Yearn.finance’s governance token – YFI – has erased a significant portion of its recent gains throughout the past few weeks, with relentless selling pressure coming about due to various factors.

Heightened “founder’s risk,” a fragmented community, and low yields for the ecosystem’s yVaults have been degrading the value of the YFI token.

News of a major crypto fund investing $5 million into the YFI token did provide its price with a serious boost yesterday. However, it is important to note that this is only a small percentage of the fund’s total AUM.

It has been able to hold onto the majority of its recent gains, and its price is showing continued signs of strength as it consolidates around $15,000.

Its short-term uptrend may be bolstered by the significant push higher seen by both Bitcoin and Ethereum today.

One analyst is now noting that there are two things he is closely watching for before flipping macro long on the Yearn.finance token.

He claims that until YFI can retrace and bounce at a key trendline, it could still be on track to reel to below $10,000.

Yearn.finance’s YFI Stabilizes as Crypto Market Trends Higher

At the time of writing, Yearn.finance’s YFI is trading down less than 2% at its current price of $15,000. This is around where it has been trading throughout the past day.

Late last week, its price plunged to $13,000 before news broke regarding Polychain’s $5m allocation to YFI – making them one of the token’s largest holders.

This boosted investor confidence in the project and sent its price surging towards $16,000.

It has since retraced from its daily highs but is looking stable as the aggregated crypto market trends higher.

Here are the 2 Things YFI Must Do Before Breaking Its Downtrend

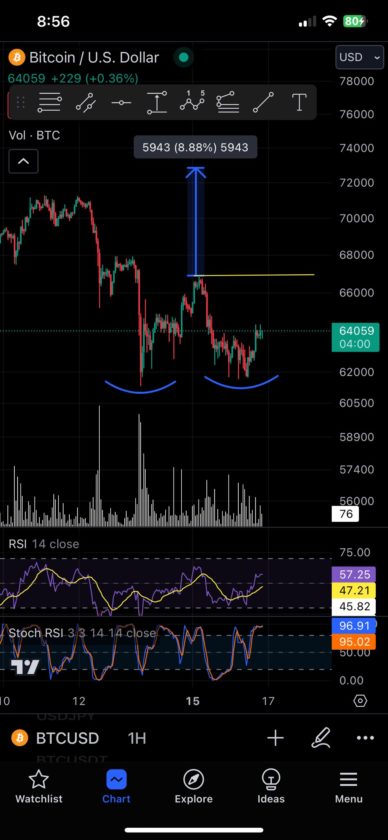

One analyst shared that he is closely watching for Yearn.finance to do 2 things before flips long.

He specifically notes that YFI must retrace and then post a rebound at a key trendline that exists just below where it is currently trading.

“About to become a DeFi maximalist, but not just yet… Waiting for: 1. Retrace 2. Buying contact with resistance (hopefully new support). Invalidation back below dotted line. Patience is key, no need to rush this,” he said.

Image Courtesy of Teddy. Source: YFIUSD on TradingView.

As seen in the above chart, if YFI loses its momentum and breaks below its descending trendline, a move towards $6,000 could be imminent.

Featured image from Unsplash. Charts from TradingView.