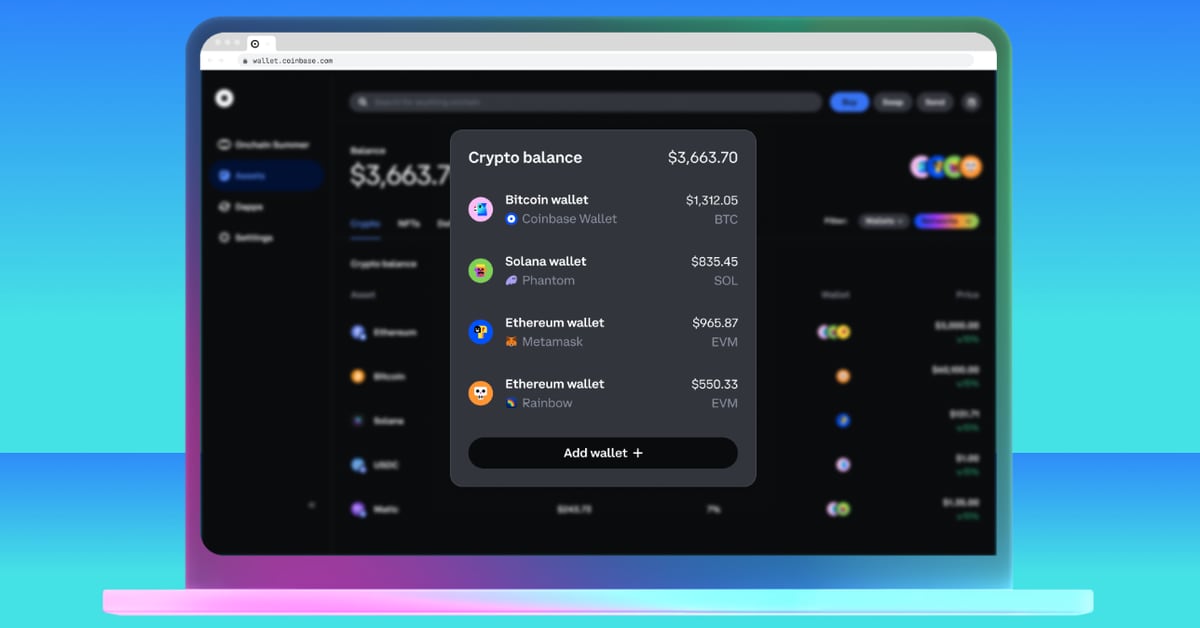

Blockchain analytics firm Arkham Intelligence has launched a new feature that enables users to connect their Coinbase Wallets directly to its platform. The integration enables users to track their crypto holdings and transactions seamlessly on Arkham. Arkham’s platform specializes in de-anonymizing blockchain transactions and linking them to real-world entities and individuals. It is known for identifying individuals who have moved large amounts of crypto on the blockchain. Announcing Arkham X Coinbase Wallet! You can now connect your Coinbase Wallet to Arkham to track your holdings & transactions directly on the…

Tag: Coinbase

Coinbase (COIN) Unit CBPL Fined $4.5M by UK’s FCA for Money Laundering Lapses, Serving High-Risk Customers

“Despite the restrictions in place, CBPL onboarded and/or provided e-money services to 13,416 high-risk customers,” the FCA said in a release on Thursday. “Approximately 31 per cent of these customers deposited around USD $24.9 million. These funds were used to make withdrawals and then execute multiple cryptoasset transactions via other Coinbase Group entities, totalling approximately USD $226 million.” Source

Coinbase Asset Management Plans Tokenized Money-Market Fund, a Hot Area After BlackRock’s BUIDL Success: Sources

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Single Entity Risk Questioned as Coinbase Dominates ETH and BTC ETF Reserve Storage

The day before the spot ether exchange-traded funds (ETFs) were introduced, Coinbase posted on X to clarify its position regarding spot BTC and ETH ETFs. The company mentioned that it holds assets for ten out of 11 spot bitcoin ETFs and eight out of nine ether ETFs. Gabor Gurbacs, founder of Pointsville and former strategy […] Source CryptoX Portal

Coinbase (COIN) Upgraded to Buy From Neutral on Improving Regulatory Risk: Citi

“Notwithstanding the increased turbulence in the upcoming U.S. elections, we believe the risk/reward setup for Coinbase, particularly as to its defense against the Securities and Exchange Commission’s (SEC) lawsuit, has improved markedly in the past few weeks,” analysts led by Peter Christiansen wrote. Source

Coinbase Analysts Warn: Bitcoin’s Upward Trend Could Hit a Wall — Here’s Why

As Bitcoin is experiencing an uptrend in price increasing by 12.6% in the past week to trade above $66,000, analysts at Coinbase in a Friday report have disclosed potential limitations to its upward trajectory due to “increasing sell orders” on the exchange. According to the report, the recent appreciation in Bitcoin’s value has tempted many traders to capitalize by selling, which could curb further gains. A Wall Ahead, What Happens To Bitcoin Then? This report, which analyzes the market’s overall picture, was compiled by Coinbase researchers David Duong and David…

BlockFi to Start Interim Crypto Distributions This Month Through Coinbase

“The distributions will be processed in batches in the coming months, and eligible clients will receive a notification to the BlockFi account email on file,” the announcement said. “Please note that non-US Clients are unable to receive funds at this time due to the regulatory requirements applicable to them.” Source

Genesis moves $760m BTC to Coinbase amid sell-off

A wallet linked to crypto lender Genesis has transferred 12,600 Bitcoin (BTC) worth approximately $760 million to crypto exchange Coinbase. On-chain data tracked by Arkham shows the addressed labeled “Genesis Trading” moved the funds to the exchange amid the broader market sell-off witnessed over the past month. The wallet’s holdings have shrunk from 46,000 BTC in mid-June, and currently has around 33,356 BTC. Genesis received approval to repay $3 billion to creditors This amount is not as much as the over 43,000 BTC dump that the German government has so…

Crypto markets likely to remain choppy in Q3, Coinbase analysts say

Crypto price action is likely to continue on a choppy trajectory for the rest of Q3, 2024, analysts at crypto exchange Coinbase say. Coinbase’ head of institutional research David Duong and David Han, an analyst at the US-based crypto exchange, shared their forecast in the company’s weekly market report. They anticipate greater volatility for cryptocurrencies over the next month or two before a potentiall rally in the fourth quarter. JPMorgan analysts offered a similar bullish analysis, although with a different timeline, noting crypto markets could rebound in August. Q3 started…