Facebook’s Libra continues to face opposition from lawmakers and central banks around the world. French Finance Minister Bruno Le Maire said that Europe should consider a European public digital currency to counter the Libra. German Christian Democratic Union parliamentarian Thomas Heilmann said that the grand coalition in Germany has agreed that it will not allow “market-relevant private stablecoins.”

However, Bertrand Perez, the director general of the Libra Association, stated that the company will satisfy all regulatory requirements and that Libra might launch in the second half of 2020. He said that Libra does not aim to create new money supply, hence, it will not destabilize the fiat currencies that are a part of its basket.

United States Treasury Undersecretary Sigal Mandelker has said that terrorist organizations and their supporters are looking at new ways of raising and transferring funds to evade tracking by law enforcement agencies. She stressed the need to establish a system that will prevent illicit finance in crypto for the United States to work with governments to ensure that “non-compliant networks and fintechs do not survive.”

With sustained pressure from regulators, let’s take a look at this week’s top performers and see what their charts project.

ATOM/USD

Cosmos (ATOM) has been a huge outperformer in the past seven days as it has risen over 34%. The rally has helped it climb back into the top-20 cryptocurrencies by market capitalization. Can it continue its stellar run or will it give up some of its recent gains? Let’s analyze the chart.

Due to a short trading history, we are analyzing the daily chart on the ATOM/USD pair. It hit a lifetime low of $1.9101 on Sept. 5, from where the recovery has been strong. This shows that bulls have used the dip to buy aggressively. After more than an 80% rally within 10 days, the price has now reached the previous support-turned-resistance of $3.6043.

The recovery might face some resistance at this level but once it is crossed, a move to $4.4389 and above it to $5.7961 is possible. The moving averages are on the verge of a bullish crossover, which indicates a likely change in trend.

Any dip from current levels is likely to find support at the upsloping 20-day EMA. Our bullish view will be invalidated if bears sink the price below $2.40. If that happens, a retest of the lows is possible. The traders can wait for a pullback to the 20-day EMA before initiating long positions.

EOS/USD

A hacker exploited a bug in the EOS gambling game EOSPlay to steal over $110,000 in cryptocurrency. The hack did not freeze the network, but it caused an overload due to which “there was just no extra bandwidth available for free use,” according to Daniel Larimer, the CTO at Block.One. However, this event did not affect the price as the cryptocurrency was the second-best performer of the past seven days. The upcoming hard fork on Sept. 23, the largest upgrade to the network since it was launched, has kept sentiment bullish, but what do the technicals projec

The bulls are attempting to push the EOS/USD pair above the descending channel. A breakout and close (UTC time) above the channel will indicate a possible change in trend. However, above the channel, the pair is likely to face stiff resistance at both moving averages and above it at $4.8719.

Once the price ascends $4.8719, it will signal the start of a new uptrend that can result in a move back to $8.6503. The traders can initiate long positions as we recommended in the previous analysis.

If the bulls fail to scale $4.8719, the cryptocurrency might remain range-bound for a few more days. Our bullish assumption will be negated if the price turns down from any of the overhead resistance levels and plummets below $3.1534. Below this level, a drop to $2.20 and below it to $1.55 is possible.

ETH/USD

Spanish bank Banco Santander issued a $20 million bond, the first end-to-end blockchain bond, on the Ethereum blockchain. Santander Corporate and Investment Banking said that the whole transaction was faster, simpler and more efficient.

With positive technical news on the Ethereum network, let’s see what the charts project for Ether (ETH).

The ETH/USD pair is attempting to bounce after hitting $163.755 the week before. It has risen above the 50-week SMA and will now attempt to rise above the 20-week EMA. Both moving averages have flattened out and the RSI is gradually climbing back toward the midpoint, which shows a balance between buyers and sellers.

A breakout of the 20-week EMA will be a positive sign that will shift the advantage in favor of the bulls. Above $235.70 the recovery can reach the critical overhead resistance of $320.84.

However, if the price turns down from the 20-week EMA or $235.70 and plunges below $163.755, it will signal weakness.

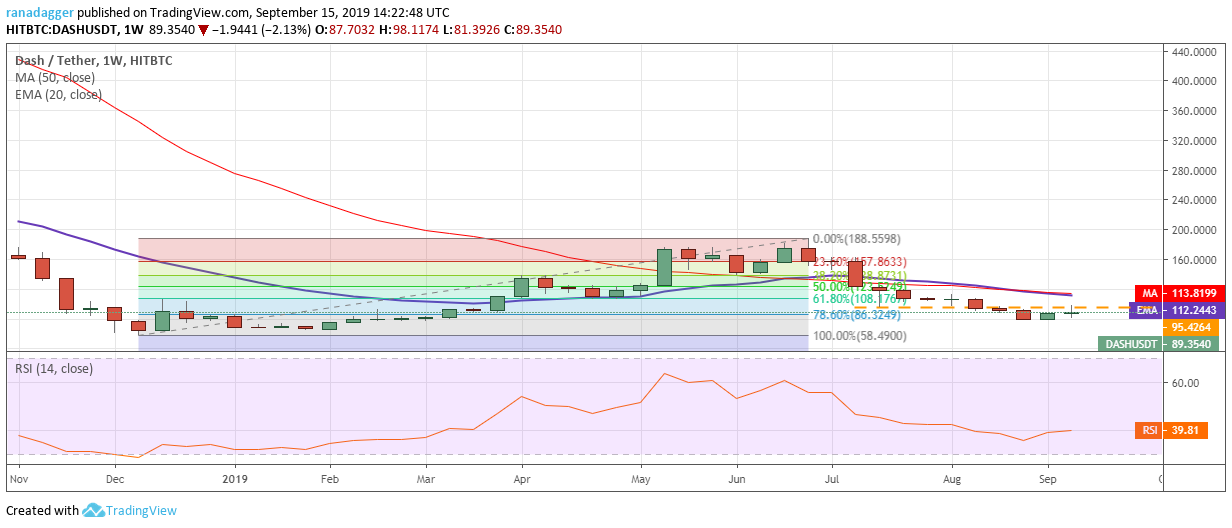

DASH/USD

Coinbase Pro announced that it will add support for the Dash (DASH) token next week. The professional trading platform will accept DASH deposits for 12 hours before full trading begins. Dash also received support from Brazilian cryptocurrency exchange NovaDAX and cryptocurrency payments merchant solution PumaPay. These positive developments have kept the cryptocurrency among the top five performers for the second straight week. Can it continue its run? Let’s analyze the chart.

The pullback in the DASH/USD pair is facing selling at the previous support-turned-resistance of $95.4264. Above this level, the bulls will again hit a roadblock at the downsloping moving averages. If the price breaks out of the moving averages, it is likely to turn positive and rally to $162 and above it to $188.5598.

However, if the pair turns down either from $95.4264 or from the moving averages and plummets below the recent lows of $77.9187, it might complete a 100% retracement of the entire rally and decline to $58.49.

The gradually down-sloping moving averages and RSI in the negative territory suggests a bearish sentiment. Therefore, we will wait for the price to break out of the moving averages before suggesting a trade in it.

TRX/USD

According to Cointelegraph Analytics, Tron (TRX) is likely to release an update for the Sun Network. The Sun Network protocol aims to improve the security and efficiency of decentralized applications (DApps). The number of DApps on the Tron network continues to rise according to DAppTotal. Can the price follow higher? Let’s study its chart.

The TRX/USD pair is still struggling near the yearly lows. It is likely to face stiff resistance in the $0.016–$0.01774 zone, which had previously acted as a strong support. The 20-week EMA has turned down and the RSI is in the negative zone, which shows that bears have the upper hand. If the price turns down from the resistance zone and dips below $0.0139038, it can retest the lows at $0.01124. A drop to new yearly lows will be a huge negative.

Conversely, if the bulls can propel the price back above the overhead resistance zone, it will indicate demand at lower levels. The pair will face resistance at the moving averages, above which it is likely to pick up momentum and move up to $0.0409111 in the medium term. We will wait for the buyers to assert their supremacy before suggesting a trade in it.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.