Credit rating agency Moody’s has recently downgraded its outlook on the entire United States banking system from “stable” to “negative.” The move comes in light of the recent failures of Silicon Valley Bank, Silvergate Bank and Signature Bank, which has prompted regulators to intervene with a rescue plan for impacted depositors and institutions. Despite the downgrade, bank stocks rallied strongly, with the SPDR Bank exchange-traded fund rising nearly 6.5% in morning trade, NBC News reported. Moody’s reportedly noted that an extended period of low rates combined with pandemic-related fiscal and monetary…

Day: March 14, 2023

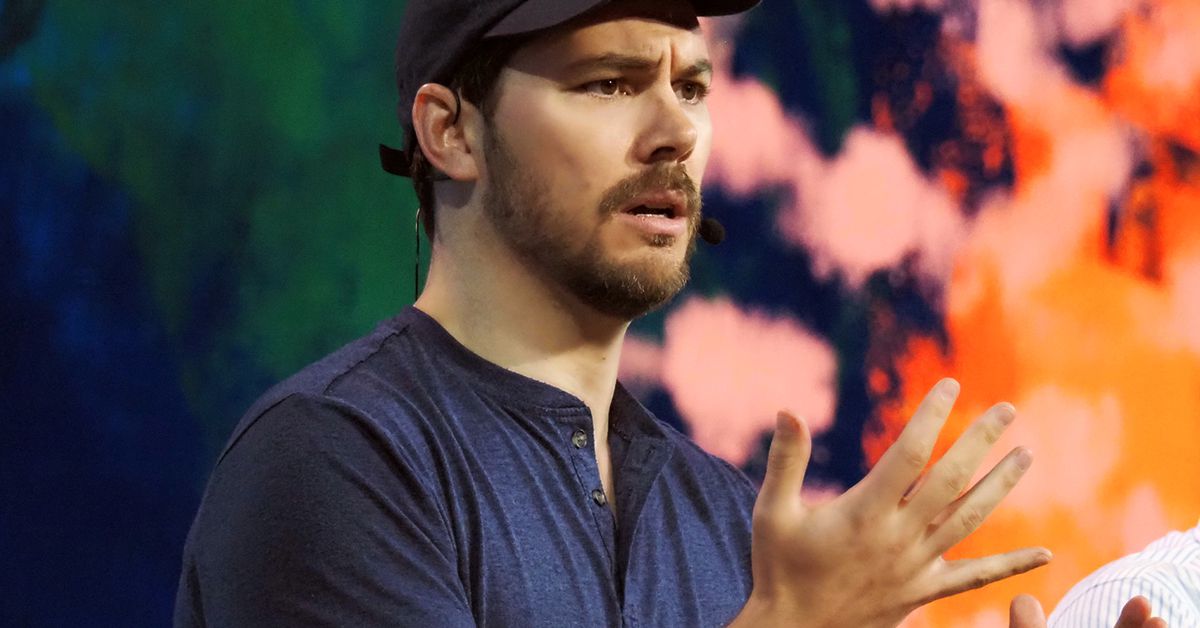

Crypto Platform Anchorage Digital Laying Off 20% of Its Staff: Bloomberg

“The need for better crypto infrastructure is growing ever clearer,” Anchorage said in a statement to Bloomberg. “For us, that means focusing resolutely on our status as an unequivocal qualified custodian, among other safe and regulated ways for institutions to participate in the digital asset ecosystem.” Source

MetaMask addresses privacy concerns with new features for enhanced control

Web3 wallet app MetaMask has introduced a number of new features aimed at enhancing privacy and giving users more control, according to a March 14 blog post by the developer. The new features come after MetaMask had previously been criticized for allegedly intruding on users’ privacy. MetaMask Mobile v6 is now available to everyone! Our biggest release yet fixes issues around slow load times and provides a new and improved UX that gives users more control over their funds and digital identities. Upgrade to the latest version todayhttps://t.co/tGtA4GUXR1 — MetaMask…

Moody’s Downgrades US Banking Sector to Negative After Collapse of Three Major Banks – Bitcoin News

After the failure of three major U.S. banks last week, with two of them being the second and third largest banking failures in the country, Moody’s Investors Service has downgraded the rating of the U.S. banking system from “stable” to “negative.” As one of the “Big Three” credit rating firms, Moody’s cited a “rapid deterioration in the operating environment” following the collapse of these banks. Moody’s Downgrades U.S. Banks, Financial Institutions Face Rising Deposit Costs and Reduced Earnings Moody’s Investors Service, the American credit rating agency, has downgraded the U.S.…

Signature Bank regulator says it was closed for not providing data: Report

The New York Department of Financial Services (NYDFS) shut down Signature Bank for “failing to provide consistent and reliable data” and not because of a bias against crypto, according to a March 14 report from the International Business Times. Signature Bank Board Member Barney Frank had previously accused the regulatory agency of shutting it down merely to “send a very strong anti-crypto message.” According to the report, an NYDFS spokesperson said that the shutdown had “nothing to do with crypto.” Instead, there was “a significant crisis of confidence in the…

Bitcoin vs Ethereum? BEST Investment? Whales BUYING! 🐳

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin vs Ethereum? I give my opinion. Which coin will have the best ROI? What are the whales buying? We will be at Bitcoin … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Europarliament approves Data Act that requires kill switches on smart contracts

The European Parliament passed the Data Act on March 14. The comprehensive bill was intended to “boost innovation by removing barriers obstructing access to industrial data.” Among its provisions is an article that would require smart contracts to be alterable. The legislation established rules for fairly sharing data generated by “connected products or related services,” such as the Internet of Things and “industrial machines.” Eighty percent of industrial data generated is never used, the Europarliament noted in a statement, and this act would encourage greater use of those resources to…

U.S. Treasury Poised to Release View on How DeFi Used in Illicit Finance

The U.S. Treasury Department is close to releasing a risk assessment analyzing criminal use of decentralized finance (DeFi), according to Assistant Secretary for Terrorist Financing and Financial Crimes Elizabeth Rosenberg. Source

Signature Bank and former executives sued by shareholders for alleged fraud

On March 14, a class action lawsuit was filed against the recently shut down crypto-friendly, New York-based Signature Bank, and its former chief executive office, Joseph DePaolo, chief financial officer, Stephen Wyremski, and chief operating officer, Eric Howell, for allegedly committing fraud Reuters reported. Shareholders have accused the bank of falsely claiming to be “financially strong” just three days before it was seized by the state regulator. The lawsuit seeks unspecified damages for shareholders who held stock between March 2 and 12, 2023. The lawsuit was filed in federal court in…

Bitcoin exchange net inflow highest in 10 months

On-chain data shows that bitcoin (BTC) has been flowing to centralized cryptocurrency exchanges at an impressive rate amid the recent market chaos. Data provided by Glassnode shows that the net transfer value of BTC to exchanges just reached $547.6 million. This is the highest positive BTC inflow to centralized crypto exchanges since May 10, 2022 — when $936 million more flowed into crypto exchanges than out of them. Bitcoin net transfer volume to and from crypto exchanges daily chart. | Courtesy of Glassnode This notable increase in bitcoin inflows to…