Ever since Coinbase Pro revealed that it will be listing OmiseGO on its retail platform, this ERC-20 token has done nothing but shoot up. Since then, its price skyrocketed by more than 260%. OMG went from trading at a low of $0.62 to a new yearly high of $2.27.

Even though this cryptocurrency took a 30% nosedive in the past week, on-chain metrics reveal that the bullish momentum behind may not be over yet.

is OmiseGo Bound for Another Upswing?

Data from Santiment reveals that a bullish divergence appears to be developing between the number of daily active addresses on the OmiseGo network and the 21-day moving average. It is worth considering that the recent levels of volatility could have affected this technical indicator since it reflects the price action.

Nonetheless, Santiment maintains that this significant bullish divergence cannot be ignored.

“Four straight days over a +0.5 threshold means there is still a serious running average of major daily active addresses that price hasn’t caught up to yet,” said Brian Quinlivan, Marketing and Social Media Director at Santiment.

OmiseGO’s Daily Active Addresses vs. 21-day Moving Average. (Source: Santiment)

OmiseGo’s NVT adds credence to the bullish outlook. This index takes into consideration the network value and the daily volume of money transmitted through the blockchain. Even after a few weeks since Coinbase announced it was adding support for this altcoin, OMG is “having the healthiest rate of token circulation NVT in its existence,” affirmed Quinlivan.

Massive Supply Barrier Ahead

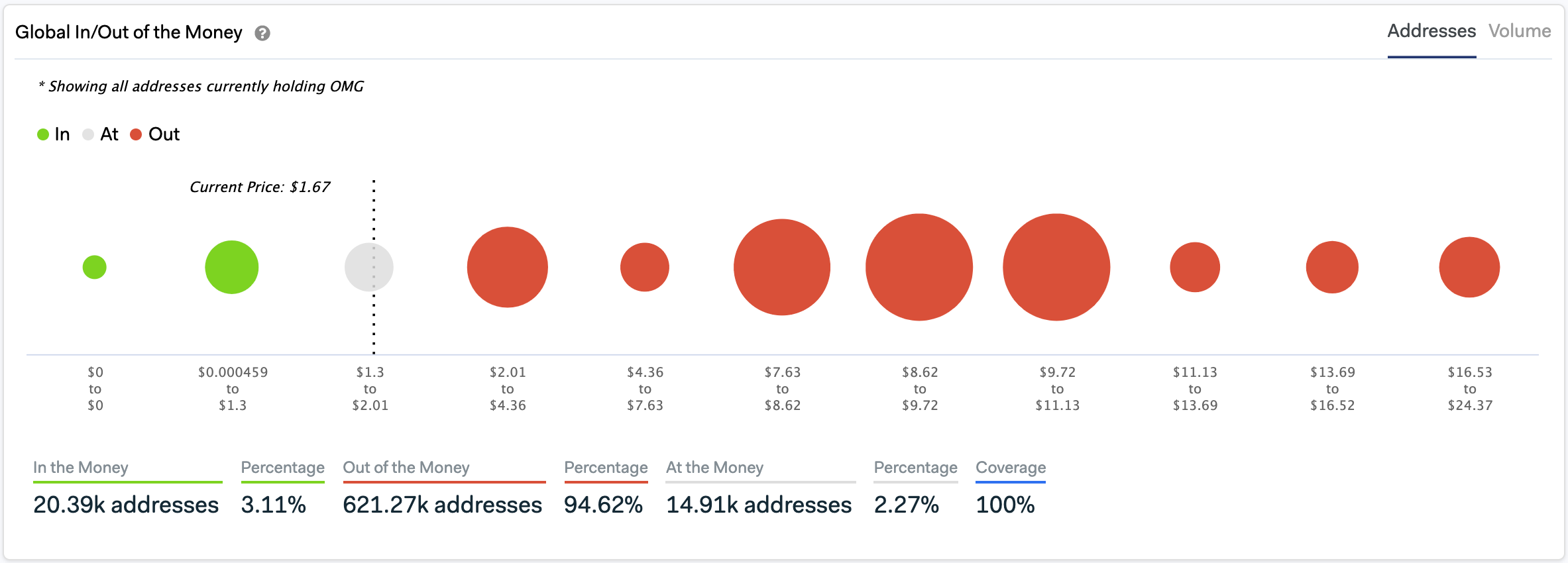

Despite the massive rally OmiseGo has experienced over the past couple of weeks, IntoTheBlock’s “Global In/Out of the Money” model reveals that it still would need to climb over 1,400% to reclaim all-time highs.

Out of all addresses holding this cryptocurrency, more than 94% are currently “Out of the Money,” while only 3% are “In the Money. ” These figures may indicate that the investor base behind OMG is not as confident about upwards price action in the future.

Global In/Out of the Money. (Source: IntoTheBlock)

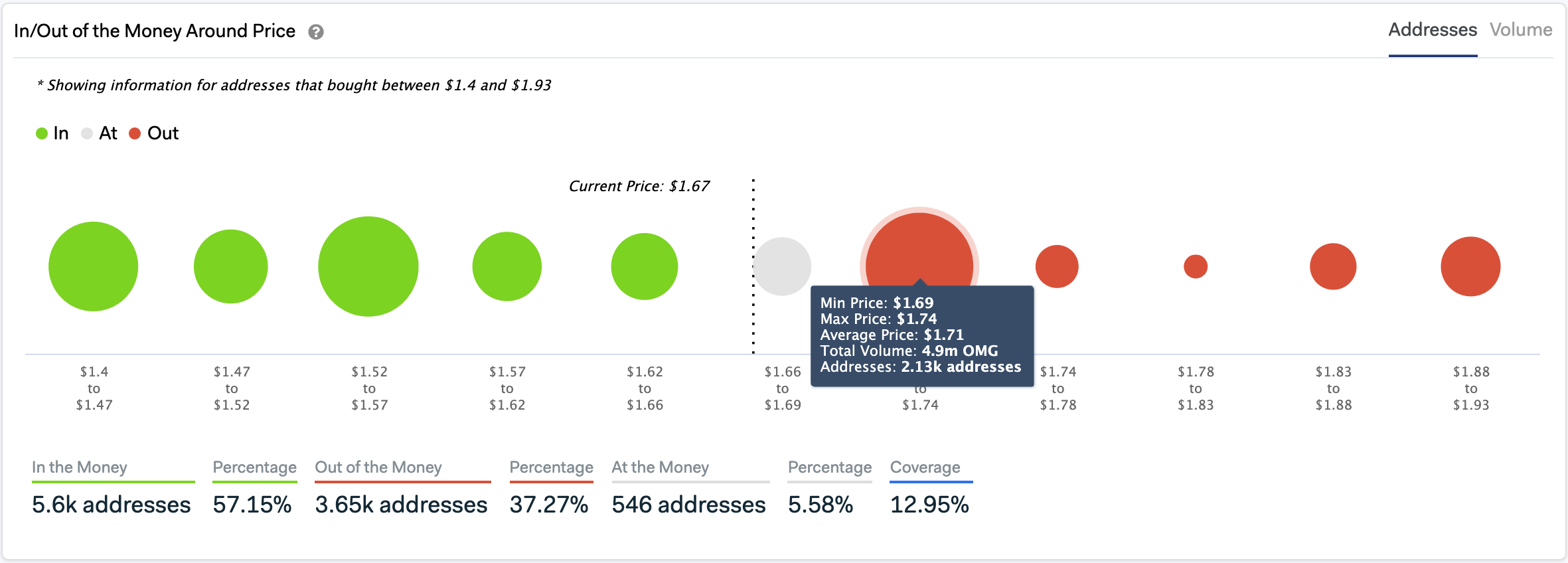

Looking at the “In/Out of the Money Around Price” (IOMAP) model cohorts shows that for OmiseGo to continue surging, as the aforementioned on-chain metrics suggest, it would have to reclaim the $1.71 level as support. Here, more than 2,100 addresses bought nearly 5 million OMG.

As such, the $1.69-$1.74 price level is a massive supply wall and will provide strong resistance if this altcoin were to advance further up. But breaking through it may see prices increase sharply since there are few barriers above it.

In/Out of the Money Around Price. (Source: IntoTheBlock)

On the flip side, the most significant area of support sits between $1.40 and $1.52. Between these price levels, the IOMAP reveals that over 4,000 addresses purchased 4.7 million OMG. In the event of a correction, this supply wall may be able to prevent a further decline.