▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin. Ton coin va boshqa bir necha kripta valyutalar telegram botda mining qilish imkoniyati ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Tag: Mining

Indonesia Scraps Crypto VAT, Doubles Mining Fees in Policy Shift

Key Notes Indonesia’s crypto transaction volume tripled in 2024, with over 20 million users on exchanges. Crypto buyers will no longer have to pay VAT. However, cryptocurrency miners will see a 100% rise in VAT. The finance ministry of Indonesia will reportedly bring a significant policy shift on cryptocurrency taxes in August. The regulator will increase the domestic trades tax from 0.1% to 0.21%, while foreign exchange trades face a 1% tax, up from 0.2%, according to a Reuters report on July 30. Moreover, the new policy removes friction for…

Best 2 Crypto Mining Websites 2025!

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Best Crypto Mining! In this video, we review the best crypto mining sites and tools dominating the crypto mining space in the year 2025. If you’re beginning or growing your business, the review contains everything from the best crypto mining sites to the newest crypto mining applications that offer real worth. You can find the best new crypto mining projects, the best-rated crypto mining platforms, and true free crypto mining programs to aid you in passive income mining crypto. We include platforms…

Iranian Government Slams Crypto Mining for 15-20% of Power Deficit Crisis

Key Notes Cryptocurrency mining operations in Iran now consume approximately 2,000 megawatts of electrical power daily. Illegal mining activities dropped consumption by 2,400 MW during recent internet outages, revealing massive scale. Authorities seized over 240,000 mining devices and offer rewards up to $2,300 for reporting illegal operations. Currently, Iran is experiencing frequent power cuts due to its summer season and has a significant electricity deficit. Mohammad Allahdad, deputy director of Iran’s national power company Tavanir, said on July 29 that cryptocurrency mining is responsible for 15–20% of the country’s current…

Bitmain to launch first U.S. Bitcoin mining chip factory by 2026: Bloomberg

Bitmain plans to open its first U.S.-based manufacturing facility by early 2026 and set up a new headquarters in either Texas or Florida later this year. Bitmain, the world’s leading manufacturer of Bitcoin (BTC) mining ASIC chips, plans to launch… Original

Bitcoin Mining Giant Mara Completes $950M Deal to Buy More BTC

The world’s largest publicly-traded bitcoin miner is also the world’s second-largest bitcoin holder among publicly listed companies. Mara Secures $950M Funding to Expand Bitcoin Holdings Bitcoin mining firm Mara Holdings (Nasdaq: MARA) has raised $950 million by issuing interest-free senior convertible notes to private qualified investors, according to a Monday press release. The funds will […] Original

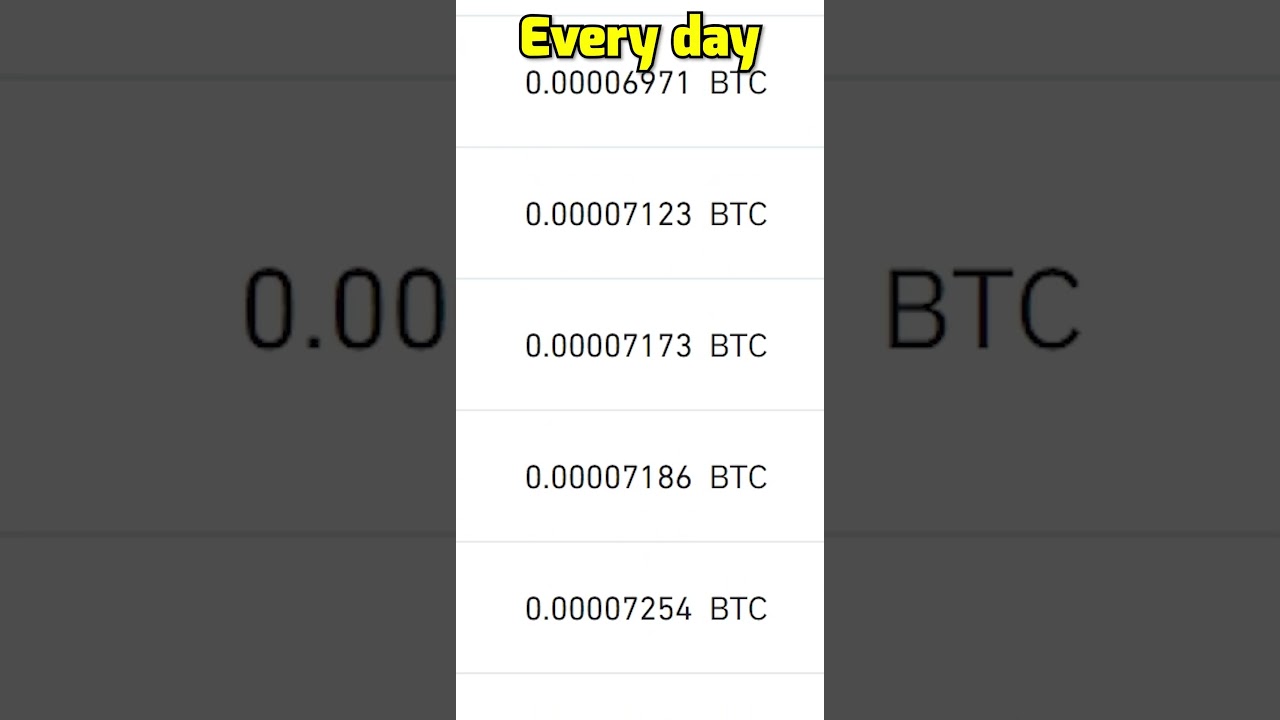

Binance Cloud Mining Results 90 Days #crypto #bitcoin

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Hey! In this #shorts video I show you what is Binance Cloud Mining in 2023. I use 90 days cloud mining plan and here is a results. Thank you for watching. Our Discord – #crypto #viral #binance #btc #mining #investing #usdt ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Bitcoin BULL vs. BEAR: Will It Crash or Hit $150K?

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin is back in the spotlight after smashing through a new all-time high. But is this the beginning of a massive breakout or the top of the cycle? To find out, we sat down with two Bitcoin OG’s: Scott Melker, the bull, and Mike McGlone, the bear. From ETFs and macro signals to policy and price action, they break down the forces behind this rally and what’s coming next. Spoiler: they completely disagree. Follow COINTELEGRAPH: Website: Telegram: Facebook: Twitter: Mobile app: Cointelegraph…

Quid Miner launches mobile crypto mining app for Bitcoin, DOGE, and altcoin investors

Quid Miner launches mobile cloud mining app, making passive crypto income as simple as everyday banking. #pressrelease Original

Cango finalizes pivot to a Bitcoin mining company

Cango Inc., a publicly traded company listed on the New York Stock Exchange, has completed its transformation into a Bitcoin miner. Cango, a Chinese firm listed in the United States that announced plans to pivot into a Bitcoin (BTC) mining… Original