The developer of the decentralized finance (DeFi) exchange dYdX is reportedly negotiating the sale of its derivatives trading software for an undisclosed amount. Citing anonymous sources, Bloomberg reports that dYdX Trading is in talks to sell dYdX v3 software to potential buyers, which include the algorithmic crypto trading company Wintermute Trading and the venture capital firm Selini Capital. The exchange enables peer-to-peer trading of perpetual futures contracts on crypto assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and Dogecoin (DOGE). The older, semi-decentralized version of the trading platform uses…

Tag: Trading

Wazirx Details Plan to Resume Withdrawals and Trading — Insists Signers’ Machines Show ‘No Evidence of Compromise’

Indian crypto exchange Wazirx has provided an update on its progress to enable users to withdraw funds and resume trading on its platform following a cyberattack that caused a loss of over $230 million. “Our preliminary investigation reveals no evidence of compromise on our signers’ machines. We are continuing to explore all possible sources of […] Source CryptoX Portal

Swiss Bank Sygnum Posts First-Half Profit as Spot Crypto Trading Doubles, Derivatives Increase 500%

Sygnum, which is licensed in Luxembourg, Singapore, and its native Switzerland, plans to acquire new licenses in Europe under the Markets in Crypto Assets (MiCA) regulations, which started to take effect last month and introduced a single regulatory environment throughout the 27-nation trading bloc. It also plans to expand its regulated operations in Hong Kong. Source

Wazirx Prepares Poll for User Input on Resuming Withdrawals and Trading

Indian crypto exchange Wazirx is setting up a poll to let customers decide on reopening the platform for withdrawals, deposits, and trading. “Some options have emerged to help with the recovery which we’re exploring,” said Wazirx co-founder Nischal Shetty. “We’re actively contacting projects linked to the stolen tokens to seek their support in the recovery […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Decentralized Exchange D8X to Bring Tool for Trading Polymarket Contracts With Leverage

Sauter explained that with D8X, the maximum leverage available depends on the state of the market. This approach, he said, prevents destabilization by ensuring that leverage limits are in line with current market dynamics, thereby maintaining stability and preventing any single trader from disproportionately affecting liquidity. Source

ETH ETF Trading Volume Above $600M in First Half Day

“We assume $ETHE volume is mostly outflows,” Bloomberg Intelligence senior ETF analyst Eric Balchunas wrote in a post on X. Grayscale’s ETHE, in similar fashion to its Bitcoin Trust (GBTC), entered the race with over $9 billion in assets, thus giving rise to the idea that much of its volume is due to outflows. Source

Ethereum Market Stagnation Marks Tepid Trading Day Despite ETF Launch

Ethereum’s price exhibited volatility on Tuesday, coinciding with the launch of U.S. spot ether exchange-traded funds (ETFs) on Wall Street. At around 5 a.m. EDT, ETH surged to an intraday high of $3,540 per coin but later dropped to approximately $3,406 by 12:55 p.m. in the afternoon. Ether’s Bearish Sentiment Dominates Trading Day Amid ETF […] Source BitcoincryptoexchangeExchanges CryptoX Portal

Ethereum ETFs Witness Stellar Start As Trading Soars; Analyst Sees ETH’s Price Reaching $8,000 In Q4

Ethereum ETFs (exchange-traded funds) began trading on Tuesday, generating significant volume within the first 2 hours of trading. Interestingly, the Ethereum ETFs ranked among the top 1% regarding ETF volume. Related Reading Ethereum ETFs Surpass Traditional Launch Volumes According to Bloomberg ETF expert Eric Balchunas, the ETH ETFs traded $361 million in the first 90 minutes on launch day, surpassing the typical volume seen at the launch of traditional ETFs. Blachunas said: Here’s where we at after 90 minutes. $361m total. As a group that number would rank them about…

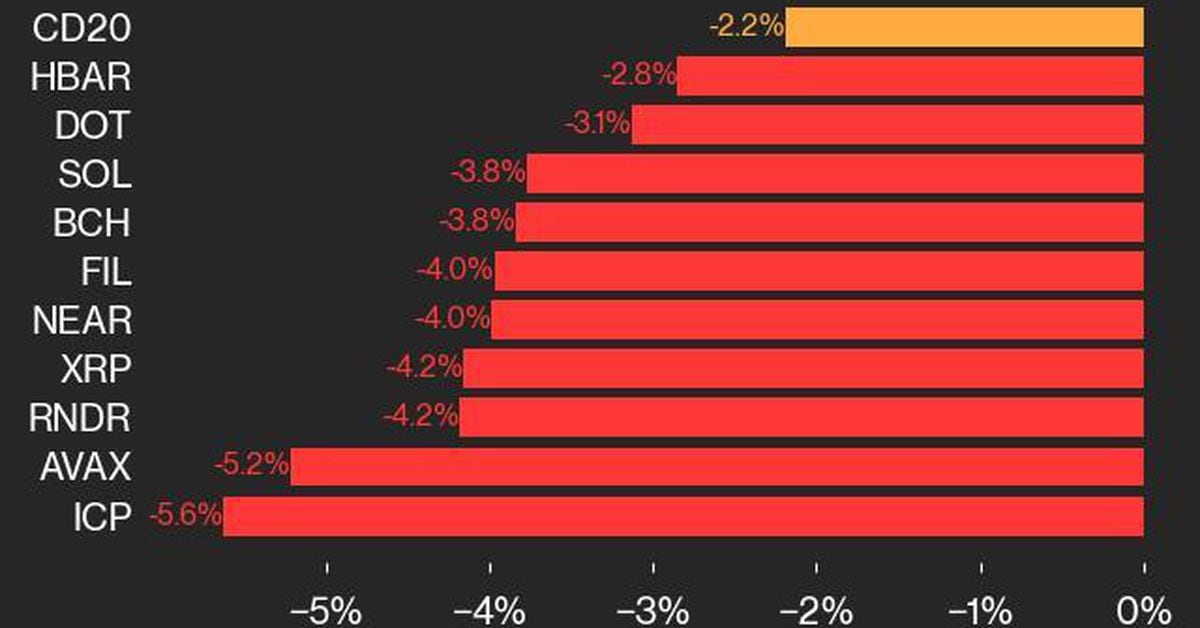

CoinDesk 20 Performance Update: Index Slips 2.2% as Spot Ether ETFs Begin Trading

A decline of 5.6% in ICP and 5.2% in AVAX dragged the index down in overnight trading. Source

SEC Extends Review Period for Bitcoin Trust Options Trading Proposals

The U.S. Securities and Exchange Commission (SEC) has announced an extension for its decision on proposed rule changes from various self-regulatory organizations regarding the listing and trading of options on trusts holding bitcoin. The organizations involved include Box Exchange LLC, Cboe Exchange Inc., Miax International Securities Exchange LLC, Miax Pearl LLC, Nasdaq ISE LLC, and […] Original