The current Bitcoin (BTC) bull run could send BTC/USD as high as $590,000, one indicator forecast this week.

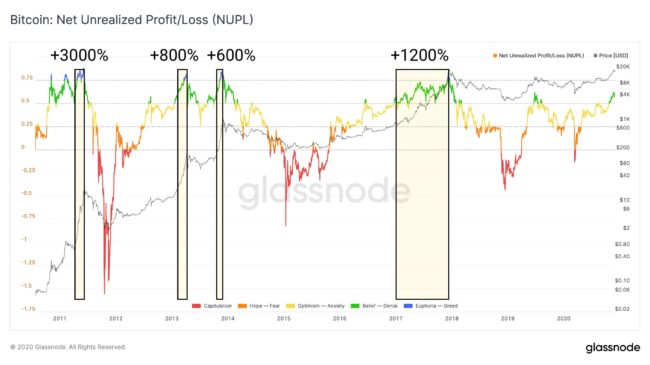

Curated by on-chain analytics resource Glassnode, the Net Unrealized Profit/Loss (NUPL) index has reached a level that has historically launched the Bitcoin price an order of magnitude higher.

Unrealized profit chart hits launchpad level

The latest bull signal was noticed and uploaded to social media by the company’s CTO, Rafael Schultze-Kraft, on Nov. 30. At the time, BTC/USD was already making new all-time highs on several exchanges.

NUPL currently resides at 0.62. Previously, reaching this level has begun an uptrend that only reversed once Bitcoin had hit a new price range.

In 2011, the price expanded by a record 3,000% after the NUPL event, while in early 2013 it expanded 800% and another 600% later that year. 2017, the year which delivered Bitcoin’s previous all-time high, meanwhile saw 1,200% gains.

NUPL measures the proportion of coins in the network which are in profit versus those that aren’t. Built around a neutral zero value, the closer the index gets away from it, the more the network is in profit. Negative readings likewise signify majority losses.

“NUPL is at 0.62 and predicts tops at 0.8+,” Schulze-Kraft explained alongside an annotated chart.

A 0.8 reading or higher this time around thus opens the door to BTC/USD topping out at anywhere between $133,000 and $590,000.

“Just getting started,” he concluded.

PlanB: The Bitcoin bull market is upon us

Monday’s action meanwhile boosted an already confident analyst who had long said that this year’s performance would be “like clockwork.”

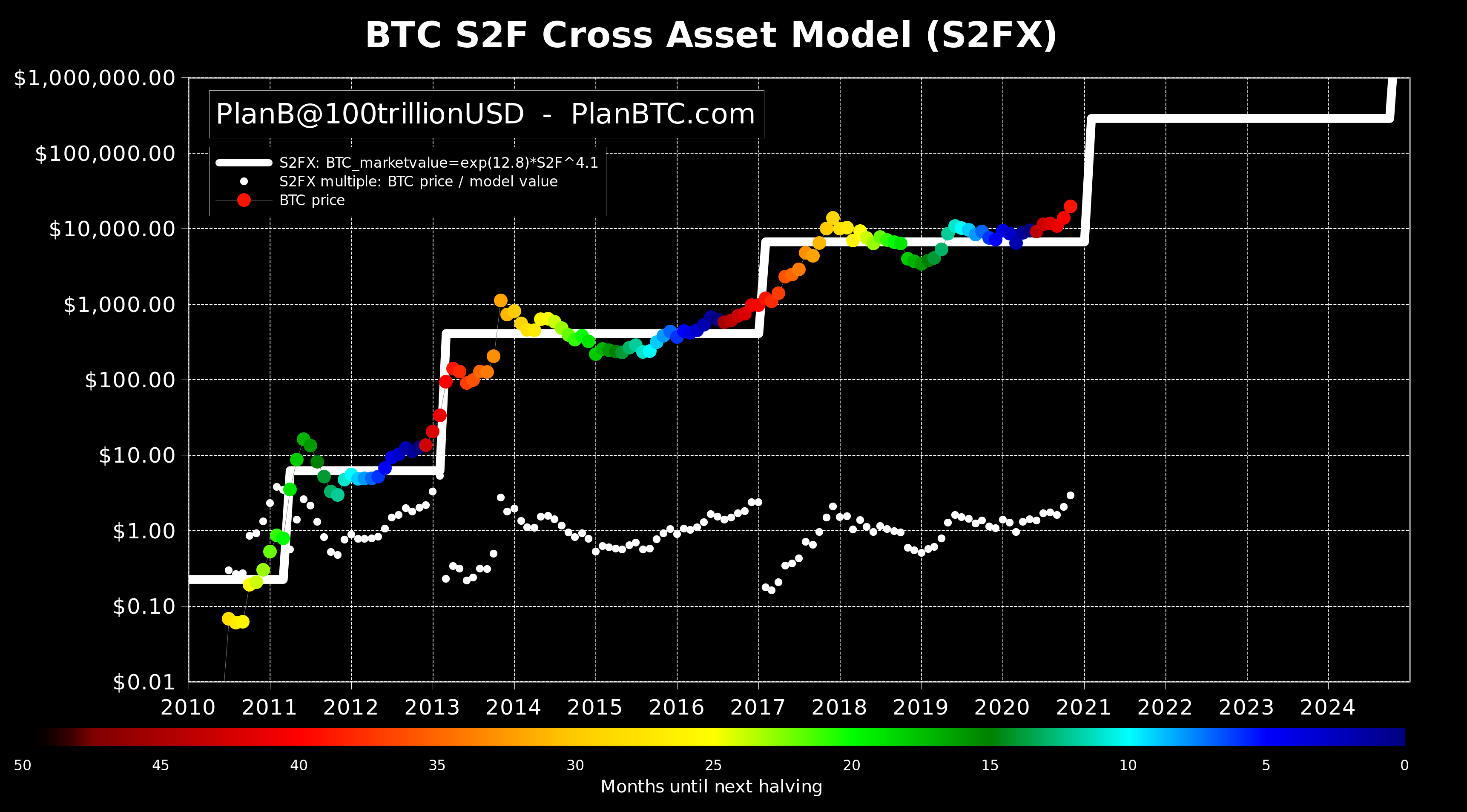

PlanB, the pseudonymous creator of the stock-to-flow-based family of Bitcoin price models, said on Dec. 1 that all was still going to plan after the most recent halving event in May.

“My fellow bitcoiners, the bull market is upon us,” he declared, producing the latest version of his Stock-to-Flow Cross-Asset (S2FX) chart showing BTC/USD posting its highest-ever monthly close.

Like Schulze-Kraft, PlanB believes that recent gains mark just the start of Bitcoin’s next phase, a theory which would see Bitcoin simply follow its historical behavior.

“Like clockwork November red dot closed above all other red dots .. at $19,700 .. a new #bitcoin ATH. This is just the beginning. We will see volatility (e.g. -35%), but also new ATH’s. Enjoy the ride!” he added.