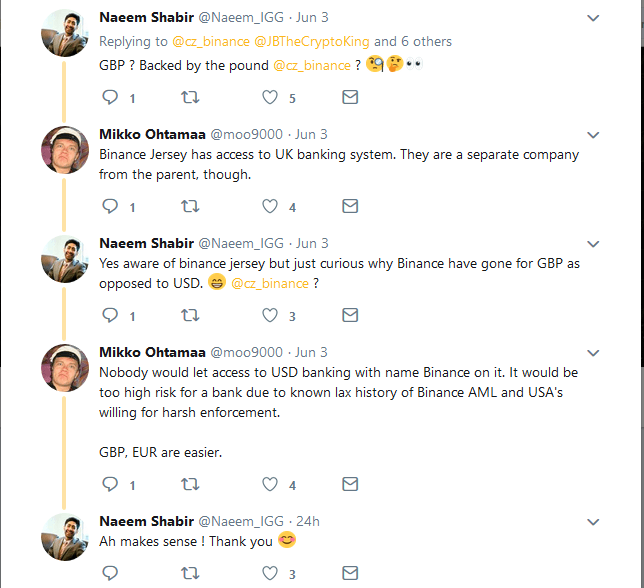

Some Twitter users wondered why Binance would choose the Pound Sterling instead of the US Dollar.

Binance has no established businesses in countries dominated by the dollar, but it does have Binance Jersey, which gives them access to the UK banking system. A couple of users speculated this is why the exchange chose GBP over USD.

Zhao didn’t comment on the reason for a GBP stablecoin rather than a USD one, but users guessed it has to do with legal entanglements. Source: Twitter

For his part, CZ didn’t give any other details. All he mentioned is that it’s a stablecoin in the testing phase.

The BGBP enters a wide field of choices for stablecoins.

Binance’s explicit backing may give it a potential advantage over other stablecoins. When users buy BGBP on Binance, at least, the units can be instantly issued. When traders sell the units, they can be instantly destroyed.

A truly transparent supply could exist for at least one stablecoin. Most have gone to great lengths to demonstrate their veracity. Circle, Gemini, Paxos, and TrustToken each issue monthly audits.

Binance isn’t the only major exchange flirting a stablecoin. Huobi launched HUSD in recent months. HUSD is more of an exchange IOU than an actual token, however, as you can’t withdraw it or use it elsewhere.

If history is any lesson, Binance will probably see enduring success with BGBP. For one thing, it will be the first stablecoin issued on Binance Chain, which may or may not be a serious Ethereum contender in the next year or two.