After the block reward halving, many analysts in the Bitcoin space expected a “death spiral.”

The term is one created by a professor who, in 2018 speculated that BTC could fall to $0 due to a collapse in miners. A “death spiral,” per the journalist, takes place when Bitcoin miners leave the network, resulting in slow/no transactions, making BTC intrinsically worthless.

“As I argued, once Bitcoin’s price falls below its cost of mining, the incentive to mine will deteriorate, thrusting bitcoin into a death spiral. That is, without the mining activities supporting the ledger that maintains the records of who owns what, BTC becomes worthless,” an excerpt from the original death spiral article reads.

This “death spiral” never happened, with new data showing that Bitcoin miners are more bullish than ever before.

Related Reading: Economist Steve Hanke: Bitcoin Is Not a Currency, It’s a “Speculative Asset”

Bitcoin Hash Rate Establishes New All-Time High

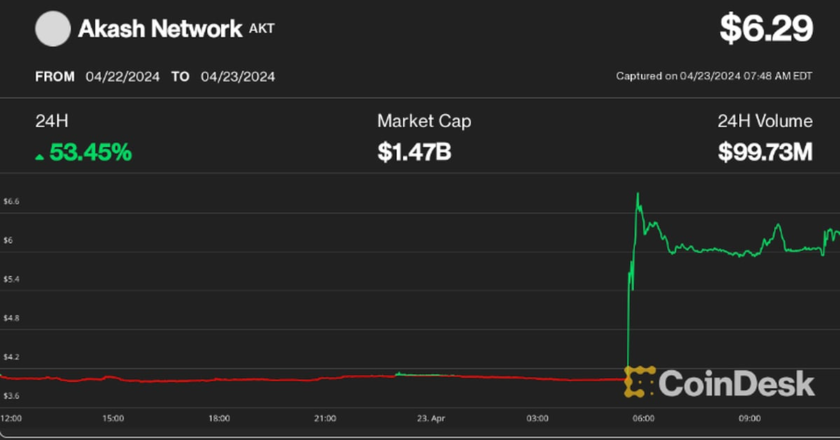

According to crypto data firm TradeBlock, Bitcoin’s network hash rate just hit a new all-time high. The company shared the image below on July 7th, showing that the seven-day moving average of the hash rate is now above 124 exahashes per second. This is over double that seen a year ago.

Chart of Bitcoin's hash rate over time from TradeBlock (@Tradeblock on Twitter)

The hash rate is the measure of the computational power being used to secure transactions on a blockchain network. As Bitcoin.org describes the term:

“The hash rate is the measuring unit of the processing power of the Bitcoin network… When the network reached a hash rate of 10 Th/s, it meant it could make 10 trillion calculations per second.”

Investors in the space have responded to this metric with immense optimism. One trader bashed the death spiral narrative, asking where the death spiral is.

Their optimism isn’t unfounded: analysis suggests that increased Bitcoin mining activity should correspond with higher prices for BTC.

This theory was cemented with a price model from digital asset manager and investor Charles Edwards. In 2019, he came out with a model showing that Bitcoin’s price has always centered around its energy consumption in joules.

Edwards recently found that with the ongoing hash rate surge, Bitcoin is now trading around 27% under its energy value. Should the hash rate stay this high, BTC is likely to be attracted towards its energy value.

Bitcoin Energy Value analysis by Charles Edwards (@caprioleio on Tiwtter), a digital asset analyst. Chart from TradingView.com

Related Reading: “No Position Is the Best Position,” Says Bitcoin Trader as Price Stagnates

Catalysts Behind the Hash Rate Surge

Behind Bitcoin’s ongoing hash rate surge is seemingly two catalysts:

- Rainy season in China: A large majority of the Bitcoin network is powered by Chinese hydroelectricity farms in the river regions of China. With it currently being rainy/flood season in China, hydroelectricity rates are much cheaper now than in other parts of the year. This incentivizes miners to turn on more machines.

- Mining firms roll out new ASICs: Mining firms continue to roll out new ASIC devices, making it more profitable to mine Bitcoin.

Considering that mining firms continue to roll out fresh hardware and the rainy season is still ongoing, Bitcoin’s hash rate could trend even higher.

Photo by Nick Chong on Unsplash Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com What Death Spiral? Bitcoin Hash Rate Surges to Fresh All-Time High