Binance Research, the research arm of the world’s largest crypto exchange, claims that President Donald Trump caused the latest bitcoin price spike.

Binance Research made the specious claim on Twitter, where it noted: “BTC has rallied, together with multiple safe-haven assets, after Trump’s latest tariff storm. Will the trade war continue to be a catalyst for Bitcoin price growth?”

Reminder: Correlation is not causation

Specifically, Binance Research suggested that the bitcoin price rallied this week due to Trump’s escalating tariff war with China.

The implication is that mounting geopolitical uncertainty is causing investors to seek refuge in “safe haven assets” such as gold and U.S. Treasury bills. Safe haven assets are believed to offer protection against stock market downturns.

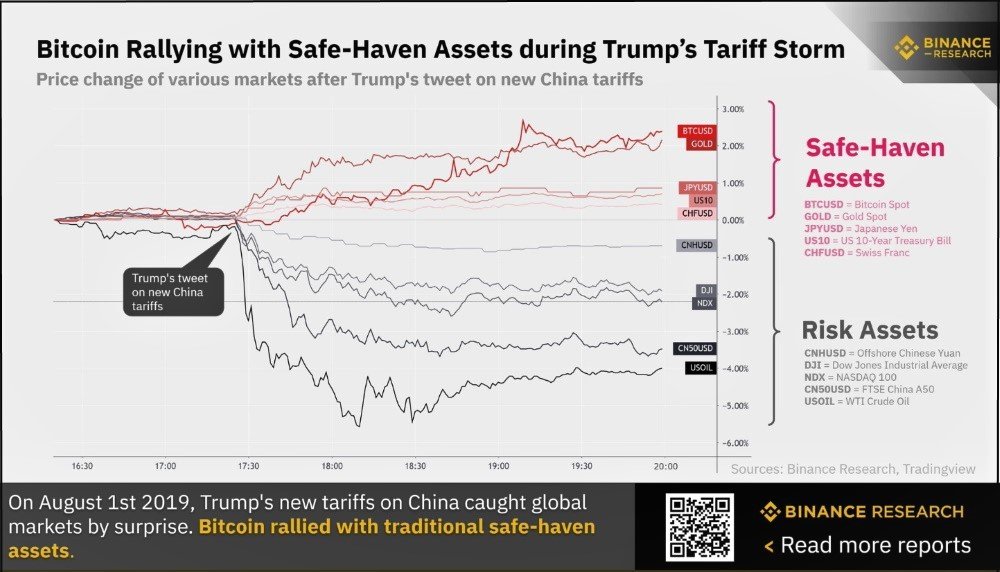

To buttress its claims, Binance tweeted a chart that apparently showed a correlation in the price movements of bitcoin, gold, the 10-year U.S. Treasury bill, and “safe haven” currencies such as the Swiss franc.

Most people know that correlation is not causation. However, Binance tried to tie Trump’s trade rhetoric to rising bitcoin prices. It offered no other evidence to support this flimsy contention.

Binance’s CZ: Trump raised global awareness of crypto

Binance Research’s claim aligns somewhat with the statements of its CEO, Changpeng Zhao. Last week, Zhao told CNBC that Trump’s criticism of cryptocurrencies is extremely bullish for the industry.

CZ says Trump’s tweets dramatically raised bitcoin’s global profile by forcing the public and the mainstream media to discuss crypto.

“Trump so far has not done anything positive or negative. He just said that he’s not a fan. The fact that he tweeted about it, and the President of the United States is talking about cryptocurrency, is a good thing.”

Zhao is correct that Trump has not taken any actions to hamper the growth of the crypto industry in the United States. He merely said that he’s “not a fan of bitcoin or other cryptocurrencies,” citing their extreme volatility.

Trump also expressed concern that bitcoin could undermine the U.S. dollar and might be used to facilitate money-laundering and other crimes. His objections are not new, as they are often cited by crypto critics in explaining their skepticism.

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity….

— Donald J. Trump (@realDonaldTrump) July 12, 2019

…and International. We have only one real currency in the USA, and it is stronger than ever, both dependable and reliable. It is by far the most dominant currency anywhere in the World, and it will always stay that way. It is called the United States Dollar!

— Donald J. Trump (@realDonaldTrump) July 12, 2019

Crypto analyst predicts extended bitcoin rally

As usual, there does not appear to be any concrete news or triggering event that caused the latest bitcoin price bump. However, some crypto evangelists insist that a sustained bull market is just around the corner.

As CCN reported, crypto analyst Willy Woo claimed that last week’s dip in bitcoin prices was a transitional phase before things start heating up again.

Woo, a partner at cryptocurrency hedge fund Adaptive Capital, says the latest tumble was laying the foundation for an extended rally that will last through the end of 2020.

Amid Bitcoin Price Drop, Crypto Analyst Foresees Sustained Rally https://t.co/xXvZ9uFkE0

— CCN Markets (@CCNMarkets) July 28, 2019

Craig Wright warns: I may topple the market

So will bitcoin rally — or tumble — in 2020 and beyond? Only time will tell, since there are many variables that could easily change its trajectory.

As an example, self-proclaimed bitcoin inventor Craig Wright telegraphed that he might tank the market once he gains access to the 1.1 million bitcoin he allegedly mined with Dave Kleiman.

In a chilling August 2 blog post, Wright says he can’t wait to “systematically destroy” the crypto shills who “corrupted my creation” and used bitcoin to promote fraud and Ponzi schemes. He then warned that when he comes into possession of his 1.1 million bitcoin on January 1, 2020 (market value: $10 billion), he might wreak havoc on the market.

“Bitcoin can be seized,” Wright warned. “In the coming year, you’re going to learn just how fragile the house of cards that is a criminal system built upon Bitcoin or any other cryptocurrency really is.”

So, how exactly could Wright decimate bitcoin’s “fragile house of cards?” For one, by flooding the market with 1.1 million bitcoin all at once. If such an apocalyptic event occurred, it could tank bitcoin prices. But will that happen? Who knows? So stay tuned.