Trading in ether futures went live on the Chicago Mercantile Exchange (CME) late last Sunday with the February contract registering an opening price of $1,669.75.

In less than two weeks, the open price of the February contract has jumped 5% to $1747.75 as ether spot prices have continued to climb upwards of $1,700.

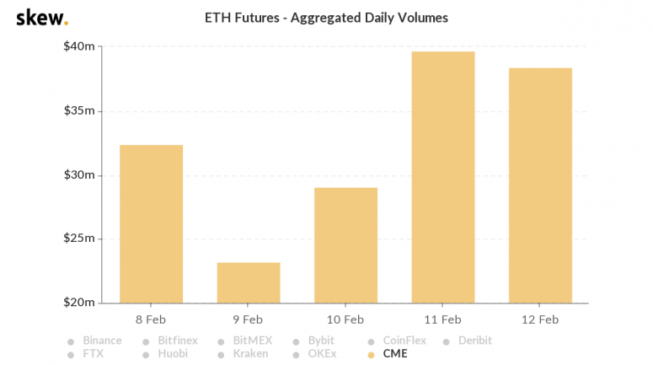

In terms of weekly trading volume, CME ether futures contracts surpassed $160 million in its first full week of trading.

According to Tim McCourt, Global Head of Equity Index and Alternative Investment Product at CME Group, the initial activity of the CME’s market for ether futures is promising but there’s still a long way to go before the product is fully established and mature enough to support other derivatives products such as options.

“We’ve done a really good job the first few days but obviously we want to see more in terms of on-screen liquidity. Right now, about five out of the eight maturities have an active market. So we want to continue to round out that term structure. … We have some work to do in terms of continuing to onboard clearing members and customers. So ether futures will certainly keep us busy for a while,” said McCourt in an interview with CryptoX.

Ether futures aren’t new

The CME Group isn’t the first to launch an ether futures product. In 2018, digital asset trading service Crypto Facilities based in the U.K. announced the launch of its ether futures product. Last year, U.S.-based crypto derivatives platform ErisX announced the same.

What is significant about the launch of CME ether futures is that it is the first financially settled ether futures product that is also regulated in the U.S., meaning expiry of any futures contracts don’t warrant the transfer of 50 ETH to a U.S. buyer but rather an equivalent amount in dollars. Being financially settled, according to McCourt, is a feature that was in high demand from the CME’s customers.

“Certainly when you’re looking at financially settled futures contracts, you have the ability to avoid some of the barrier to entry around wallets [and] custody of the assets,” said McCourt in an interview with CryptoX. “Some of the institutional clients would need different types of insurance of the [crypto] assets if they do sort out their custody solution so financially settled just makes it easier for a lot of people.”

A financially settled ether futures product relies heavily on a robust and reliable reference rate for price while also removing and abstracting away the need for interactions with Ethereum, the underlying technology behind ether.

The only impact the Ethereum blockchain could have on CME ether futures products is if its issuance schedule and technical upgrades like Eth 2.0 were to somehow impact its listing on the five major exchanges that the CME pulls data from in order to calculate its ether-dollar reference rate. (More information on the CME CF ETH-USD Reference Rate here.)

But just as Ethereum 2.0 is crucial for the technical development of Ethereum, a U.S.-regulated and financially settled ether futures market is a crucial component for the market development of ether.

Why CME ether futures matter

The launch of ether futures on the CME, the world’s largest derivatives exchange platform, is the key to bringing new institutional players to market, according to James Putra, VP of Product Strategy at TradeStation Crypto. TradeStation Crypto’s sister company, TradeStation Securities, recently began offering its clients the ability to trade CME ether futures contracts on its platform.

“There’s a lot of firms that want crypto exposure but just can’t get access to [the spot market]. So they need to interact with futures,” said Putra in an interview with CryptoX.

Futures contracts enable the ability for traders and investors of an underlying asset to hedge against future price movements. They are also an important tool in the hands of market participants for price discovery.

“Futures give you a long-short optionality so you don’t only have to bet one side,” said Putra. “[In the spot market,] you’re pretty much limited to long only. You can just buy and hold.”

Finally, futures are a critical step in the maturation of markets that pave the way for other sophisticated products and tools for investors to leverage. Tim McCourt, Global Head of Equity Index and Alternative Investment Product at CME Group, said:

“It is critical that the futures market take root [first] and develop that robustness such that it can support [ether] options overlaid on top of the futures.”

McCourt added that the upwelling of interest and demand for an ether futures product, in his view, mirrors increasing interest in what’s being built on Ethereum, pointing to innovations and ongoing projects such as Ethereum 2.0, decentralized finance (DeFi) and stablecoins.

“Interest in [CME ether] products also follows in a congruent manner to the interest in the network that has been growing in the past year,” said McCourt.

The promise of Ethereum 2.0

On Ethereum 2.0 specifically, McCourt affirmed the benefits to scalability and energy efficiency that this new proof-of-stake network could achieve. However, like the ether futures market, he also mentioned that it would take time to see if the promise of Eth 2.0 truly comes to fruition.

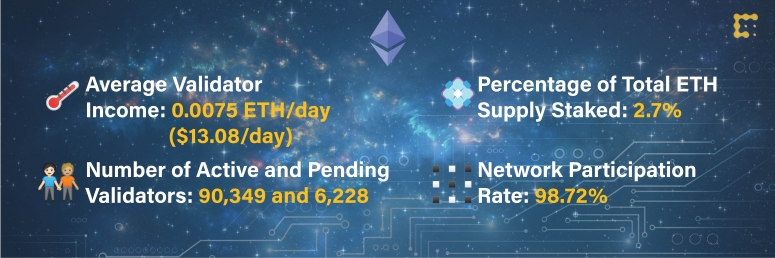

Now 11 weeks into its launch, Ethereum 2.0 is secured by over 90,000 active validators each staking 32 ETH, worth roughly $55,600 at time of writing. This represents about 2.7% of the total ETH supply locked in Ethereum’s proof-of-stake network.

On average, Eth 2.0 validators are earning 0.007554 ETH/day or $13.08/day. In total, validator rewards only make up roughly 2.6% of the rewards that Ethereum miners earn daily.

Validated takes

- The evolution of Ethereum 2.0’s roadmap (HackMD post, Ben Edgington)

- CME ether futures explained (Article, CryptoX)

- Coinbase opens waitlist for Ethereum 2.0 staking (Article, CryptoX)

- Crypto market cap breaks $1.5 trillion as buyers show up for the dip (Article, CryptoX)

- Ethereum 2.0 deposit contract tops $5.5 billion in staked ether (Article, CryptoX)

- Tim Beiko on how Ethereum governance works and the upcoming EIP 1559 (Podcast, cryptotesters)

- Quick update on Eth 2.0 (Blog post, Ethereum Foundation)

- Mark Cuban on why ETH has an advantage over BTC as a store of value (Podcast, The Defiant)

Factoid of the week

Open comms

Feel free to reply any time and email research@coindesk.com with your thoughts, comments or queries about today’s newsletter. Between reads, chat with us on Twitter.

Valid Points incorporates information and data directly from CryptoX’s own Eth 2.0 validator node in weekly analysis. All profits made from this staking venture will be donated to a charity of our choosing once transfers are enabled on the network. For a full overview of the project, check out our announcement post.

You can verify the activity of the CryptoX Eth 2.0 validator in real time through our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it on any Eth 2.0 block explorer site!

Finally, if you like what you read today and want more original insights about Eth 2.0 development, be sure to check out Will Foxley and I’s weekly podcast, “Mapping Out Eth 2.0.” New episodes air every Thursday.